XAU/USD

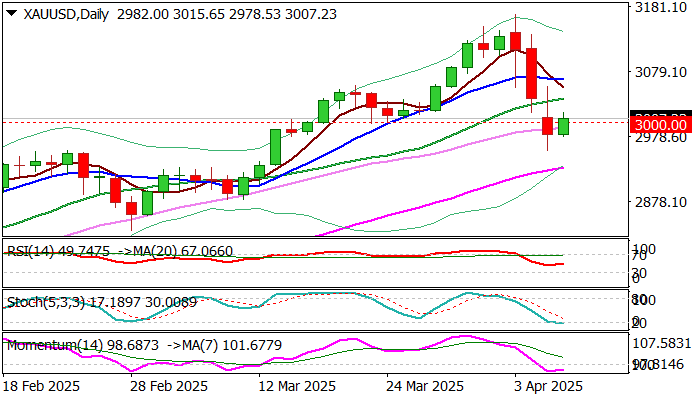

Gold price bounced on Tuesday and returned above key $3000 level, partially offsetting initial negative signal on violation of this support on Monday and threats of deeper pullback on clear break lower.

Profit taking after a steep fall in past three days, which was mainly driven by closing profitable gold longs to cover losses from sharply falling stocks and attempts to regain its safe haven appeal in situation of strong risk aversion, inflated metal’s price.

As mentioned in previous comment, reaction on $3000 level will be crucial for the near term direction, with downside risk still present despite today’s bounce.

Markets await more news about potential negotiations about tariffs after more than fifty countries contacted US administration for a ‘peace talks’, while unstable economic and geopolitical situation continues to provide support for safe haven assets.

Technical picture slightly improved on daily chart, with oversold conditions adding to hopes of further recovery, but countered with still negative momentum.

Potential close above $3000 could provide temporary relief, however more work at the upside will be required.

Break and close above $3037 (Fibo 38.2% of $3167/$2956 / 20DMA) would brighten near term picture and boost expectations of further recovery, while failure here but ability to hold above $3000 would keep hopes of recovery alive, but fragile.

The negative scenario sees attempts above $3000 as a false break which would keep the downside vulnerable of deeper correction towards targets at $2911/00 (Fibo / psychological.

Res: 3017; 3037; 3050; 3061.

Sup: 2978; 2956; 2926; 2911.

Interested in XAU/USD technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

Gold moves to record highs past $3,340 Premium

Gold now gathers extra steam and advances beyond the $3,340 mark per troy ounce on Wednesday, hitting all-time highs amid ongoing worries over escalating US-China trade tensions, a weaker US Dollar and lack of news from Powell's speech.

Australian Dollar receives support from improved global risk mood, US Retail Sales eyed

The Australian Dollar extends its winning streak against the US Dollar for a sixth consecutive session on Wednesday, with the AUD/USD pair holding firm after the release of Australia’s Westpac Leading Index. The index’s six-month annualised growth rate eased to 0.6% in March from 0.9% in February.

EUR/USD remains in a consolidative range below 1.1400

EUR/USD navigates the latter part of Wednesday’s session with marked gains, although another test of the 1.1400 level remained elusive. The strong bounce in spot came on the back of a marked move lower in the US Dollar, which remained apathetic following the neutral stance from Chair Powell.

Bitcoin stabilizes around $83,000 as China opens trade talks with President Trump’s administration

Bitcoin price stabilizes around $83,500 on Wednesday after facing multiple rejections around the 200-day EMA. Bloomberg reports that China is open to trade talks with President Trump’s administration.

Future-proofing portfolios: A playbook for tariff and recession risks

It does seem like we will be talking tariffs for a while. And if tariffs stay — in some shape or form — even after negotiations, we’ll likely be talking about recession too. Higher input costs, persistent inflation, and tighter monetary policy are already weighing on global growth.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.