Brokers News

Creso Pharma hires former Canopy Growth executives

Creso Pharma Limited (ASX:CPH) has appointed two former Canopy Growth Corp. (TSX:WEED, NYSE:CGC) executives to the senior management team of its wholly-owned Mernova Medical Inc. in Nova Scotia, Canada.

The pair are former employees of Canopy Growth Corp, the world’s largest cannabis company by market capitalisation, currently capped at C$6.8 billion, having once hit the heights of C$24 billion.

Mr Jack Yu has been appointed as managing director and brings expert-level knowledge of cannabis cultivation and production from 25 years of practical experience growing cannabis, including nine years of consulting for licensed Canadian medicinal cannabis growers.

Mr Yu’s experience includes working for Canopy Growth Corp. (TSX:WEED, NYSE:CGC), the world’s largest cannabis company by market cap in the position of Production Manager.

He also held the role of Interim Cultivation Manager for Canopy’s Newfoundland, Edmonton, Eastern Canada and Scarborough facilities, and previously held the position of Master Grower for MedReleaf Corp., which is now owned by Aurora Cannabis Inc (TSE:ACB).

Furthermore, he consulted for Health Canada license applicants throughout the process to attain licenses for cultivation, production and sales of medicinal cannabis in Canada.

As Managing Director, Mr Yu will replace outgoing Managing Director Mr Bill Fleming, and will be responsible for managing all operations at Mernova and will work closely with the Creso Pharma Board.

Isaac Allen has been appointed Vice President.

Mr Allen has significant expertise in optimising business operations from executive positions in industries spanning cannabis, insurance, technology and entertainment.

He was formerly National Operations Process Improvement Manager at Canopy, where he developed and executed a number of business strategies and efficiency initiatives.

He is also the founder and former chief executive of a disruptive insurance technology start-up and has held senior executive positions at various companies.

Mernova close to achieving European Union GMP certification.

Mernova continues to work towards securing European Union Good Manufacturing Practice (GMP) certification.

Once this certification is obtained, Creso Pharma will be able to begin sales of high-quality cannabis flower and oil into the established and growing consumer markets in countries such as Germany and Switzerland.

Tickmill Group Breaks Records in Key Financial Metrics in the First Half of 2018

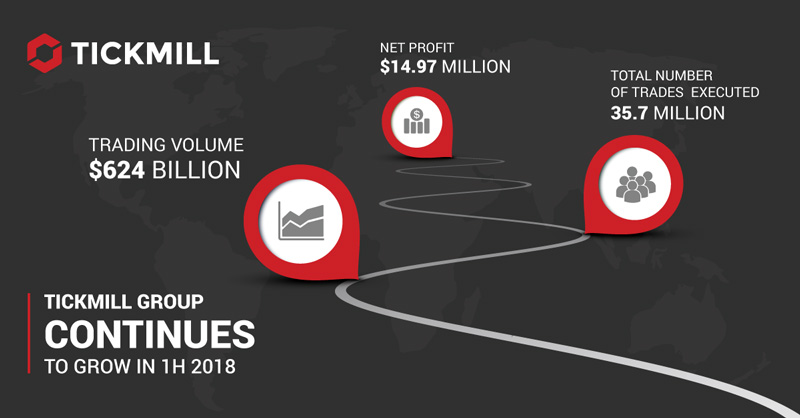

Tickmill Group continues its strong growth in key performance indicators with robust financial results for the first half of 2018.* The Group’s consolidated net profit amounted to $14.97 million whereas the total trading volume came in at $624 billion, almost doubling last year’s first half figure of $332 billion.

Marking accelerated growth in client acquisition, Tickmill executed 35.7 million trades for its Clients across its three entities (Tickmill UK Ltd, Tickmill Europe Ltd and Tickmill Ltd) with the average number of trades executed per month exceeding 5.9 million. In May 2018, a record 6.8 million trades were executed, representing a nearly twofold increase on last year’s record figure of 3.6 million trades which was posted in March 2017.

Commenting on the results, Duncan Anderson, CEO of Tickmill UK Ltd, stated: “Our consistent growth in key financial metrics is a living proof of our robust growth strategy, operational efficiency and firm commitment to delivering value-added products that go above and beyond our Clients’ expectations.”

Mr Anderson, added: “Building on this outstanding business performance, we will continue to focus on expanding our global reach and diversifying our activities into new business areas with a view to making Tickmill a respected leader in the financial services industry.”

Illimar Mattus, CFO of Tickmill UK Ltd, said: “We are pleased to see Tickmill going from strength to strength in our financial performance. Through nimble decisions and strong business leadership, we managed to thrive in an increasingly demanding and complex regulatory environment. Our strong group net capital base of $42.9 million as of June 30, 2018 allows us to look optimistically into the future and expand our business even further. In order to meet end-client demand we are in fact in the process of launching at least 3 new regulated entities in the next 12 months along with new product offerings.”

Ingmar Mattus, COO of Tickmill Ltd, commented: “We have always been focused on experienced traders and what once might have seemed as a too long-term or low-profit approach in the retail brokerage world is now paying off tremendously. We strongly not only support but also benefit from stricter regulations as they level the playing field given that brokers are forced to compete on crucial end-client profitability factors such as spreads, execution speed, commission rates and client service quality. In view of our operational efficiencies, we are able to rapidly react to the changing environment and meet client needs.”

*Unaudited consolidated figures for Tickmill Group in the first 6 months of 2018 (1 January 2018 – 30 June 2018).

About Tickmill:

Tickmill is a Forex and CFD trading services provider, authorised and regulated by the UK Financial Conduct Authority, the Cyprus Securities and Exchange Commission and the Seychelles Financial Services Authority, offering first-class trading products with competitive conditions and ultra-fast execution.

For more information, please visit: http://www.tickmill.com

79.27% of retail investor accounts lose money when trading CFDs with Tickmill. You should consider whether you can afford to take the high risk of losing your money.

BDSwiss’ Maintains Its Client-centric Approach With Brand New Trading Academy Launch

Introducing a hands-on, practical approach to trading education, including a comprehensive collection of educational material such as webinars, tutorials, and a beginner to advanced video course series along with

Delivering on its pledge to maintain a strictly client centric approach, BDSwiss has just announced the launch of its new forex educational portal, the BDSwiss Trading Academy. The well-established financial services firm aims to deliver a useful set of tools for novice and advanced traders alike, offering its clients a 360° educational solution. A wealth of video courses, tutorials and live webinars educate learners while the interactive trading quizzes enable them to put theory into practice.

BDSwiss Trading Academy hosts an impressive collection of educational video courses series, covering unique trading concepts and organised in three separate levels including beginner, intermediate and advanced. Each video is hosted by BDSwiss professional analyst & seasoned trader, Alexander Douedari who provides real MT4 setups to elaborate on major trading topics such as leveraged trading, key indicators, risk and money management, popular trading strategies and much more. Each course follows a hands-on approach with the host illustrating various strategies and techniques, directly on the BDSwiss MT4, Webtrader and mobile app. Each level concludes with a practical quiz, giving the learner the opportunity to perform a thorough self-assessment.

Apart from the pre-recorded video course series, BDSwiss Trading Academy offers more than ten live webinars on a daily basis, in English and German language. The daily webinar list includes BDSwiss’ ‘Start Smart’ webinars that cater for beginners, market morning briefs and live trading sessions during key financial events. Additionally, an A-Z Forex Basics e-course gives traders a solid foundation on trading forex and CFDs, while an impressive collection of 200+ live trading videos & recorded webinars are also made available to BDSwiss clients. In this way, BDSwiss Trading Academy provides easy access to a vast number of past events enabling traders to constantly monitor the markets, backtest their strategies and refer to previous major market events to inform their future trades.

