Yen surges, bets build, BoJ to scrap negative rates, DXY falls

Aussie jumps, EUR, GBP, EMFX, stocks rally; US payrolls next

Summary

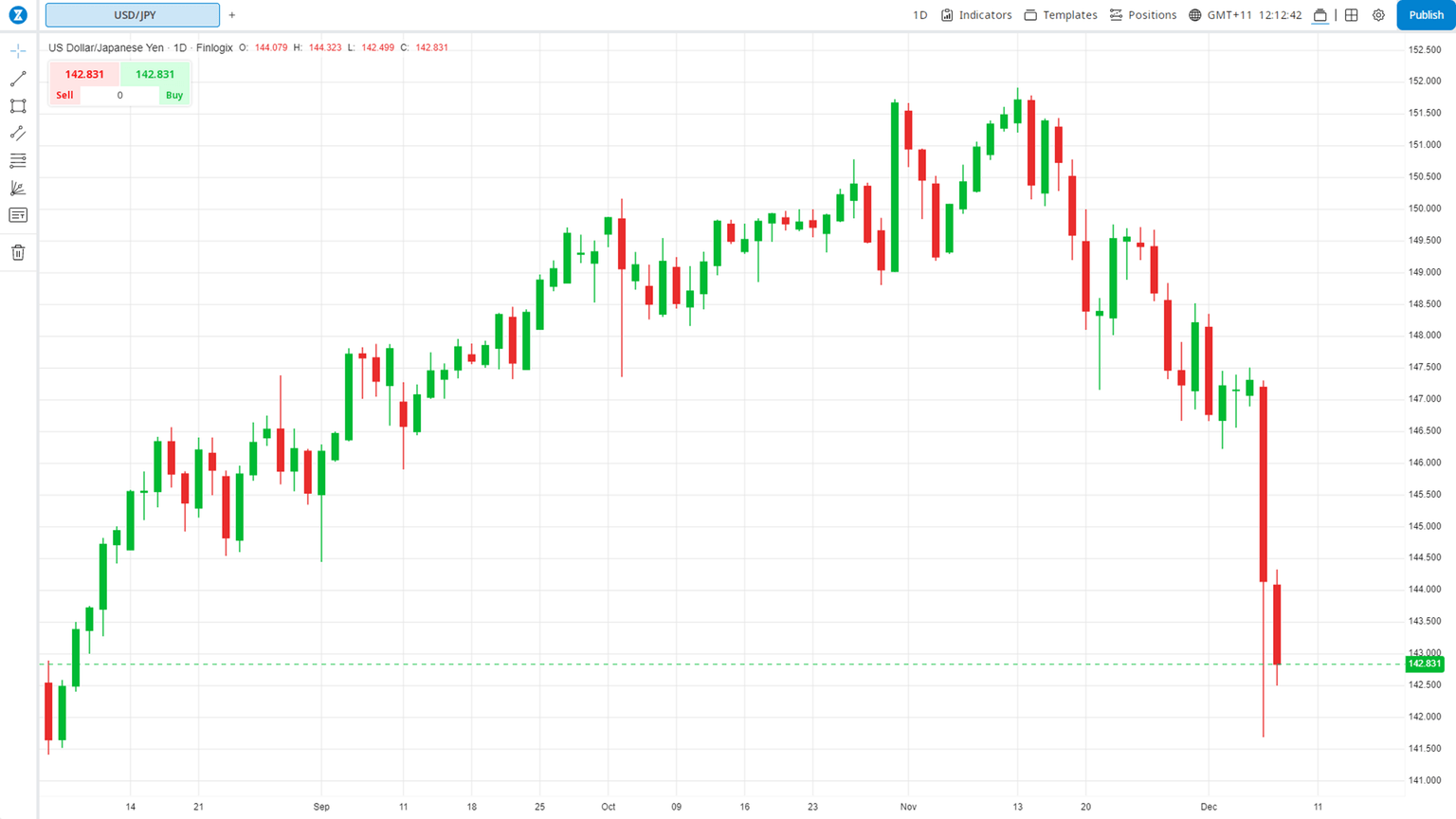

The Dollar plummeted against the Japanese Yen to 143.45 in late New York after the Bank of Japan signaled that it would scrap its negative interest rate regime this month.

The Japanese currency strengthened against all Rivals but most against the US Dollar. A popular gauge of the Greenback’s value against a basket of 6 major currencies, the Dollar Index (DXY) fell to 103.55 from 104.05 yesterday.

The Euro (EUR/USD) rallied 0.33% to 1.0800 from 1.0785 yesterday. Sterling (GBP/USD) edged higher to 1.2597, up from 1.2580 yesterday. The British Pound climbed off its one week low at 1.2544.

The Australian Dollar jumped 0.83% against the Greenback, settling at 0.6605 (0.6555 yesterday). New Zealand’s Kiwi (NZD/USD) gained 0.6% vs the US Dollar to 0.6177 from 0.6133.

Against the Emerging Market and Asian Currencies, the Dollar grinded lower. USD/CNH (Dollar-Chinese Yuan) eased to 7.1640 from 7.1740. USD/SGD (Dollar-Singapore Dollar) slid to 1.3375 from 1.3415 while USD/THB (Dollar-Thai Baht) fell to 35.15 (35.35).

US Treasury Bond yields fell. The benchmark 10-year yield settled at 4.13% (4.17% yesterday). Other global rates were lower apart from Japan’s. Ahead of today’s Bank of Japan meeting, the Japanese 10-year JGB yield climbed 8 basis points to 0.74%.

Wall Street stocks rallied. The US S&P 500 rose 0.7% to 4,584. from 4,570. However, Japan’s Nikkei 225 (which comprises the top 225 Japanese companies) slumped 2.09% to 32,440 (32,920).

