Yen's downward trajectory continues as market anticipates BoJ's move

The USD/JPY pair is drawing nearer to the closely watched 150.00 level, currently experiencing most of its activity around 148.40, as of Monday. The market remains in anticipation of potential financial interventions from the Bank of Japan (BOJ). The BOJ has maintained its ultra-accommodative monetary policy, leaving the yen lingering near ten-month lows.

Last Friday, the BOJ opted to sustain the negative interest rate at -0.10% per annum. The Governor of the central bank highlighted the necessity for additional time to scrutinize the economy and assess the data. For currency market participants and those observing the yen exchange rate, the key concern is not the rate decision per se, but the absence of indications regarding any alterations in the monetary policy framework.

USD/JPY currency pair technical analysis

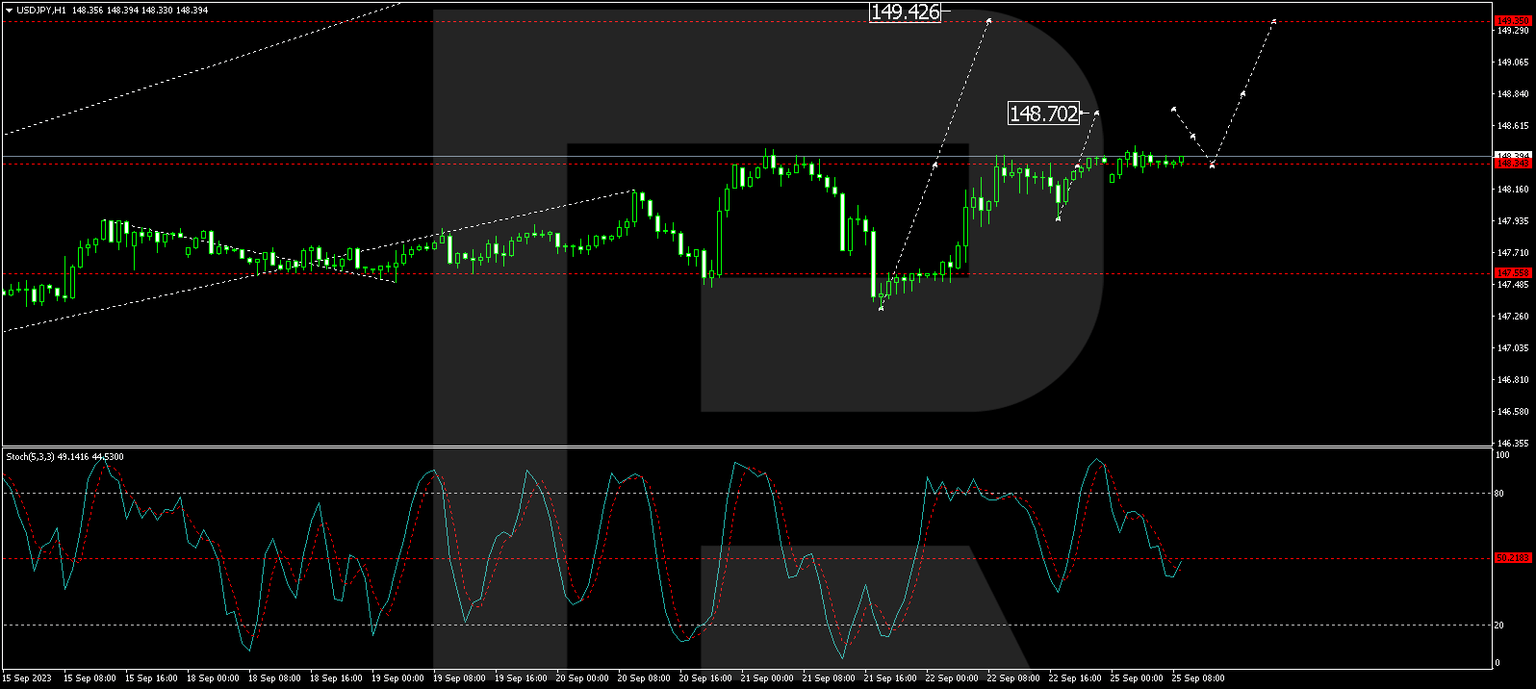

The H4 chart illustrates that USD/JPY has reached the projected target of a growth wave at 148.44 and underwent a correction to 147.33. The market has finalized a growth structure to 148.47 and is currently forming a consolidation range beneath this level. An upward breakout is anticipated, with the price potentially advancing to 149.42. Upon reaching this level, a correction to 148.44 may occur, followed by a rise to 150.50. The MACD oscillator substantiates this scenario, with its signal line positioned above zero and pointing strictly upwards.

On the H1 chart, a consolidation range has emerged around 148.33. The market is currently on an upward trajectory, aiming for 148.70, with the potential to extend to 149.90. The Stochastic oscillator confirms this scenario, as its signal line, having rebounded from 50, is directed strictly upwards.

The yen continues its descent, with market participants keenly observing any signs of change in the BOJ's monetary policy framework. Technical analysis suggests potential further growth for USD/JPY, but traders will closely watch for developments and adjust their positions accordingly.

Author

Andrey Goilov

RoboForex

Higher economic education. Andrey Goilov has been working on the Forex market since 2005. A financial analyst and successful trader. Preference in trading is highly volatile instruments.