Overall, the BDSwiss Trading Academy includes a complete set of comprehensive educational material and was well received by both new and experienced traders. To further expand its add-on services for VIP clients and cater to their particular needs, BDSwiss is also offering its VIP clientele complimentary 1on1 trading e-sessions, on a subject of their choice. This gives BDSwiss’ exclusive client base the opportunity to have a 1hr private trading session with one of BDSwiss’ qualified and experienced analyst

BDSwiss’ Marketing Director comments that the Trading Academy was not created to be a “once-off visited portal”, but rather a dynamic, evolving and interactive space where traders will always be able to find new ways to stay up to date with the markets: “BDSwiss new Trading Academy required a great deal of research, resources and man-hours. Everything was developed in house to accommodate our traders’ needs. Our goal is to offer traders a dynamic portal that they can visit time and time again to find new webinars, market news and insightful resources on a daily basis. It is a portal that offers lifelong investment education; as markets evolve and our traders become more sophisticated we will be able to continue to cater to their needs arming them with the knowledge they need. At BDSwiss we believe in supporting our clients throughout their trading journey and ensuring that they have access to all the required resources and information prior to making any investment decisions”

Visit BDSwiss’ New Trading Academy: https://eu.bdswiss.com/trading-academy/

About BDSwiss

BDSwiss is one of Europe’s leading financial institutions specializing in Forex and CFD trading. BDSwiss provides access to competitive trading conditions to retail and institutional clients in more than 150 countries via its advanced trading platforms and superior execution technologies.

2018 International Financial Expo IFINEXPO Kuala Lumpur Investment Summit- Power to Connect the World

After the Figure Finance 2018 International Financial Expo Overseas Summit has been well received by Sydney Station and Bangkok Station, it will come to the beautiful and welcoming tropical country again in October this year. This time we chose Malaysia, one of the "Four Tigers in Asia", not only because Malaysia has good relations with China since ancient times, but also we hope to comply with the development of the times, promote economic and cultural exchanges between the two countries, and strengthen exchanges of peoples between the two countries. We have united with many strategic partners in Malaysia and many authoritative exhibitors to jointly build a financial ecology and create future of industry to promote the financial industry exchanges, cooperation and development as well as mutual benefit between China and Malaysia. As the capital of Malaysia, Kuala Lumpur is not one of but the most international city of Malaysia, which is also economic and cultural center of Malaysia. The Kuala Lumpur station summit this time is scheduled on October 27, 2018, located at Mandarin Oriental, Kuala Lumpur, hoping to bring a different experience to you who are coming or already in the financial industry!

This summit will continue the theme of “Connection – Making Business Finance More Efficient” in the past few fairs, establishing a professional and high-end brand image for enterprises, focusing on sharing and resources docking of professional knowledge in the financial field to realize Zero-distance contact of financial rookie and industry mogul and to collide the spark of wisdom. In addition to foreign exchange brokers, financial technology companies, technology solutions companies and other financial companies, exhibitors attending the summit will also cover PE, VC, mergers and acquisitions, real estate and other industries, not only covering resources of all aspects in the financial industry, but also moving forward outside the industry. At the same time, there will also be a lot of financial industry's moguls to arrive at the scene, with the participation and support of many companies and industry insiders, this summit will become an opportunity to share, exchange and dock which cannot be missed.

【Conference Topics】

What are you waiting for? Quickly click on the following link to sign up!

【Event Website】

【Registration Link】

http://v3.rabbitpre.com/m2/aUe1ZjuVsu

【Organizer Contact Information】

Chai Yu: Manager of Market Development of Figure Finance

Mobile: 15000833793

Line: 13764672397

JFD Brokers Released Its Digital Asset Management Solution for Retail Investors

10/09/2018, Limassol, Cyprus

JFD Brokers is bridging the gap between its self-trading and passive investment product lines with a brand-new digital asset management solution. It allows the retail investors to get exclusive access to a marketplace of preselected top performing strategies with a proven track record verified by the portfolio management division of the company. For the first time, the clients of the broker will have the possibility to compose portfolios of strategies that can be automatically executed through a custom mirror trading platform called JFD Invest.

Lars Gottwik, Partner and Chief Executive Officer of JFD Brokers, commented: “We consider JFD Invest a major milestone in the strategic development of our company as it established a new product line for us. We believe that investing products with all their complexity can be delivered in a simplified way under transparent conditions. Taking full advantage of the latest innovations in our industry, we developed our mirror trading platform as a digital marketplace where our clients can review and follow expert-driven strategies for a fully-automated trading. With JFD Invest, we are opening the gates for more people (including the less sophisticated traders) to institutional-grade asset management, previously available only to a limited number of high-net-worth individuals.”

Lars Gottwik, Partner and Chief Executive Officer of JFD Brokers, commented: “We consider JFD Invest a major milestone in the strategic development of our company as it established a new product line for us. We believe that investing products with all their complexity can be delivered in a simplified way under transparent conditions. Taking full advantage of the latest innovations in our industry, we developed our mirror trading platform as a digital marketplace where our clients can review and follow expert-driven strategies for a fully-automated trading. With JFD Invest, we are opening the gates for more people (including the less sophisticated traders) to institutional-grade asset management, previously available only to a limited number of high-net-worth individuals.”

The users of JFD Invest will need to create a special account that will be connected to their live trading account with JFD Brokers. Afterwards, they can use the company’s mirror trading platform to build their own portfolios of investment strategies trading multiple asset classes (forex, indices, metals etc.). Funds allocation and risk management controls are also in place. The orders are executed in bulk via a single coverage account to ensure that all investors following a particular strategy get the same performance and trading conditions.

JFD Brokers will charge its mirror trading clients only a 25% high-water mark performance fee which means no management or setup costs for the clients of the firm.

ABOUT JFD:

Launched in December 2011, JFD Brokers is an internationally licensed global provider of multi-asset trading and investment solutions. The company operates a pure agency model with 100% DMA/STP execution, i.e. direct, anonymous and MiFID compliant post-trade transparent access to 20+ LPs (Tier1 Banks, Non-Bank LPs and MTFs) for a choice of 1000+ instruments. JFD is acknowledged by numerous independent sources as one of the fastest-growing and respected brokerage firms worldwide. Thanks to its core values of transparency, fairness and trust, many experienced retail investors consider the company as their best choice for multi-asset trading.

FOR MORE INFO CONTACT:

Victor Tomov

Email: [email protected]

Skype: jfd_victor_tomov

Tel: +35725878530 x 315

JFD Brokers Offers 4 New Cryptocurrencies along with Bitcoin

31/07/2018, Limassol, Cyprus

Leading multi-asset investment company JFD Brokers is now offering its clients the opportunity to capitalise on the recent cryptocurrency hype trading on institutional-grade terms and conditions 4 new CFD instruments - Bitcoin Cash, Ethereum, Litecoin and Ripple – all against the USD. Partial trading is allowed on the first three symbols with a minimum trade size of 0.01 CFD, while for the last one the minimum trade size is 1 CFD.

Overall, JFD now offers 5 cryptocurrency pairs (BTCUSD, BCHUSD, ETHUSD, LTCUSD and XRPUSD) giving traders the flexibility to fine-tune their strategies in these volatile instruments by testing them in smaller amounts for a better risk management. In full compliance with the recent ESMA regulations, JFD’s margin requirements for these new cryptocurrency CFDs is 50% equalling a leverage of 1:2.

Mihail Kamburov, Chief Operations Officer at JFD Brokers, commented: “We are happy to launch these new products as we always aim to offer our clients something more. The cryptocurrency markets are showing another uptrend nowadays. Therefore, after careful evaluation and analysis of the increased volumes and volatility, we have concluded that now is the right time to expand our crypto offering with the respective symbols.”

JFD is once again exemplifying its trader-centric approach enlarging the scope of investment opportunities available to all its clients.

ABOUT JFD:

Launched in December 2011, JFD Brokers is an internationally licensed global provider of multi-asset trading and investment solutions. The company operates a pure agency model with 100% DMA/STP execution, i.e. direct, anonymous and MiFID compliant post-trade transparent access to 20+ LPs (Tier1 Banks, Non-Bank LPs and MTFs) for a choice of 1000+ instruments. JFD is acknowledged by numerous independent sources as one of the fastest-growing and respected brokerage firms worldwide. Thanks to its core values of transparency, fairness and trust, many experienced retail investors consider the company as their best choice for multi-asset trading.

FOR MORE INFO CONTACT:

Victor Tomov

Email: [email protected]

Skype: jfd_victor_tomov

Tel: +35725878530 x 315

Wealth management by Dukascopy Bank: let's create liquidity together

The Bank believes that this offer has no equivalent on the market and should satisfy a large clientele. A simple comparison of a sharpe ratio of 1.11 of proposed investment (LP PAMM) with a sharpe ratio of another class of investments shows that Dukascopy proposes investments of a very high quality. The sharpe ratio calculation time-frame was the same. Please see table below.

