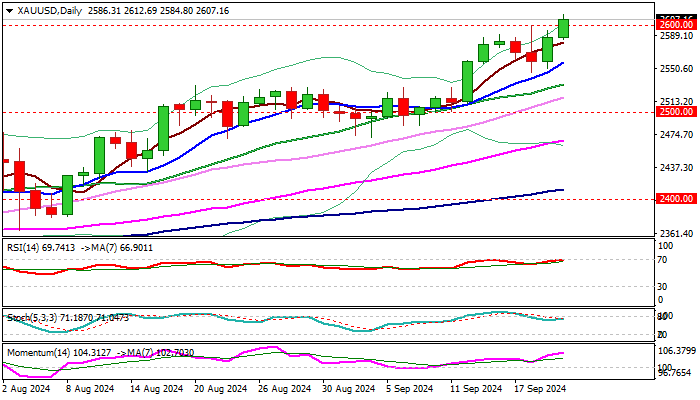

XAU/USD outlook: Gold surges to new all-time high above $2,600

XAU/USD

Gold broke through psychological $2600 barrier and hit new all-time high on Friday morning, on track to register clear break higher after the resistance was cracked in post-Fed jump but resisted attack.

The yellow metal shined after market digested Fed’s decision, with prospects for more rate cuts, deteriorating geopolitical situation, growing uncertainty over fiscal conditions in a number of Western economies and ongoing destabilization of the US dollar, boosting its safe haven appeal.

Fresh bull-leg $2546 (low of a shallow correction) signals continuation of larger uptrend, with close above $2600 to confirm signal.

Gold is also on track for the second consecutive weekly gain, which came after a triple weekly Doji candles, adding to bullish continuation signals.

Gold price has moved at a high speed and rose from $2000 (which marked very strong resistance) to $2600 in about ten months.

The sentiment is very bullish and sustained break above $2600 would look for targets at $2628 and $2650 (Fibo projections) initially, with stronger bullish acceleration to bring in focus $2700.

Dips on partial profit taking should be shallow and mark positioning for further advance.

Res: 2614; 2628; 2636; 2650.

Sup: 2600; 2589; 2581; 2557.

Interested in XAU/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.