Yen goes on a wild ride after BoJ shocker

The Japanese yen took investors on a wild ride on Friday but has settled down. In the European session, USD/JPY is trading at 139.54, up 0.05%.

Yen swings wildly after BoJ tweaks yield curve control

The Bank of Japan appears to relish catching the markets with its pants down, and I’ll be the first to admit that I was shocked to read that the BoJ had made a shift in policy at today’s policy meeting. Clearly, I wasn’t alone, as the yen has fluctuated almost 400 points since the BoJ shocked the markets and announced it would loosen its yield curve control. The policy statement noted that the BoJ will “conduct yield curve control with greater flexibility, regarding the upper and lower bounds of the range as references, not as rigid limits, in its market operations”.

BoJ Governor Ueda had signalled that he would maintain policy settings, and he reiterated this stance just a few days ago. Instead, Ueda went ahead with his first major policy shift since taking over as head of the BoJ in April, which triggered sharp volatility from the yen.

In September, the BoJ widened the target band on 10-year Japanese government bonds (JGBs) from 0.25% to 0.50%, sending the yen sharply higher. The BoJ said in today’s policy statement that the target band will remain in the range of -0.50% to +0.50%, but it will offer to purchase JGBs at 1%. Effectively, this widens the band by a further 50 basis points.

The BoJ maintained interest rates at -0.1% and raised its inflation forecast for fiscal 2023 from 1.8% to 2.5%. Inflation has persistently hovered above the 2% target and has put pressure on the BoJ to normalize its monetary policy. Interestingly, Governor Ueda insisted at a follow-up press conference that today’s tweak was not intended as a step towards policy normalization, dampening any expectations that the BoJ will abandon its yield curve control.

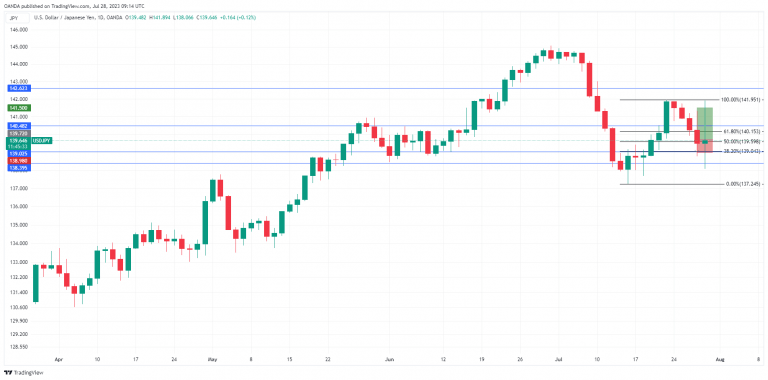

USD/JPY technical

-

USD/JPY has pushed above resistance at 1.4049. Above, there is resistance at 142.62.

-

There is support at 139.03 and 1.3840.

Author

Kenny Fisher

MarketPulse

A highly experienced financial market analyst with a focus on fundamental analysis, Kenneth Fisher’s daily commentary covers a broad range of markets including forex, equities and commodities.