XAU/USD outlook: Recovery may extend further on fading US rate hike prospects

XAU/USD

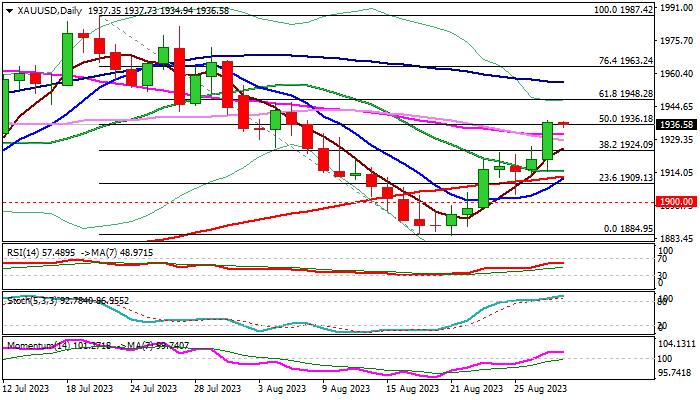

Gold price is holding within a narrow consolidation on Wednesday, following 0.9% acceleration on Tuesday.

Fresh bulls extended recovery from $1884 (Aug 17/21 double-bottom) to the highest in three months, cracking important Fibo barrier at $1936 (50% retracement of $1987/$1884 bear-leg).

The recent rally was mainly driven by soft economic data which hurt bets for further US interest rate hikes, though markets await more signals from data due this week.

The yellow metal may rise further on weaker than expected labor and consumer spending data, which will signal increased negative impact from high borrowing cost to the economic growth and make the dollar less attractive to investors.

Significantly improved technical picture on daily chart (strong positive momentum / MA’s turned to bullish setup) adds to near-term bullish bias, with tomorrow’s twist of daily cloud ($1953), also attracting bulls.

Close above cracked 50% retracement level ($1936) would add to positive signals and open way for extension towards $1948/53 (Fibo 61.8% / daily cloud top).

Broken daily Kijun-sen ($1933) should ideally contain, with extended dips to find firm ground at $1924 zone (broken Fibo 38.2% / former tops) to keep fresh bulls in play.

Res: 1938; 1948; 1953; 1963.

Sup: 1933; 1924; 1912; 1909.

Interested in XAU/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.