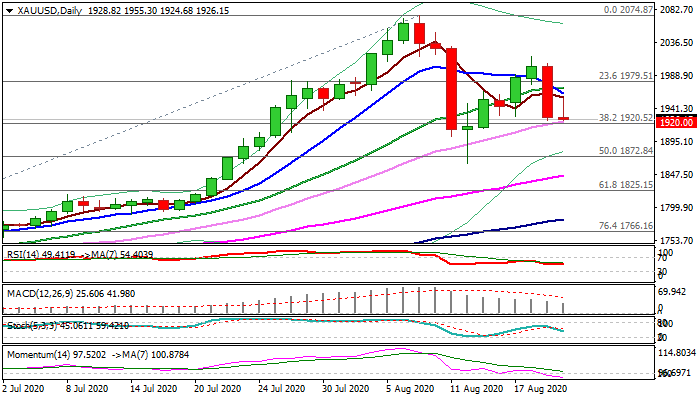

XAU/USD outlook: Gold remains in red after Wed's strong fall and pressures key support at $1920

GOLD

Spot gold remains under pressure on Thursday following 3.7% fall previous day, as subsequent recovery attempts from one-week low at $1924 stalled and metal's price fell back near Wed-Thu lows ($1924). Dovish Fed and likely scenario in which the US central bank is not going to allow an increase of interest rates for some time, should be supportive for the yellow metal's price, currently in corrective phase from new all-time high ($2074). Traders still see dips as buying opportunity, but further weakness cannot be ruled out if fresh bears break important support at $1920 (Fibo 38.2% of $1670/$2074 / former record high of 2011). Wednesday's massive bearish daily candle weighs heavily, with the notion being supported by rising negative momentum.

Res: 1955; 1962; 1971; 1979

Sup: 1920; 1900; 1872; 1862

Interested in XAU/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.