ASSET TYPE | REPRESENTED BY | TICKER | SHARPE |

Dukascopy LP PAMM | Dukascopy Wealth Management Portfolio | 1.11 | |

Stocks | |||

S&P500 | SPDR S&P 500 ETF | SPY | 0.81 |

World | Vanguard Total World Stock ETF | VT | 0.67 |

Developed markets | iShares MSCI EAFE ETF | EFA | 0.46 |

Emerging markets | Vanguard FTSE Emerging Markets ETF | VWO | 0.31 |

Bonds | |||

Corporate | iShares iBoxx $ Investment Grade Corporate Bond ETF | LQD | 0.38 |

Government | iShares International Treasury Bond ETF | IGOV | 0.14 |

Alternative investment | |||

Real-estate | Vanguard Real Estate Index Fund | VNQ | 0.21 |

Gold | SPDR Gold Shares | GLD | 0.16 |

Broad commodities | PowerShares DB Commodity Index Tracking Fund | DBC | -0.05 |

Wealth management by Dukascopy Bank: let's create liquidity together

IQ Option Review - Broker Of The Year

If you are looking for a trustworthy and high quality trading platform, look no further: IQ Option is for you.

IQ Option is a prominent online broker enabling users to trade with binary options, Forex, CFDs, and cryptocurrencies. Founded in 2013 and operated by IQ Option Ltd, the platform has become known for its impressive growth, boasting over 26 million registered users around the globe.

There are many factors that make IQ Option truly unique, allowing the platform to stand out from the rest. IQ Option combines accessibility, intuitive design, and outstanding customer service to provide the best trading experience possible.

This review will delve deeper into exactly why IQ Option is one of the most reputable brokers out there today.

Regulatory Compliance

In the world of trading, regulatory compliance shows you how reliable a company really is. You can rest assured that IQ Option meets all regulatory requirements in the countries where it operates. Registered in Cyprus as IQ Option Europe Ltd, the company acquired its CySEC license back in 2014. In addition, the brokerage is registered with European regulatory entities such as the UK’s FCA and Germany's BaFin.

Low Minimum Deposit

Most brokers require a minimum deposit of $100 or more to begin trading. With IQ Option, you can dive into trading with a deposit of just $10! It is the lowest minimum deposit of all brokers by far.

Keep in mind that you will need to verify your account in order to deposit or withdraw money. Once you have successfully verified your account, you can connect your bank card or ewallet such as Skrill or Neteller to commence trading.

IQ Option offers 3 different types of accounts depending on your desired deposit amount.

Training account - enjoy real account features without depositing a single penny! This account gives you $10,000 to familiarize yourself with the platform and explore all of the different instruments available. The amount is replenishable, so you can practice training to your heart’s desire.

Real account - after depositing the minimum amount, you can trade with numerous assets and withdraw your money whenever you wish. The vast majority of requests are processed within 24 hours, though some transactions do take up to 3 business days. With this account, you can pay a small fee to participate in tournaments and compete with other traders for prizes.

VIP account - as the name implies, this account type offers many benefits including higher profitability rates, and even a personal manager who gives advice and helps resolve any issues you may have with your trading account. VIP account holders get free access to tournaments.

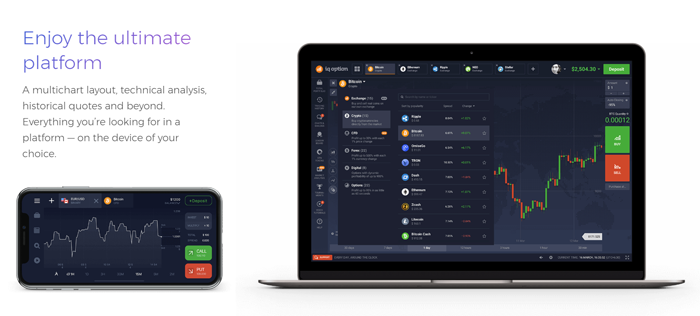

User-Friendly Platform

IQ Option is undoubtedly one of the most innovative trading brokers. It provides users with an intuitive interface, great graphics, and a plethora of resources that prove useful to both novice and expert traders alike. Moreover, the platform is created by in-house developers who ensure that the application works smoothly.

Here is a taste of what you get with IQ Option:

- A variety of indicators and trend lines

- Ability to view up to 9 screens at once

- Newsfeed to keep you up to date with the latest developments that could potentially affect trade prices

- Free educational videos to help you hone your trading skills

You can choose between running the platform online or downloading it onto your desktop or mobile phone. The application is available on iTunes and the Google Play store. The mobile app supports exactly the same functions as the desktop version, so you can experience the same level of high quality performance no matter which option you choose.

Users rave about IQ Option’s unparalleled level of customer support. If you face an issue or simply have a question regarding your account, you can get in touch with the platform’s support team day or night, 24/7. Support specialists can be contacted via chat, email, or phone. IQ Option provides support in over 12 languages, including English, Spanish, Italian, French and more!

Final Word

Over the past few years, IQ Option has made huge strides in order to offer users an accessible platform and pleasant trading experience. It is clear that they have traders in mind whenever they update their platform with new features.

If you have any questions, their support team is available to lend you a hand. Whether you are new or a seasoned trader, make sure you check out IQ Option!

BDSwiss Launches New Natively-Developed Webtrader and Releases New Mobile App Version

Leading German Forex and CFD broker BDSwiss has announced the launch of its new WebTrader Platform, exclusively developed in house, to better cater for the needs of their ever growing client base. The new BDSwiss WebTrader is a faster, simpler and more advanced online trading platform that promises to deliver an unparalleled trading experience.

With everything from real-time currency rates, to live support, tick chart trading and a full transaction history, the new BDSwiss WebTrader delivers on its promise for improved responsiveness and even better performance. The new BDSwiss WebTrader also features unique indicators and charting tools, full customization options, automated trading via the pending orders feature, and an intuitive order window that automatically calculates total position size, required margin and proposed TP and SL levels, according to the amount the client wishes to trade.

Featuring a cutting-edge interface that allows for simple and instantaneous trade execution, the new BDSwiss WebTrader will allow traders to access their accounts and trade more than 250 assets on any web browser. The BDSwiss WebTrader does not require downloading and it is fully synchronised to the downloadable versions of the MT4, allowing for live price monitoring via an advanced market watch. Translated in more than 24 languages, the BDSwiss’ new WebTrader is designed to accommodate the needs of traders around the globe.

Fully developed in house, by the company’s software development team, the new WebTrader comes as a latest addition to BDSwiss’ unique tools. BDSwiss’ Chief Technology Officer comments on the release of the WebTrader:

“After months of development and rigorous testing, we are very excited about the release of the BDSwiss Webtrader. By listening to our clients and using their feedback we have delivered a product that offers all the benefits of the MT4 platform, but with a much more clean-cut design.

We believe that our new WebTrader is a tool that will empower our clients and make trading much more transparent and straightforward. We emphasize on user experience, offering a decluttered platform that does away with complicated terminology and calculates everything automatically for the client. With BDSwiss Webtrader, the client knows exactly what he is trading, whether he is trading in euro, ounces, coins etc., what leverage ratio he is using, and the exact margin he will need to place his trade.”

To meet the needs of traders on the go, BDSwiss has also recently released a new and improved version of its natively designed mobile app, available in both iOS and Android operating systems. Users can login using the same details, place their trades in a single click, switch between accounts, chat with support and monitor their positions 24/7. The two platforms were developed to have a consistent, clean design, that allows for effortless trading, anywhere, anytime.

Investing in innovation and unique products, tailored to the needs of the company and its clients, is the primary differentiator of BDSwiss which follows a strictly client-centric approach. With promises for many more updates, new assets and unique features aimed at enhancing future functionality and improving user experience, BDSwiss sets high standards and continues to exceed expectations.

About BDSwiss

BDSwiss Group is a leading financial group, offering Forex and CFD investment services to more than a million clients worldwide. BDSwiss as a brand was established back in 2012 and has since then been providing top-class products, a wide range of platforms, competitive pricing and fast execution on more than 250 underlying CFD instruments. BDSwiss complies with a strict regulatory framework and operates its services on a global scale under different entities. With 200+ personnel, BDSwiss Group’s holding company is located in Zug, Switzerland and maintains its operating offices in Berlin, Germany and Limassol, Cyprus.

