Today’s gold report is to discuss the fundamental issues affecting the direction of gold’s price, which in the past few days has reached new record high levels. Issues like the uncertainty created in the market by US President Trump’s tariffs, the perception of a negative correlation of gold with the USD, any news regarding central bank buying and the Fed’s stance are to be discussed. At the end we are also to include a technical analysis for gold’s daily chart in order to provide a rounder view for the trading instrument.

Negative correlation of Gold to USD rejuvenated?

Over the past few days the negative correlation of the USD with gold’s price seems to have been largely rejuvenated, as the precious metal’s price rose reaching new record high levels while the USD index fell for the past three days, while gold’s price rose has been rising for a few days now pausing yesterday. We would like to see clearer evidence regarding the negative correlation of the two trading instruments before adopting a rejuvenation of it on a fundamental level. At the same time we also note the rise of US yields over the past few days since our last report and their relative stabilisation at high levels. The course of yields should make US bonds more attractive for investors thus weighing on gold’s price, given the antagonistic nature of the two investment instruments (gold and US bonds). Yet gold traders were not influenced by the rise of US yields and safe haven inflows continued to reel in for the precious metal, as the uncertainty of investors is also based on the possibility of a recession in the US economy. Hence we see a possible decoupling of gold with bonds for the time being and should market worries for a possible recession in the US economy intensify, we may see gold’s price getting more safe haven inflows.

Uncertainty over Trumps’ trade wars maintained

The trade wars instigated by US President Trump continue to stoke uncertainty in the markets, which in turn continue to drive safe haven inflows for the precious metal. In a latest development, US President Trump, announced that he is to announce tariffs on semiconductors and possibly pharmaceuticals, practically citing the need for the US to be self sufficient on these products. On the flip side White House officials are signaling the possibility of separate trade deals being possible for individual countries, while also US President Trump announced that high tech products could be exempted practically blurring the picture of the overall issue. We maintain the view that the trade wars may continue tantalizing the markets for the coming days and any further escalation could create further safe haven inflows for the precious metal, while any easing of the market worries could weigh on gold’s price.

The Fed’s stance

In the coming days with the exception of the US retail sales we have no major financial releases on the calendar stemming from the US, hence we expect fundamentals to lead the markets especially gold traders. As we have allready commented on Trump’s trade wars, we note on a monetary level that should Fed policymakers reiterate in the coming days, their doubts for extensive rate cuts, we may see gold’s price weakening while any enhancement of the market sentiment for more rate cuts to come by the bank could support gold’s price, as was the case with Fed Board Governor Waller yesterday. We also are worried for any signs of recession in the US economy with inflation being at the same time at relatively high levels, and any market worries to that end could enhance support for gold’s price and vice versa.

