XAU/USD - Tweezers Top In Gold - Is It Good Time to Take Sell Position?

On Monday as a shortage of certainty on U.S.-China trade relations urged traders back to safe havens assets such as gold and Japanese yen.

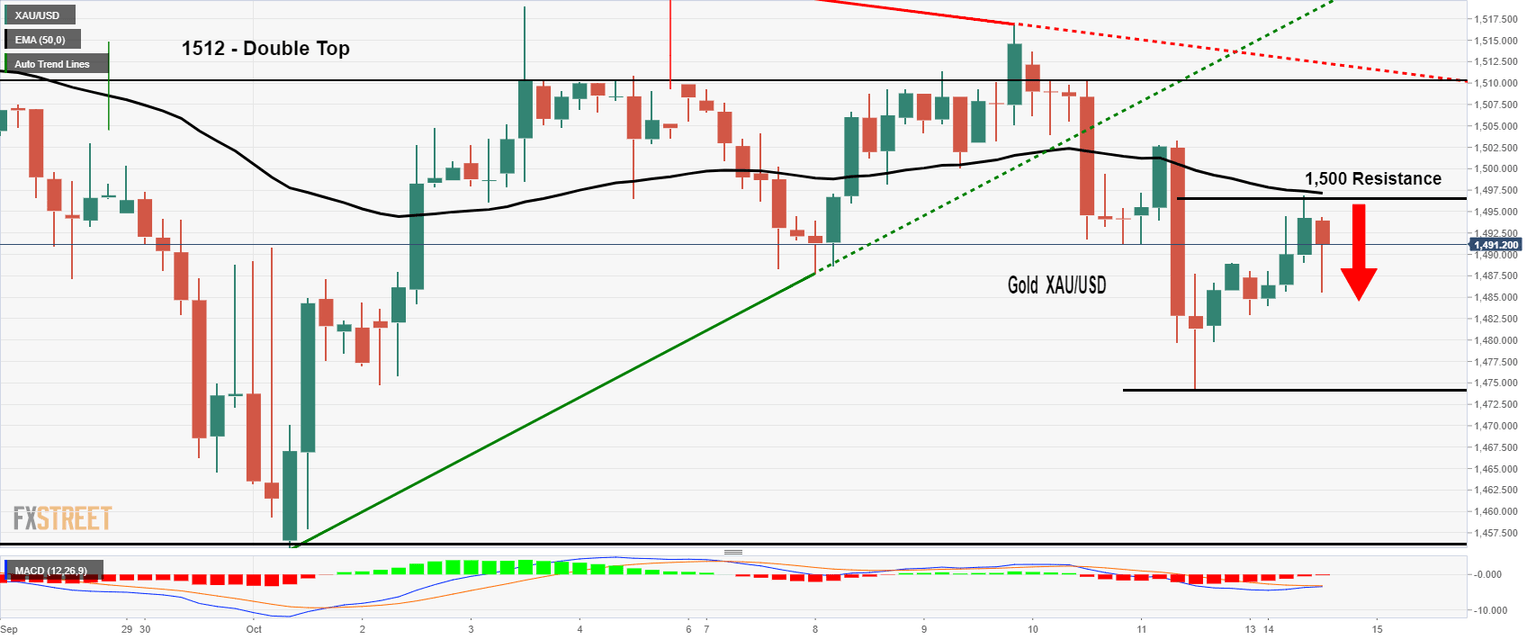

On the 4 hour and hourly timeframe, the precious metal gold seems to form a bearish trade setup.

XAU/USD -Hourly Chart

As you can see from the chart above, the XAU/USD surged after testing the double bottom support level of 1,476. The metal bounced off to place a high around 1,497 area.

Gold has formed a test bar/ a Doji pattern right below the 50 periods EMA, which is likely to keep gold bearish below 1,495. Investors can look for sell trades below 1,495 level to target 1,482. Whereas, the violation of 1,482 can drive more selling until 1,480.

XAU/USD - 4 Hour Chart

At the same time, the 4-hour chart seems to from tweezers top pattern around 1,490 level.

The MACD and Stochastics are holding in the selling zone, supporting the bearish bias in gold.

XAU/USD - Trade Setup

Entry Price: Sell Below 1,495

Take Profit: 1,489 and 1,484

Stop Loss: 1,502

Author

EagleFX Team

EagleFX

EagleFX Team is an international group of market analysts with skills in fundamental and technical analysis, applying several methods to assess the state and likelihood of price movements on Forex, Commodities, Indices, Metals and