XAU/USD outlook: Gold surges as violent clashes in the Middle East spark strong safe-haven demand

XAU/USD

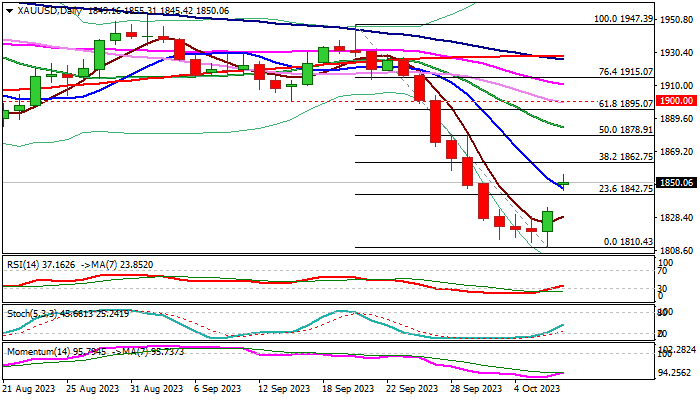

Gold opened with a gap higher, starting trading on Monday at $1850 zone, after closing on Friday at $1832.

Growing uncertainty over spiraling violence in the Middle East prompted traders into safer assets and strongly boosted demand for safe haven gold at the start of the week.

Technical picture on daily chart improved, as Friday’s positive close marked the first bullish day after nine consecutive days of losses.

Initial positive signal was generated by completion of bullish engulfing pattern on Friday, boosted by a false break below the base of weekly Ichimoku cloud, as well as bear-trap under 200WMA.

Daily RSI reversed from oversold zone and 14-momentum is heading north (though still deeply in the negative territory), supporting the action.

Fresh rise broke above 10DMA ($1846) but needs to register daily close above here to verify initial signal and expose upper pivot at $1862 (Fibo 38.2% of $1947/$1810), break of which to generate reversal signal and open way for further advance.

Near-term action is going to be highly dependent on the news and further escalation of the conflict would add support to gold price.

Caution on return and close below broken Fibo level at $1842 (23.6% of $1947/$1810), while deeper fall and filling today’s gap would signal that recovery phase might be over.

Res: 1855; 1862; 1878; 1884.

Sup: 1846; 1843; 1832; 1823.

Interested in XAU/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.