BDSwiss on:

Twitter | https://twitter.com/bdswissen

Linkedin | https://www.linkedin.com/company-beta/5898057/?pathWildcard=5898057

Instagram | https://www.instagram.com/bdswiss/

Facebook | https://www.facebook.com/BDSwissEN/

Tickmill Group: Continued Growth Underlined by Global Expansion in 2017

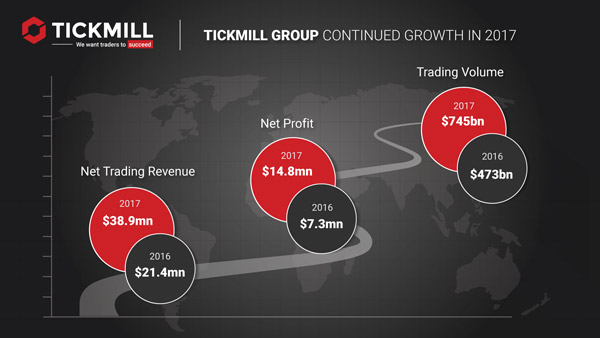

Tickmill Group announced strong consolidated financial results for 2017, a year which was marked by solid business growth and further geographical expansion into new markets. The financial metrics posted in the past year showed continued progress across key performance metrics.

Tickmill Group’s Business Metrics for 2017

- Consolidated net profit rose from $7.29 million in 2016 to $14.81 million in 2017, representing an increase of 103%.

- Net trading revenue amounted to $38.96 million, marking an increase of 82% compared to the previous year.

- Total trading volume came in at $745 billion notional value, easily surpassing the projected $600-650 billion range. In November 2017, Tickmill Group recorded its highest monthly trading volume of $79 billion when its clients placed a record 4.25 million trades. Taking a full-year perspective, the clients of Tickmill Group placed 42.58 million trades in total which also signals a new record for the Company.

Growth Projections for the Year Ahead

Tickmill had a powerful start to 2018, posting a record monthly trading volume of $110.6 billion in January followed by triple-digit figures in February and March.

In 2018, the company projects to reach a $1200-1300 billion full-year trading volume on the basis of organic growth in its key markets in Southeast Asia, South America, the MENA region and Europe.

Duncan Anderson, CEO of Tickmill UK Ltd, commented: “Tickmill was nimble enough to deliver record revenues and profits in the past year, despite the many regulatory changes and increased competition in the financial landscape. Our global presence, excellent trading conditions and robust trading technology has made Tickmill a strong brand and a go-to-broker for some of the most sophisticated retail and professional traders.”

Mr Anderson, added: “At Tickmill we have always had a long-term perspective in everything we do, which makes us excited about the future of the brokerage industry.”

Illimar Mattus, CFO of Tickmill Ltd, highlighted: “Despite markets experiencing extended periods of low volatility in 2017, Tickmill Group was able to deliver strong financial results for the year. We increased our profitability twofold and revenues by 82%. Our strong net capital base of $27.94 million at the end of 2017 will allow us to invest in new products and technologies to deliver more value to our global client base.”

Commenting on the Group’s growth strategy, Mr Mattus stated: “Having successfully completed the acquisition of Vipro Markets Ltd in 2017, we will continue looking for meaningful acquisition opportunities in 2018 to increase our market share and improve our overall efficiency. Building on last year’s positive results, we renew our focus on the core principles that underpin our success: providing cost-effective solutions, strengthening our competitive advantages, and diversifying our business.”

About Tickmill

Tickmill is a Forex and CFD trading services provider, authorised and regulated by the UK Financial Conduct Authority, the Cyprus Securities and Exchange Commission and the Seychelles Financial Services Authority, offering first-class trading products with competitive conditions and ultra-fast execution.

For more information, please visit: http://www.tickmill.com

Trading CFDs can involve losses that exceed the initial investment.

FxPro and McLaren F1™ Team Announce Partnership Agreement

24 May 2018, London. Online broker FxPro and McLaren F1™ Team are delighted to announce a multi-year partnership agreement. From the Monaco Grand Prix (24-27 May), the McLaren MCL33 will feature prominent FxPro branding, highlighting the firm’s position as the world’s number one online broker.

Zak Brown, Chief Executive Officer, McLaren Racing, commented:

“We are pleased to welcome FxPro as an official partner to the McLaren Formula 1 team. Both FxPro and McLaren are committed to innovation and excellence in their fields, making this a natural partnership. With over 50 domestic and international awards to their name, FxPro have proven their ability to perform at the highest level.”

In the Sky Blue Ball, striker of Sydney FC Bobo, won the A-League Player of the Year and Golden Boot Award with his netting 27 goals in 27 regular-season matches – a new A-League record. Bobo witnessed the partnership announcement and said, “We are glad to wear the jersey with AETOS logo printed on, we are pleased and confident to complete in the AFC Champions League in 2019 with the full support of AETOS, a global renowned Forex broker.”

With over 250 million orders executed and up to 7000 orders processed each second, FxPro is well aware of the challenges high pressure, high performance environments present. This partnership underpins the commitment to excellence and innovation shared by McLaren and FxPro.

FxPro CEO, Charalambos Psimolophitis, commented:

“We are proud to be entering this multi-year partnership with McLaren, a team with an illustrious history and exciting future. We always look for partners that share our passion for excellence and success, and McLaren embodies those values perfectly.”

Ilya Holeu, Chief Marketing Officer, FxPro, commented:

“FxPro have always been visionary pioneers in everything we do, from multiple world-class sports sponsorships to the way we value our name and the way that we do business. Sports sponsorship has long been a significant part of our outreach program and we are delighted to be partnering with McLaren to take that forward.”

Notes to Media

About FxPro: FxPro is an award-winning online broker, serving retail and institutional clients in more than 150 countries. FxPro provides access to competitive pricing and deep liquidity with no-dealing-desk intervention (subject to the FxPro Order Execution Policy) via its advanced trading platforms, superior execution technologies and algorithmic tools.

If you have any questions, please contact PR team, who can be reached by calling +44 (0) 20 7776 9720, or via email at [email protected], https://www.fxpro.com/.

Legal Information: FxPro Group Limited is the holding company of FxPro UK Limited, FxPro Financial Services Ltd, FxPro Global Markets MENA Limited, and FxPro Global Markets Ltd. FxPro UK Limited is authorised and regulated by the Financial Conduct Authority (registration no. 509956). FxPro Financial Services Ltd is authorised and regulated by the Cyprus Securities and Exchange Commission (licence no. 078/07) and by the Financial Services Board (authorisation no. 45052). FxPro Global Markets MENA Limited is authorised and regulated by the Dubai Financial Services Authority (reference no. F003333). FxPro Global Markets Ltd is authorised and regulated by the Securities Commission of the Bahamas (licence no. SIA-F184). Trade Responsibly: Contracts for Difference (CFDs) and Spread Bets are complex financial product that are traded on margin. Trading CFDs and Spread Bets carries a high level of risk since leverage can work both to your advantage and disadvantage. As a result, CFDs and Spread Bets may not be suitable for all investors because you may lose all your invested capital. You should not risk more than you are prepared to lose. Before deciding to trade, you need to ensure that you understand the risks involved taking into account your investment objectives and level of experience. Most CFDs and Spread Bets have no set maturity date. Hence, a CFD and/or a Spread Bet position matures on the date you choose to close an existing open position. Seek independent advice, if necessary. Please read FxPro’s full ‘Risk Disclosure Statement’AETOS CAPITAL GROUP EXTENDS AFC CHAMPIONS LEAGUE PARTNERSHIP WITH SYDNEY FC

The first good news at the time of its 11th anniversary, AETOS Capital Group extended AFC Champions League partnership with Sydney Football Club (Sydney FC), the three-time A-League champion. AETOS will be the principal partner of Sydney FC in the 2019 AFC Champions League season. Both parties celebrated the partnership in the “Sky Blue Ball” held at the Star Sydney on May 19th. Players of the year in the 2017/18 A-League season was awarded their honors in this gala night. Different from their look in the pitch, Sydney FC players with their gorgeous attire in black ties refreshed the impression of their fans.

Scott Barlow, Chairman of Sydney FC delivered his keynote speech in the Ball, saying “we are so delighted to sign up another sponsorship deal with AETOS Capital Group. At Sydney FC, we strive to be the best in everything we do. Our partnership with AETOS, the global market-leading forex broker, will further extend and strengthen the two brands’ influence in the Asia-Pacific market.”

Councilor Mike Thomas, Senior Vice President of AETOS Capital Group, said “in addition to the principal sponsorship in the AFC Champions League, AETOS and Sydney FC will also extend our cooperation to the A-League pitch, and will launch a series of privileges programs, including membership of Sydney FC for our clients and exclusive financial services for Sydney FC’s hundreds of thousands of fans. AETOS adheres to the philosophy of “Fairness, Efficiency, and Intelligence”, we believe that Sydney FC will become the leader in Asian football pitch through its adherence to fair games, efficient performance and intelligent training system.”

