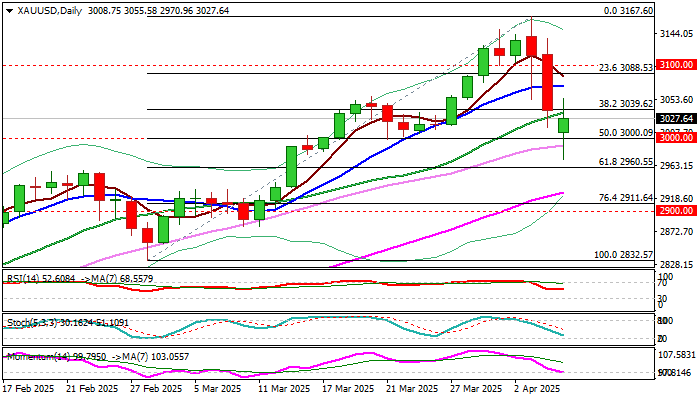

XAU/USD outlook: Reaction at key $3,000 level to provide fresh direction signals

XAU/USD

Gold dipped below $3000 and hit the lowest in three weeks in early Monday trading, in extension of pullback from new record high in past two days.

Sharp selloff surprised markets as gold price should have risen further in situation of strong risk aversion and growing uncertainty, but heavy losses in stock markets prompted investors to liquidate profitable positions in gold to cover part of losses and margin calls.

Fresh bears cracked $3000 level, which I previously marked as key support (psychological / former higher base / 50% retracement of $2832/$3167 upleg), but subsequent bounce signaled increased headwinds at this zone, highlighting the importance of support.

Reaction at $3000 level will probably provide clearer direction signals, with ability to hold above this level (to register minimum two daily closes above) to generate initial signal that correction is nearing its end.

The notion is partially supported by fresh dovish signals from Fed as markets in new reality, see growing chances for more rate cuts this year than initially estimated.

However, more work at the upside will be required to validate signal with rise above $3050 zone (today’s high / Fibo 38.2% of $3167/$2970 pullback) to revive bulls and close above $3070 zone (50% retracement / 10DMA) to confirm and shift near term focus higher.

On the other hand, unchanged fundamentals (with threats of deterioration) keep the downside at risk.

Sustained break of $3000 trigger to sideline larger bears and open way for deeper correction and unmask targets at $2970/60 and $2926 in extension.

Res: 3039; 3055; 3070; 3088.

Sup: 3000; 2970; 2950; 2926.

Interested in XAU/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.