Technical analysis

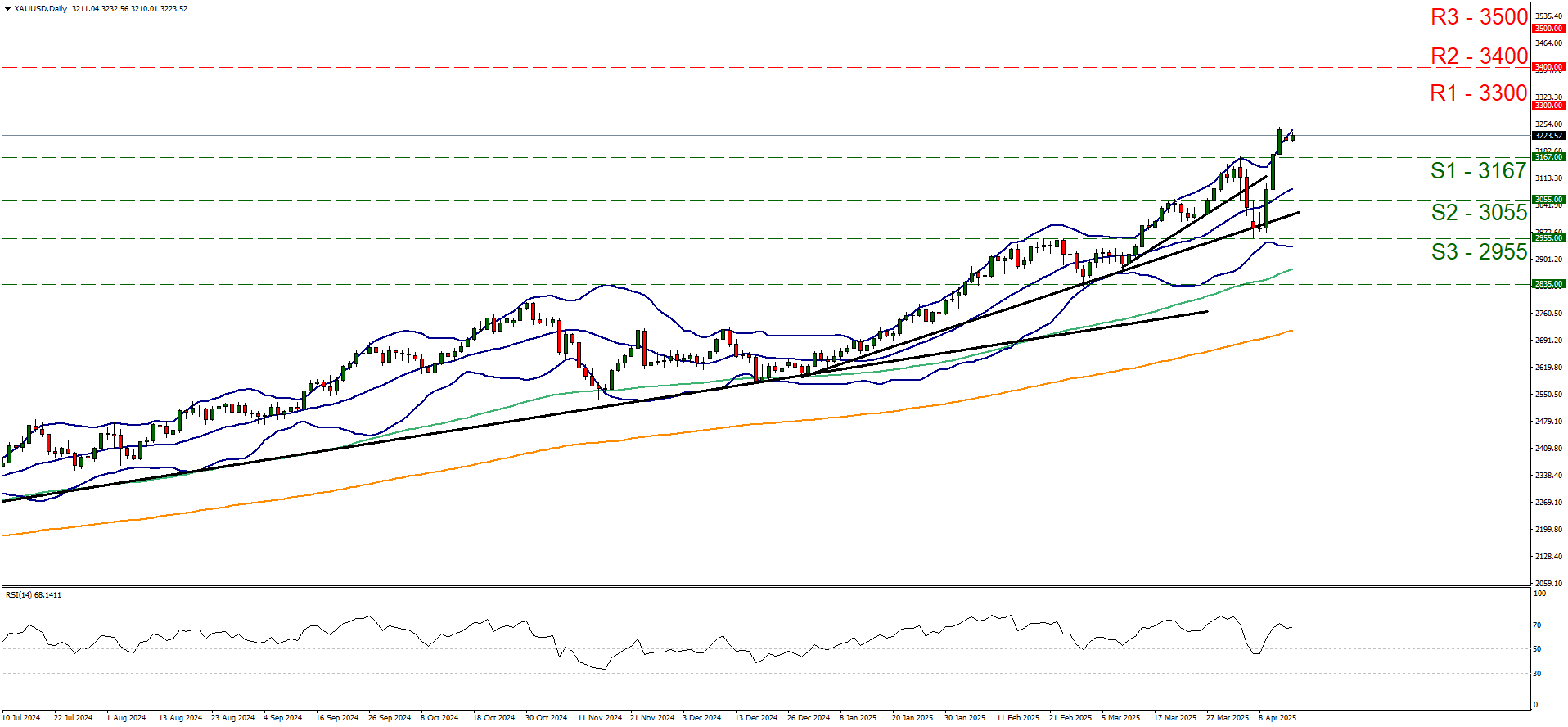

XAU/USD daily chart

- Support: 3167 (S1), 3055 (S2), 2955 (S3).

- Resistance: 3300 (R1), 3400 (R2), 3500 (R3).

Technically we note the rally of gold’s price since our last report with the precious metal price bouncing on the 2955 (S3) support line and then breaking consecutively the 3055 (S2) and the 3167 (S1) resistance lines, both now turned to support and culminating around the $2250 per troy ounce level. Given that gold’s price in its upward movement was able to form a new higher trough and higher peak, reaching new record highs and respecting the upward trendline guiding its since the 3oth of December last year we maintain a bullish outlook for the precious metal’s price. Yet as a word of warning we also note that the RSI indicator has reached the reading of 70, which on the one hand showcases the strong bullish sentiment among market participants yet on the on the other highlights that the precious metal’s price is nearing overbought levels, thus becoming ripe for a correction lower. Similar signals are coming from the price action flirting with the upper Bollinger band. Should the bulls maintain control over gold’s price, we may see it setting out to new, unchartered territories, breaking the 3300 (R1) resistance line and we set as the next possible target for the bulls the 3400 (R2) resistance level. A bearish outlook seems currently remote and for its adoption we would require gold’s price to break the 3167 (S1) support line, the 3055 (S2) support level and continue lower to break the prementioned upward trendline signaling the interruption of the upward movement and proceed to also break the 2955 (S3) support level, allowing gold’s price to form a lower trough.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69.80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Our services include products that are traded on margin and carry a risk of losing all your initial deposit. Before deciding on trading on margin products you should consider your investment objectives, risk tolerance and your level of experience on these products. Margin products may not be suitable for everyone. You should ensure that you understand the risks involved and seek independent financial advice, if necessary. Please consider our Risk Disclosure. IronFX is a trade name of Notesco Limited. Notesco Limited is registered in Bermuda with registration number 51491 and registered address of Nineteen, Second Floor #19 Queen Street, Hamilton HM 11, Bermuda. The group also includes CIFOI Limited with registered office at 28 Irish Town, GX11 1AA, Gibraltar.

Recommended Content

Editors’ Picks

Gold price extends fresh record run toward $3,500

Gold price continues to build on its record rally, closing in on the $3,500 mark in Asian trading on Tuesday. Investors continue to flock to safety in the traditional store of value, the Gold price, amid no confidence in the US Dollar and Trump’s attacks on Fed Chairman Powell.

AUD/USD bounces back toward 0.6450 as US Dollar resumes downside

AUD/USD picks up fresh bids toward 0.6450 in the Asian session on Tuesday. The US Dollar fizzles its bounce and resumes downside amid uncertainty over Trump's trade policies and the weakening confidence in the US economy. Concerns about the rapidly escalating US-China trade war could act as a headwind for the Aussie.

USD/JPY mires in multi-month low near 140.00

USD/JPY languishes in seven-month lows near 140.00 in the Asian session on Tuesday. Trade war concerns, global recession fears, hopes for a US-Japan trade deal, and the divergent BoJ-Fed bets could continue to underpin the Japanese Yen while the US Dollar selling resumes.

ARK Invest integrates Canada's 3iQ Solana Staking ETF into its crypto funds

Asset manager ARK Invest announced on Monday that it added exposure for Solana staking to its ARK Next Generation Internet exchange-traded fund and ARK Fintech Innovation ETF through an investment in Canada's 3iQ Solana Staking ETF.

Five fundamentals for the week: Traders confront the trade war, important surveys, key Fed speech Premium

Will the US strike a trade deal with Japan? That would be positive progress. However, recent developments are not that positive, and there's only one certainty: headlines will dominate markets. Fresh US economic data is also of interest.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.