In the Sky Blue Ball, striker of Sydney FC Bobo, won the A-League Player of the Year and Golden Boot Award with his netting 27 goals in 27 regular-season matches – a new A-League record. Bobo witnessed the partnership announcement and said, “We are glad to wear the jersey with AETOS logo printed on, we are pleased and confident to complete in the AFC Champions League in 2019 with the full support of AETOS, a global renowned Forex broker.”

Sydney FC will learn their opponents for the Group Stage of the 2019 AFC Champions League following the Group Stage draw in early December.

Sydney FC announced the extension of AFC Champions League partnership with AETOS in the Sky Blue Ball.

Guests and Sydney FC players in their gorgeous attire further brightened up the event

Sydney FC announced the extension of AFC Champions League partnership with AETOS in the Sky Blue Ball.

Guests and Sydney FC players in their gorgeous attire further brightened up the event

8 May 2018, Formax Prime launches new Chinese and Spanish websites

Formax Prime Capital (UK) Limited are pleased to announce the launch of their Spanish and Chinese language sites to Traders.

“Following the successful launch of our new website and marketing in December last year, we took the decision to expand our existing ‘ECN only broker’ offer further to Chinese and Spanish speaking clients. Our support team are bilingual in a number of languages and it made sense to widen our approach and offer those clients access to all of the information on our English site, but in their native language.” - David Rapp, Director at Formax Prime.

Formax Prime Capital (UK) Limited obtained their FCA license in January 2015 and backed by their parent company Formax Group offer Forex, Commodities and Indices trading, across two platforms, MT4 and ZuluTrade.

Formax Prime believe that Traders need better insight into how their trades are placed and how trading platforms make money from their clients. Formax Prime was developed solely as an ECN Brokerage.

About Formax Prime Capital (UK) Limited

Formax Prime Capital (UK) Limited, is regulated by the FCA and offers ECN trading across Forex, Indices and Commodities, with highly competitive spreads from 0.2 pips on both MT4 and 1.5 pips on ZuluTrade platforms. Clients can choose pricing models from ECN commission free or ECN raw spreads + commission.

Formax Prime Capital (UK) Limited believe in developing long term partnerships with clients from day one, ensuring 24/5 support by phone and live chat via the website.

Experience the professional difference that an exclusive ECN broker can make, and discover the new way to trade, visit www.formaxprime.co.uk or call us on +44(0)20 3819 3100.

Contacts:

Business enquiries:

David Rapp

Director, Formax Prime Capital UK

Tel: +44(0)20 3819 3103

Email: [email protected]

Media enquiries:

Louise Stevens

Client Services Director, Talisman Marketing Solutions

Tel: + 44 (0)20 3735 5534

Email: [email protected]

What is Next for Forex after ESMA’s New Measures? Tickmill UK CEO Explains

The new regulatory measures announced by the European Securities and Markets Authority (ESMA) regarding the provision of Contracts for Difference (CFDs) and binary options to retail clients sent shock waves throughout the Forex industry. We sat down with the CEO of Tickmill UK Ltd, Mr Duncan Anderson to get his take on what the new measures entail for retail investors, Forex brokers and the financial services sector.

Read on to discover Mr Anderson’s interesting insights and find out what’s next for Tickmill and the industry at large.

How do you view the state of the Forex industry following the new measures announced by the European Securities and Markets Authority?

The proposed measures were first aired some time ago. There was a significant response to ESMA both from the industry and clients. We anticipate the measures will come into force in or around July 2018. Tickmill welcomes strong regulation and the protection of clients’ interests is paramount; however, there is a feeling within the industry that these measures are misguided, costly and ultimately do not benefit client interests.

In your opinion, how will the new regulations affect the future of the Forex industry and market participants?

Additional burdens will be imposed on the industry. This will involve further IT and compliance costs. It is likely that there will be consolidation within the EU and firms ceasing business altogether. Clients will continue to look for better choice and this is likely to push them offshore, something the industry has repeatedly voiced concern about.

How can Forex brokerages remain competitive in light of the new state of affairs?

The cost of business has increased significantly in the EU due to regulatory pressure. Firms will increasingly need to show a strong balance sheet, something that Tickmill has always considered important. Some firms may even pass on specific costs to their clients. Tickmill is regulated in multiple jurisdictions in order to offer its clients a more robust trading environment.

What advice would you give to the Forex trading community?

My advice would be to look very closely at the broker you do business with. Ensure they are financially strong and that they are regulated in multiple jurisdictions. Ensure you have the necessary protections and the ability to choose the investment products and services that meet your needs.

What is Tickmill’s stand on the new measures?

As I mentioned previously, Tickmill is a strong supporter of regulation and we always abide by the guidelines and best practices laid out by regulatory bodies to safeguard the best interests of our clients. I would like to emphasise that our clients are at the heart of our business model and we strive to provide them with the best possible trading environment. For instance, our client funds are fully segregated. FCA regulation in this instance is very clear and should provide our clients assurances that their funds are protected.

Do you expect the new regulations to have any effect on the Group’s financial results?

No, if anything, we anticipate that our growth rate will increase as clients look for better trading conditions in a consolidating market. We are known for having some of the fastest transaction speeds and competitive pricing spreads in the industry; advantages like this mean that we can stay competitive without compromising our values.

How does Tickmill adapt to the new regulatory regime?

Regulations change constantly, so the regulatory regime is always new. Changes in regulation are constantly evolving and Tickmill strives to meet its compliance obligations. We just have to stay compliant, but in essence it is simple – if you put your clients’ interests first you are well on the way to ensuring compliance. Achieving that is just part of the overall cost of the business.

Do you see any new areas or opportunities for growth?

There are plenty of areas for growth and this is one of the exciting elements of our business as it evolves. We are looking at a number of different product areas where we see potential. Our clients are a great barometer for exploring opportunities which we look forward to delivering in the future.

What are the goals of the Group over the next few years?

We have achieved so much in a relatively short period, but we are determined to do so much more. Clearly, we want to maintain current levels of operational excellence and to this, all credit should be given to the amazing team that makes up Tickmill. We would like to continuously increase our competitiveness in our industry and strategically move into other areas where we believe that we can make a real difference to the benefit of all.

JFD Brokers EXPANDS GLOBALLY, OPENING NEW OFFICE IN PRAGUE

5th April, Limassol, Cyprus

JFD, one of the fastest-growing FX and CFD brokerages worldwide, has relaunched the Bitcoin CFD BTC/USD pair.

With the rise of cryptocurrencies and the increasing popularity and potential of blockchain technology to transform business models, JFD Brokers wants to make sure that its clients have access to a diverse range of currencies, while striving to remain transparent and competitive within the ever-growing and robust trading industry.

Chief Trading System Officer at JFD Brokers, Monika Peeva, explained: “Bitcoins have gained so much popularity, especially recently with the rise of blockchain technology, that is impossible to ignore anymore. Bitcoins are real and their potential great.”

JFD Brokers currently offers online trading in FX and precious metals, as well as CFDs on shares, indices, commodities, bonds, ETFS & ETNS and Bitcoins. They are working towards adding more crypto CFDs to their list of trading pairs in the cryptocurrency CFD asset class.

For the full details and contract specifications regarding the trading of Bitcoin CFDs via JFD Brokers visit this page on their website.

ABOUT JFD:

JFD stands for JUST FAIR & DIRECT! Founded in December 2011 by professional traders for sophisticated clients, JFD is already ranked among the top 20 largest online brokers worldwide (source: Finance Magnates QIR1 2016). With a solid presence in over 120 countries across 6 continents, JFD has made its name as a game-changing and award-winning internationally licensed global provider of 100% Post-Trade Transparent trading solutions. Operating as a pure Agency Model, JFD offers trader-centric DMA/STP execution, keeping the best interests of the client always in mind.

FOR MORE INFO CONTACT:

Nathalie Kyrou

Email: [email protected]

Skype: jfd.nathalie.kyrou

Tel: +357 25 878530 x122

FxPro Expands Trader Education Offerings

FxPro's 'Learn from a Pro' series of trading webinars and seminars has been extraordinarily well received. Since originally launching the initiative last year, the group has maintained its long-standing commitment to providing traders with comprehensive educational material.

