Yen pairs are turning bearish with impulsive decline [Video]

![Yen pairs are turning bearish with impulsive decline [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/USDJPY/yen-japones-billetes-de-banco_XtraLarge.jpg)

XXXJPY Japanese Yen crosses are turning strongly down from the highs after another BoJ intervention. And, with bearish looking Yields, seems like Japanese Yen may face further recovery, which can push XXXJPY cross pairs even lower.

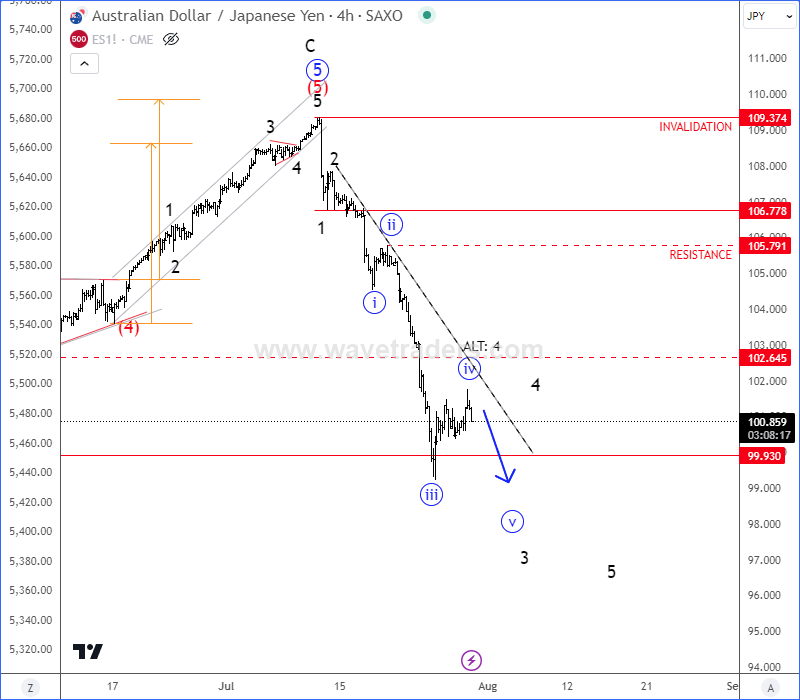

AUDJPY remains under bearish pressure in the 4-hour chart and it can be still falling in an impulsive five-wave fashion, so after current corrective recovery, which we see it as 4th wave, watch out on further weakness within the 5th wave.

AUD/JPY four-hour chart

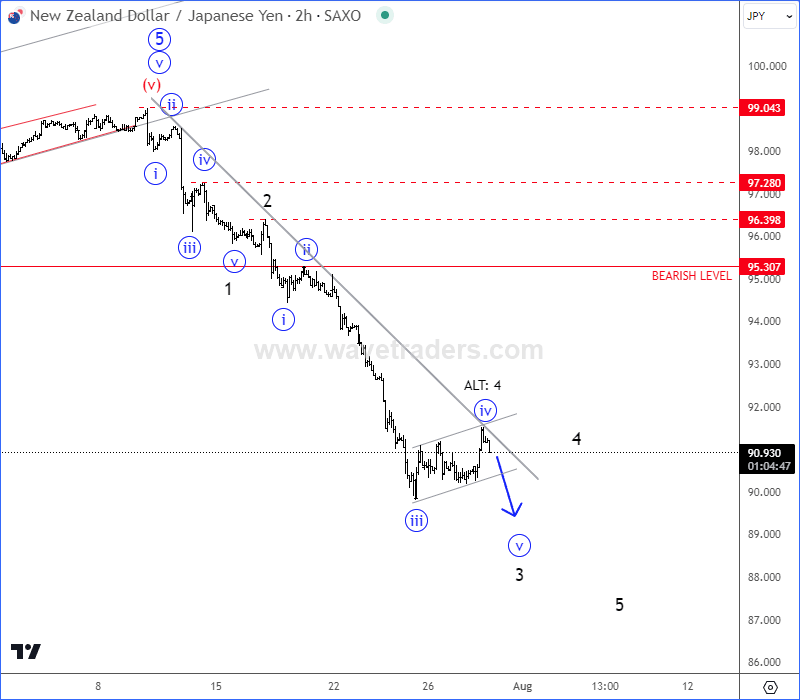

NZDJPY made a nice intraday corrective pullback in the 2-hour chart, ideally for subwave »iv« or maybe even a higher degree black wave 4, so more downside pressure can be seen for the 5th wave.

NZD/JPY two-hour chart

All that being said, looks like XXXJPY crosses are turning bearish and we can expect even a higher degree bearish reversal, but as soon as five-wave decline is finished, there will be a higher degree corrective recovery that will take some time before bears will resume.

For more analysis like this you may want to watch below our recording of a live webinar streamed on July 29 2024:

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Author

Gregor Horvat

Wavetraders

Experience Grega is based in Slovenia and has been in the Forex market since 2003.