Data released yesterday saw Japan’s Annual Tokyo Core CPI ease to 2.3% from 2.7% previously, and lower than median estimates at 2.4%. China’s Caixin Services PMI rose to 51.5 from 50.4 previously.

The Eurozone Final Services PMI rose to 49.6 from 48.2, beating forecasts at 48.2. The US JOLTs Job Openings fell to 8.31 million from 9.35 million previously, and lower than median estimates at 9.31 million.

-

USD/JPY – In another volatile session, the Greenback plunged lower to 143.45 at the close of trade in New York. Yesterday, the USD/JPY pair opened at 147.30. The overnight low traded was at 141.59 while the overnight high recorded was 147.18. One New York trader described it as a capitulation of Yen shorts.

-

AUD/USD – The Aussie Battler jumped to 0.6605 from its opening yesterday at 0.6550. In choppy trade of its own, the overnight low traded for the Australian Dollar was at 0.6523. The Australian Dollar soared to its overnight peak at 0.6620 before settling.

-

EUR/USD – The Euro rallied against the overall weaker US Dollar, closing at 1.0800 against yesterday’s 1.0785. The shared currency traded to an overnight high at 1.0817 before easing at the New York close. The overnight low recorded was 1.0755.

-

GBP/USD – Sterling soared to 1.2595 in late New York from its opening at 1.2580 yesterday. Overnight, the British Pound rallied to a high at 1.2613. The GBP/USD pair traded to a low of 1.2544. A stronger than expected UK Final Services PMI to 50.9 from 50.5 supported Sterling.

On the lookout

Today’s economic calendar is a busy one. New Zealand kicked off today’s economic data releases with its Q3 Manufacturing Sales which fell -2.7% from -1.6% previously.

The Kiwi was little changed following the release. Next up is Japan’s Q3 GDP (q/q f/c -0.5% from 1.1%; y/y f/c -2.1% from 4.5% - ACY Finlogix).

Japan also releases its October Current Account (+JPY 1,901.2 billion from +JPY 2,723.6 billion – ACY Finlogix), and finally Japan’s November Economic Watchers Survey (Current; 49.8 from 49.5 – ACY Finlogix).

Europe follows with Germany’s November Final Inflation Rate (m/m f/c -0.4% from 0%; y/y f/c 3.2% from 3.8% - ACY Finlogix).

Canada starts off North America with its Capacity Utilization (f/c 81% from 81.4%).

The US follows with its November Average Hourly Earnings (m/m f/c 0.3% from 0.2% - ACY Finlogix), US November Unemployment Rate (f/c 3.9% from 3.9%) and US November Non-Farms Payrolls (f/c 180K from 150K – ACY Finlogix).

The US rounds up today’s data with its University of Michigan Preliminary December Consumer Sentiment (f/c 62 from 61.3).

On Saturday, China releases its November Inflation Rate (m/m f/c -0.1% from -0.1%; y/y f/c -0.1% from -0.2% - ACY Finlogix) and Chinese November PPI (y/y f/c -2.8% from -2.6%).

Trading perspective

It’s all about the US Payrolls report which is released later (Saturday, 12.30 am Sydney time). Markets are focused on a median Payrolls gain of 180,000 against 150,000 previously.

Any number smaller than that of 180,000, say between 150,000 and 160,000 will see a selloff in the Greenback.

A Payrolls gain of 200,000 or more will see US Dollar shorts squeezed, and a huge topside USD move cannot be ruled out.

Markets will also be looking out for rhetoric from central bank officials. We can expect verbal intervention today from Japanese officialdom (Bank of Japan and the Ministry of Finance – MOF).

Japanese officials were always disturbed with the combination of a strong Yen and a weak Nikkei, as has happened overnight. Get those tin helmets on and look for another volatile day in FX today. “It’s just another day for you and me in FX land…”

- USD/JPY – Expect more fireworks in this currency pair today. The Greenback plummeted 1.35% lower to 143.45 from yesterday’s 147.30. Look for immediate support initially at 143.05, 142.55 and 142.00 today. Yesterday’s overnight low was 141.59. A break lower than 141.50 could see further stops triggered. Immediate resistance can be found at 144.00, 145.00 and 146.00. Look for another volatile trading day in the Dollar Yen today, likely between 142-147. Tin helmets on for this, watch for rhetoric from Japan Inc.

-

AUD/USD – The Aussie Battler rebounded against the overall weaker US Dollar to finish at 0.6605. Today, immediate resistance lies at 0.6620 (overnight high). The next resistance level is found at 0.6650 and 0.6680. Immediate support can be found at 0.6570, 0.6540 and 0.6510. Look for a likely range today of 0.6520-0.6620. Trade the range, nice and wide.

-

EUR/USD – The shared currency rallied against the backdrop of broad-based US Dollar weakness to finish just above the 1.0800 resistance level. On the day, look for immediate resistance at 1.0820 (overnight high traded was 1.0817). The next resistance level is found at 1.0850. Immediate support can be found at 1.0770 followed by 1.0740 (overnight low traded was 1.0755). Look for the Euro to trade in a likely range today of 1.0730-1.0830.

-

GBP/USD – Sterling soared against the overall weaker US Dollar to 1.2595 (1.2580 yesterday). On the day, look for immediate resistance at 1.2615 (overnight high traded was 1.2613). The next resistance level can be found at 1.2635 followed by 1.2665. Immediate support lies at 1.2570, 1.2540 (overnight low traded was 1.2544). The next support level lies at 1.2510. Look for Sterling to trade in a likely range today of 1.2540-1.2640. Trade the range.

Author

Michael Moran

ACY Securities

Michael has over 40 years’ FX experience, including running FX trading desks for some of the largest banks in the world.