The sessions have been of particular interest to traders and market participants looking to expand on their existing understanding of online trading. This is particularly true in the foreign exchange space, having proven a major success across multiple different regions and jurisdictions. The 'Learn from a Pro' series has continued to run into 2018, supporting several new languages.

Overall, its seminars are offered across three countries with webinars in Italian, Spanish, German, Arabic, Chinese, and Russian, among others. The effort constitutes FxPro's continued bid to help traders worldwide develop their knowledge of the financial markets. Indeed, trader education is a point of emphasis at FxPro, which serves as a cornerstone of its agenda over the past few years and now in 2018.

Hosted by various industry experts including Phillip Konchar, Enrico Gei, Carlos Partida and Mohamed Elghobary, the 'Learn from a Pro' series covers a wide range of topics. Such topics include unique trading concepts, economic event analysis, trading strategies for key instruments, breakdowns of major chart patterns, and how to use popular technical indicators to inform trading decisions.

Totaling over fifty unique seminars and webinars to date, the 'Learn from a Pro' series has thus far welcomed over 2,500 traders. Based on this positive reception, the online broker looks forward to adding further seminars and webinars to their schedule in the months to come.

This stance was reiterated by FxPro's Chief Client Relations Officer, Elsy Rayess, who commented: “We have always seen education as a central component of our offering at FxPro. The continued success of our Learn from a Pro series demonstrates that seminars and webinars are an ideal way to engage traders, as they provide a more hands-on approach and an opportunity to learn about the financial markets from industry professionals.”

FxPro Maintains Commitment to Trader Education

21 March 2018, London

The sessions have been exceptionally well received by investors looking to expand

Hosted by various industry experts including Phillip Konchar, Enrico Gei, Carlos Partida and Mohamed Elghobary, the Learn from a Pro series covers a wide range of topics including trading concepts, economic event analysis, trading strategies for key instruments, breakdowns of major chart patterns and how to use popular technical indicators to inform trading decisions.

Totalling 50+ seminars and webinars to date, the Learn from a Pro series has so far welcomed in excess of 2,500 traders. Based on this positive reception, we look forward to adding further seminars and webinars to our schedule in the months to come.

FxPro Chief Client Relations Officer, Elsy Rayess, commented:

“We have always seen education as a central component of our offering at FxPro. The continued success of our Learn from a Pro series demonstrates that seminars and webinars are an ideal way to engage traders, as they provide a more hands-on approach and an opportunity to learn about the financial markets from industry professionals.”Notes to Media

About FxPro

FxPro is an award-winning online broker, serving retail and institutional clients in more than 150 countries. FxPro provides access to competitive pricing and deep liquidity with no-dealing-desk intervention (subject to the FxPro Order Execution Policy) via its advanced trading platforms, superior execution technologies and algorithmic tools.

FxPro Group Limited is the holding company of FxPro Financial Services Ltd, FxPro UK Limited, FxPro Global Markets MENA Limited and FxPro Global Markets Limited.

FxPro Group Limited is the holding company of FxPro UK Limited, FxPro Financial Services Ltd, FxPro Global Markets MENA Limited, and FxPro Global Markets Ltd. FxPro UK Limited is authorised and regulated by the Financial Conduct Authority (registration no. 509956). FxPro Financial Services Ltd is authorised and regulated by the Cyprus Securities and Exchange Commission (licence no. 078/07) and by the Financial Services Board (authorisation no. 45052). FxPro Global Markets MENA Limited is authorised and regulated by the Dubai Financial Services Authority (reference no. F003333). FxPro Global Markets Ltd is authorised and regulated by the Securities Commission of the Bahamas (licence no. SIA-F184).

https://www.fxpro.co.ukTickmill Exhibited as Gold Sponsor at the FXCuffs Expo

Tickmill has successfully exhibited as Gold sponsor at the FXCuffs Expo which took place on 16-17 March 2018 in Krakow, Poland.

Known as one of the largest financial exhibitions in Eastern and Central Europe, FXCuffs attracted almost 5000 attendees who grabbed the opportunity to benefit from a range of presentations, meetings and lectures led by local and foreign experts.

Tickmill was among the high-profile companies which attended the expo, showcasing its diverse product offering and advanced trading solutions to a huge crowd of Forex enthusiasts. The company’s booth recorded an amazing turnout while the feedback received from visitors was very positive. Tickmill’s team of experts shared interesting ideas, market trends and new developments with existing and prospective clients.

Tickmill Group CMO, Marilena Iakovou commented: “We are thrilled to have attended this year’s FXCuffs which we regard as a great opportunity to further strengthen relations with the Polish trading community and reinforce our presence in Poland, one of the fastest growing markets for our company. Meanwhile, as part of our expansion strategy in the Polish market, we have several new projects in the pipeline, including educational events and webinars to offer local traders high quality forex education in their native language”.

Tickmill is gearing up to host several seminars and road trips in key regions around the world to interact face-to-face with local traders and provide them with trading education and tools that matter most to them.

About Tickmill

Tickmill is a global Forex and CFDs provider, authorised and regulated by the Financial Conduct Authority of the United Kingdom, the Cyprus Securities and Exchange Commission and the Seychelles Financial Services Authority.

Please visit www.tickmill.com or contact [email protected]

Trading CFDs can involve losses that exceed the initial investment.

Swissquote more successful than ever

Swissquote has posted record-breaking results for 2017. Compared with the previous year, total net revenues increased by 25.0 percent to CHF 187.8 million while net profit grew by 88.8 percent to CHF 39.2 million and client assets were up 29.9 percent at CHF 24.1 billion. For 2018, Swissquote is expecting net revenues and earnings to continue growing by approximately 10 percent..

Revenues up by 25%

Net revenues of CHF 187.8 million (CHF 150.2 million) were once again impacted by negative interest rates (-CHF 7.5 million). All four divisions contributed to the exceptional result. Thanks to a year-on-year increase in the number of transactions by 310,000 to 2.6 million, net fee & commission income grew by 22.5 percent to CHF 85.2 million (CHF 69.5 million). The number of transactions per customer per year remained stable at 11.0. However, other factors that contributed to the pleasing results included the growing importance of robo-advisory services (ePrivate Banking), successful trading in derivative products via Swiss DOTS, and trading in cryptocurrencies. eForex income increased by 26.2 percent to CHF 66.7 million (CHF 52.8 million). The strong growth is explained by the significant increase in new clients (+29.0 percent) and the significant increase in client assets belonging to eForex clients (+45.5 percent). Net trading income (currency trading excluding eForex) grew by 32.7 percent to CHF 22.3 million (CHF 16.8 million). Net interest income increased by 27.8 percent to CHF 19.7 million (CHF 15.4 million) owing to growth in Lombard loans issued and steadily rising US short-term interest rates.

Near doubling of earnings

At CHF 142.0 million (CHF 127.0 million), operating expenses were 11.8 percent higher in 2017 than in the previous year. The increase in expenses was mainly due to continuing heavy investment in technology, marketing and staff, whose numbers grew by 43 to 593. While operating expenses increased by CHF 14.9 million, net revenues rose by CHF 37.5 million. In line with this trend of expenses and revenues, all earnings figures rose sharply: pre-tax profit jumped by 97.3 percent to CHF 45.8 million (CHF 23.2 million), the pre-tax profit margin increased to 24.4 percent (15.4 percent), net profit surged by 88.8 percent to CHF 39.2 million (CHF 20.8 million) and the net profit margin climbed to 20.9 percent (13.8 percent). The capital ratio (CET 1) stood at 26.1 percent (24.5 percent). This means that Swissquote remains one of Switzerland's best-financed banks. Total Equity amounted to CHF 295.1 million (CHF 280.8 million).

Record level of client assets

2017 also saw client assets increase by a substantial 29.9 percent to CHF 24.1 billion (CHF 18.6 billion). The net new money inflow amounted to CHF 2.7 billion. As at the end of 2017, assets of CHF 23.0 billion (+31.6 percent) were held in trading accounts, CHF 600.6 million (-20.8 percent) in saving accounts, CHF 203.1 million (+75.2 percent) in Robo-Advisory accounts and CHF 328.9 million (+45.5 percent) in eForex accounts. The total number of accounts grew by 6,511 (+2.2 percent) to 309,286 (302,775). The breakdown is as follows: 236,861 trading accounts (+0.3 percent), 28,955 saving accounts (-11.9 percent), 1,898 Robo-Advisory accounts (+22.3 percent) and 41,572 eForex accounts (+29.0 percent).

