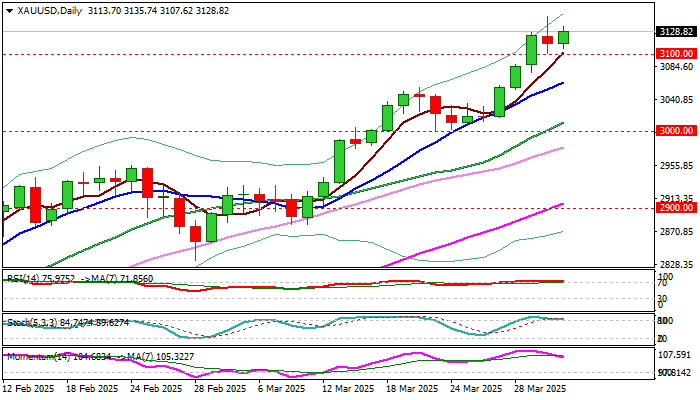

XAU/USD

Gold prices remain firm and hold above $3100 for the second consecutive day, after the metal hit new record high at $3149 on Tuesday.

Strong safe haven demand on high economic and geopolitical uncertainties continues to lift gold price, which advanced over $400 since President Trump started his term in the White house.

The yellow metal ended March with over 9% gains that marks the biggest monthly gain since August 2011 and was up over 18% in the first three months of the year.

All eyes are now on President Trump’s announcement of reciprocal tariffs (due today at 20:00 GMT) which is expected to generate strong direction signal.

If Trump decides to act according to his promises during the past few weeks and announce implementation of full package of new tariffs on various countries (in addition to existing tariffs), gold would appreciate further in such scenario.

Violation of immediate barriers at $3149/57 to expose targets at $3171 and $3200, with stronger acceleration higher not ruled if markets anticipate that consequences of escalating trade war will be dramatic.

Additional support to metal’s price would come from worsening situation in Ukraine following warnings of peace talks failure, as well as deteriorating economic conditions in US and EU, following recent discouraging economic data.

On the other hand, softer tariff rhetoric from Trump would ease bullish pressure and probably deflate gold price, though dips likely to be limited as overall picture is still very bullish, with other factors fueling safe haven demand, remaining firmly in play.

Broken $3100 level reverted to initial and solid support, followed by rising 10DMA ($3062), and Fibo 38.2% of $2032/$3149 ($3028), with $3000 level (psychological / higher base) likely to contain extended dips and keep larger bulls in play.

Res: 3149; 3157; 3177; 3200.

Sup: 3108; 3100; 3062; 3028.

Interested in XAU/USD technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD holds losses below 1.1400 amid US Dollar recovery

EUR/USD remains pressured below 1.1400 in the European trading hours on Tuesday. The Euro weakens amid rising expectations of further ECB interest rate cuts while the US Dollar draws support from some progress on US trade deals with its major global trading partners. US jobs data awaited.

GBP/USD retreats below 1.3400 ahead of US data

GBP/USD reverses its direction and trades below 1.3400 after setting a multi-year high near 1.3450 earlier in the day. The US Dollar (USD) stays resilient against its rivals as markets remain optimistic about a de-escalation in the US-China trade conflict. Focus shifts to key macroeconomic data releases from the US.

Gold declines toward $3,300 on improving risk mood

Gold price remains heavily offered through the early European session, though it manages to hold above the $3,300 mark amid mixed fundamental cues. Signs of easing US-China trade tensions continue to drive flows away from traditional safe-haven assets and undermine demand for the precious metal.

JOLTS job openings expected to dip slightly in March as markets eye April employment data

The Job Openings and Labor Turnover Survey (JOLTS) will be released on Tuesday by the United States Bureau of Labor Statistics. Markets expect job openings to retreat to 7.5 million on the last business day of March with the growing uncertainty surrounding the impact of Trump’s trade policy.

May flashlight for the FOMC blackout period – Waiting for the fog to lift

We expect the FOMC will leave its target range for the federal funds rate unchanged at 4.25-4.50% at its upcoming meeting on May 6-7, a view widely shared by financial markets and economists. Market pricing currently implies only a 9% probability of the FOMC cutting the fed funds rate by 25 bps.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.