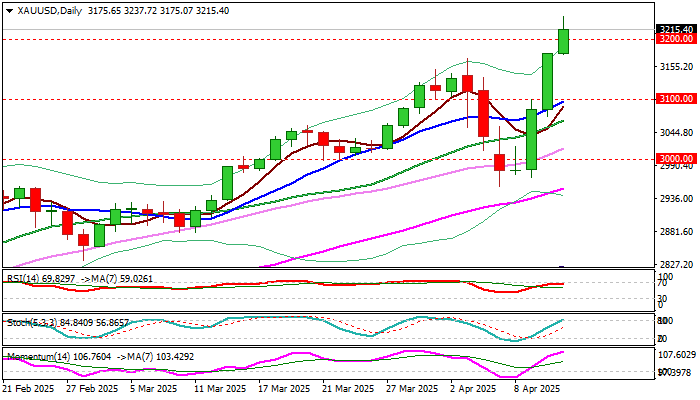

XAU/USD outlook: Gold rises above $3.200 on trade war escalation

XAU/USD

Gold surged above $3200 and hit multiple record highs on Friday, fueled by fresh rise in safe haven demand on growing worries over escalation of trade war and weaker dollar.

The latest decision of President Trump to put all tariffs on hold for 90 days but to exclude China from the deal and to increase import duties on Chinese goods to 125%, shook the world on Thursday, while China’s counter measures with the same rate of tariffs, sent fresh shockwaves through global markets on Friday.

Gold was the top market performer on Friday, along with other safe haven assets, such as Swiss franc and Japanese yen.

Mounting fears about the magnitude of the impact from intensifying trade conflict between the US and China, raise risk of recession and is likely to continue to fuel demand for the yellow metal.

The price may accelerate towards $3500 zone in coming months if two sides do not reach agreement.

Mild correction should be expected in the near term as a result of partial profit taking from strong rally in past three days, with limited dips to provide better levels for renewed entry into bullish market.

Broken psychological level at $3200 reverted to initial support, followed by former top $3167, which should ideally contain dips.

Fibo projections of the upleg from $2956 mark net targets at $3248, $3273 and $3298.

Res: 3237; 3248; 3273; 3298.

Sup: 3200; 3175; 3167; 3136.

Interested in XAU/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.