Major success in cryptocurrency trading

From mid-2017, Swissquote became the first European online bank to offer its clients the opportunity to invest in cryptocurrencies and trade in them against the EUR or USD. The service was initially confined to Bitcoin, but since December Bitcoin Cash, Ether, Litecoin and Ripple have also been available. With five leading cryptocurrencies, Swissquote now has a larger offering of virtual currencies than any other bank. Clients invest and trade in cryptocurrencies through their ordinary Swissquote trading account in the same way as with any other currencies, shares or funds. The sharp increase in interest in cryptocurrencies, particularly in the fourth quarter of 2017 (revenues of CHF 5.6 million in 2017), led to a flood of new accounts being opened towards the end of year. The impact of the new accounts on revenues will only be clearly noticeable in the figures for the first half of 2018.

Shareholders to benefit from higher dividend

In light of the very good business results, the Board of Directors will propose to the Annual General Meeting of Swissquote Group Holding Ltd, to be held on 4 May 2018, a distribution of CHF 0.90 per share of which CHF 0.86 as a dividend and CHF 0.04 as a reimbursement of Reserves from capital contributions.

The complete 2017 Financial Report is available at: https://en.swissquote.com/ - Company/Investor Relations/Financial Reporting.

Swissquote – The Swiss Leader in Online Banking

As a leading provider of online financial services, Swissquote offers innovative solutions and analysis tools to meet the wide range of demands and needs of its clients. As well as various online trading services, the user-friendly platform also provides solutions for eForex, ePrivate Banking and eMortgages. In addition to a low-cost service for private clients, Swissquote offers specialized services for independent asset managers and corporate clients. Swissquote Bank Ltd holds a banking license issued by its supervisory authority, the Swiss Financial Market Supervisory Authority (FINMA), and is a member of the Swiss Bankers Association. Its parent company, Swissquote Group Holding Ltd, is listed on the SIX Swiss Exchange (symbol: SQN).

For further information

Marc Bürki, CEO Swissquote Group Holding Ltd / CEO Swissquote Bank Ltd

Tel.: +41 22 999 98 50, Mobile +41 79 413 41 45, [email protected]

Nadja Keller, Assistant to CEO / Media Relations Manager.

Tel. +41 44 825 88 01, [email protected]

Agenda 2018

4 May 2018 - Annual General Meeting in Zurich

31 July 2018 - Presentation of figures for the first half of 2018 in Zurich

Tickmill Group Kicks off 2018 with Record Monthly Trading Volume

Tickmill Group, which consists of UK FCA, Seychelles FSA and CySEC licenced entities, reported its highest ever monthly trading volume of $110.6 billion in January 2018. This figure marks a historic milestone in the Group’s development and paves the way for an even stronger year in terms of business growth and operational excellence.

Commenting on the achievement, Tickmill Group CEO, Mr Duncan Anderson stated: “We are pleased to commence 2018 with such a strong performance that positions us among the fastest-growing and financially robust companies in the industry. The Group has thrived in all key financial metrics despite the increasingly tight regulatory regime and heightened market competition. I am confident that our hard work and dedication to core business ethics and client-centric values, will put us on a stronger growth trajectory this year.”

Tickmill’s Success Story in 2017

Beyond the numbers, Tickmill had a busy 2017, successfully completing numerous activities and projects including the following:

- Acquisition of Vipro Markets Ltd, a CySEC regulated investment firm in a bid to accelerate expansion into new markets.

- New trading products/services: 4 CFDs on German government bonds and Bitcoin trading (BTC/USD) were launched along with Tickmill Prime, a Prime Brokerage solution provider.

- Launch of Italian, Arabic, German, Korean, Thai and Vietnamese websites.

- Trading contests such as the Ultimate IB Ride contest, the Forex Demo Challenge and the Revolutionary Win-Win Live trading contest.

- Prestigious industry awards including the ‘Most Trusted Broker in Europe 2017’ recognition by the renowned Global Brands Magazine and the ‘Best Forex Trading Conditions’ prize at the 2017 UK Forex Awards.

- Educational seminars in Johannesburg and Kuwait and webinars in English, Italian, Arabic, German and Polish.

- Impressive presence at the iFX EXPO Asia, the FXCuffs Expo, the ITForum, the iFX EXPO International and the World of Trading.

Capitalising on last year’s growth momentum, Tickmill continues full speed ahead to reach even more exciting milestones in 2018; ones that will be mutually beneficial for both the organisation and its valued clients and partners all over the world.

About Tickmill

Tickmill is a Forex and CFD trading services provider, authorised and regulated by the FCA UK, the FSA SC and CySEC, offering first-class trading products with competitive conditions and ultra-fast execution.

For more information, please visit http://www.tickmill.com.

Trading CFDs can involve losses that exceed the initial investment.

Manchester City Launches Partnership With AvaTrade

AvaTrade to become Official Online Trading Partner of Manchester City Leading online trading broker signs multi-year partnership covering China, Asia and Latin America

DUBLIN, Feb. 8, 2018 -- English Premier League football club Manchester City has announced a new multi-year regional partnership with AvaTrade to become the Club's Official Online Trading Partner throughout China, Asia and Latin America.

AvaTrade is a leading online trading broker, whose portfolio of traders span across the globe. The company is revolutionising the online trading industry by providing an innovative, user-oriented trading environment built on the most advanced platforms. AvaTrade will use this partnership to further engage its customers both online and at events, rewarding affiliates and customers with a range of exclusive Manchester City offers and promotions. Prizes will include Club merchandise and VIP trips to the Etihad Stadium to see the City first team in action.

Damian Willoughby, Senior Vice President of Partnerships at City Football Group, said: "We are delighted to announce this partnership with AvaTrade. AvaTrade and Manchester City are both committed to empowering the lives of our traders and fans, respectively, and giving them the best possible experience.

"Both organisations share a passion for being innovative and leading the way in our industries. We are looking forward to working with AvaTrade for this season and beyond."

Dáire Ferguson, AvaTrade CEO, commented: "A true leader constantly seeks new mountain tops to conquer. Our partnership with Manchester City sets a new bar in the global financial industry and furthers our ongoing commitment to investing in excellence. We are very excited as to what the future may bring as part of this fantastic collaboration between two leading brands at the top of their game."

With 16 offices around the world and headquarters in Dublin Ireland, AvaTrade operates under six globally regulated bodies across the EU, Japan, Australia, South Africa, BVI and Middle East. The broker's first and foremost commitment is to empower people to invest and trade with confidence, in an innovative and reliable environment; supported by best-in-class services and uncompromising integrity.

About Manchester City Football Club

Manchester City FC is an English Premier League club initially founded in 1880 as St Mark's West Gorton. It officially became Manchester City FC in 1894 and has since then gone onto win the European Cup Winners' Cup, four League Championship titles, including two Premier League titles (2012, 2014), and five FA Cups. Manchester City FC is one of eight teams comprising the City Football Group and counts New York City FC and Melbourne City FC among its sister clubs.

Under manager Pep Guardiola, one of the most highly decorated managers in world football, the Club plays its domestic and UEFA Champions League home fixtures at the Etihad Stadium, a spectacular 55,000 seat arena that City have called home since 2003. Today, the Stadium sits on the wider Etihad Campus, which also encompasses the City Football Academy, a state-of-the-art performance training and youth development facility located in the heart of East Manchester. Featuring a 7,000 capacity Academy Stadium, the City Football Academy is also where Manchester City Women's Football Club and the Elite Development Squad train on a daily basis and play their competitive home games.

For more information, please visit http://www.mancity.com.

About AvaTrade

AvaTrade, the leading forex and CFD broker, was founded in 2006 and offers more than 250 financial instruments including forex, stocks, commodities, indices, cryptocurrencies and vanilla options. AvaTrade customers enjoy access to multiple cutting-edge trading platforms, on-the-go trading with the innovative AvaTradeGO mobile app, dedicated account managers and a 24/5 live customer service in 14 languages. AvaTrade accommodates traders of all levels, and further ensures secure trading with advanced encryption and fully segregated accounts.

Find out more about AvaTrade at http://www.avatrade.com.

ATC Brokers introduces PAMM Plus technology to streamline operations for money managers in foreign exchange market

Software solution uniquely features ability to set participation levels, stop equity loss limits and allows to unsubscribe and subscribe instantly during market hours

FOR IMMEDIATE RELEASE – London, UK – January 31, 2018 – Premier brokerage firm, ATC Brokers, introduced today the PAMM Plus technology, an innovative, all-in-one, multi-account manager software engineered to streamline operations for money managers. The software solution overcomes traditional MAM and PAMM limitations and allows money managers to execute trades, and manage multiple clients through one master account with multi-currency capabilities.

https://atcbrokers.co.uk/partnership/

“Our firm continues to implement innovative technology within the industry,” said Jack Manoukian, CoFounder of ATC Brokers. “We believe that the PAMM Plus addition to our product line reinforces our commitment to providing clients with software that enhances their trading experience.”

Built inside a powerful ECN engine, PAMM Plus allows account holders the unique ability to:

- adjust participation levels,

- set stop equity loss limits,

- subscribe or unsubscribe instantly during market hours without affecting other participants,

- easily send one batch order to liquidity providers, and one price is allocated to all participants in real-time

PAMM Plus utilises smart logic for position allocation, detecting changes made to client funds upon order placement. The sophisticated back office portal provides money managers access to real time multi-layer payouts, monitoring, reporting, and tracking of account activity.

For details on ATC Brokers’ PAMM Plus technology visit www.atcbrokers.co.uk/partnership.

About ATC Brokers

ATC Brokers is a premier brokerage firm providing online trading solutions within the foreign exchange industry servicing retail clients to institutional relations. The firm's offerings eliminate conflict of interest to clients and provides for a neutral trading environment. ATC Brokers believes the foreign exchange market should be transparent and unbiased for all market participants. It is with that vision, the firm established a pure agency model to provide clients with services that are free of manipulation. For more on ATC Brokers, visit: www.atcbrokers.co.uk.

For media inquiries: [email protected].

Tickmill Launches the Gold Miner Introducing Broker Contest

Global online Forex and CFD broker, Tickmill announced the launch of the Gold Miner IB Contest, an exciting competition that offers both new and existing Introducing Brokers the chance to win twenty 1 oz gold bars or one of more than $10,000 worth of prizes.

grow their network by introducing new active clients to Tickmill and earn points based on the trading volume generated by their introduced clients – the more their

The 1st place winner, that is the participant who will accumulate the highest amount of points will win twenty 1 oz gold bars and the rest of the winners will receive attractive cash prizes from a prize pool of over $10,000.

Tickmill Group CMO, Marilena Iakovou commented “We are excited to be launching an IB contest for yet another year to offer our Introducing Brokers the opportunity to achieve greater success in their business. The launch of the Gold Miner IB Contest is an integral part of our effort to building long-lasting and mutually beneficial relationships with our IBs.”

Commenting on the company’s Introducing Broker programme, Mrs Iakovou stated “Our IB programme is well received by Introducing Brokers from all over the world who rely on us for competitive competitions that they can use to attract more clients. We are working relentlessly to provide our IBs with a competitive package of rewards and perks that add value to their business.”

The contest will run from 24th January 2018 until 31st of May 2018. To learn more about the contest and the applicable Terms and Conditions, please click here.

Notes to Media

About Tickmill

Tickmill is a Forex and CFD trading services provider, authorised and regulated by the FCA UK and the FSA SC. Catering to the needs of both individual and institutional investors, Tickmill offers first-class trading products with competitive conditions and ultra-fast execution.

For more information, please visit: http://www.tickmill.com

Trading CFDs can involve losses that exceed the initial investment.

FXCC Announces the Winners of the New Year Lucky Draw

FX and CFD brokerage services provider, FXCC, started the year with a $1000 Giveaway, awarding 10 lucky traders.

The New Year Lucky Draw participation period started on 15th of December and completed with great success on the 15th of January.

We are pleased to announce that the New Year Lucky Draw took place on 16th of January at FXCC HQ.

All active accounts who met the criteria based on the terms and conditions, were entitled to participate in the computerized random draw.

To see the list with the 10 lucky Active Accounts who won $100 each, please click here.

Commenting on the New Year Lucky Draw, winners announcement, FXCC General Manager Saed Shalabi, stated “We launched the campaign, to celebrate a year full of operational progress, signaling the start of a new year full of objectives towards bringing the best service possible to our valued clients. Such rewards are our way to thank our clients in return for their loyalty”

We wish the lucky winners every success, to kick-start the year with profitable trades and to continue enjoying FXCC services and trading environment.

About FXCC

Founded in 2010, FXCC (FX Central Clearing Ltd) is one of the leading STP/ECN brokers, specialising in Foreign Exchange (Forex) and CFDs, delivering institutional level of service and cost-effective trading opportunities to retail clients who wish to trade across a wide range of products.

FX Central Clearing Ltd is regulated by the Cyprus Securities and Exchange Commission (CySEC), under CIF Licence Number 121/10, is on the FSA(UK) Register (Reference Number 549790).

JFD BROKERS ACQUIRES MAJORITY STAKE IN ACON BANK

Leading global brokerage JFD has just announced its acquisition of 51% of established German bank ACON, with the potential to attain another 20% of its shares in the future. Founded in 2006, ACON, which offers investment banking, trading and advisory services, will now be controlled in majority by the renowned international multi-asset broker and portfolio manager. This move signifies a strategic long-term investment for JFD.

“JFD is at the forefront of the trading industry. Within only six years of JFD’s inception, we feel it is the right time to create such a synergy,” said Lars Gottwik, Founding Partner and CEO of JFD Brokers. “We are excited about this new venture and hope to strengthen the bank’s fields of asset management, capital markets and brokerage.”

With the deal pending regulatory approval over the next few months, more news is expected on this in the near future.

ABOUT JFD:

JFD stands for JUST FAIR & DIRECT! Founded in December 2011 by professional traders for sophisticated clients, JFD is already ranked among the top 20 largest online brokers worldwide (source: Finance Magnates QIR1 2016). With a solid presence in over 130 countries across 6 continents, JFD has made its name as a game-changing and award-winning internationally licensed global provider of 100% Post-Trade Transparent trading solutions. Operating as a pure Agency Model, JFD offers trader-centric DMA/STP Execution, keeping the best interests of the client always in mind.

Tickmill Launches the Revolutionary Win-Win Live Trading Contest

Global FX and CFD brokerage services provider Tickmill announced the launch of the Revolutionary Win-Win Live Forex trading contest, giving away exciting loyalty rebates to all participants and real Bitcoin prizes every month. The company has rolled out this thrilling contest to reward its Clients for their continued loyalty and support that have set the company well on a growth trajectory this year.

The Revolutionary Win-Win Live trading contest offers participants the opportunity to put their trading expertise in action and get rewarded for their outstanding performance with a real Bitcoin, one of the fastest-growing assets in the world!

Every month, two trading champions, that is the trader with the highest monthly amount of profit and the trader with the highest monthly percentage of profit will each earn a Bitcoin. Also, eligible contestants who trade on a Pro or VIP account are entitled to 10% commission rebates for all closed positions and $1 per lot rebates on Bitcoin CFDs placed on the contest account.

Commenting on the launch of the new live trading contest, Tickmill Group CMO, Marilena Iakovou stated: “We launched this contest to celebrate an exceptional year of business excellence and growth which we largely owe to our valued Clients from all over the world. We truly believe that when our Clients excel, we grow stronger too. Our new live trading contest is our way of providing our Clients with an extra impetus to achieve optimum trading performance while offering them generous rewards in return for their loyalty. As a company that has positioned itself in the forefront of technological innovations, we have put a lot of thought to the prizes on offer to bring traders one step closer to what is deemed the future of finance”.

The Contest will run from 11th December 2017 until 9th March 2018. For more information on the Contest and the applicable Terms & Conditions please click here.

About Tickmill

Tickmill is a Forex and CFD trading services provider, authorised and regulated by the FCA UK and the FSA SC. Catering to the needs of both individual and institutional investors, Tickmill offers first-class trading products with competitive conditions and ultra-fast execution.

For more information, please visit: http://www.tickmill.com

Trading CFDs can involve losses that exceed the initial investment.

Amana Capital, Centroid Solutions, and 514 Capital Partners Plan to Unite Under One New Holding - ‘180 Capital’

London, Dec. 20,

180 Capital (180cap.com) will incorporate deep domain expertise in online brokerage, quantitative investment management,

The respective entities will seek the required legal and regulatory approvals.

Karim Farra, Co-founder of 180 Capital and Chairman of 514 Capital Partners said: “Our companies have been steadily building distinct capabilities for several years. Our entrepreneurial dynamism will allow us to build a larger, more meaningful organization for our stakeholders”