XAU/USD

Gold price rose for the third consecutive day and came ticks ahead of new all-time high in early Wednesday’s trading.

Markets await the release of US August CPI report to complete the picture ahead of Fed policy meeting next week.

If Aug numbers come in line with expectations or better, it will signal that inflation remains in a downward trajectory and heading towards Fed’s 2% target, implying that 25 basis points cut will be likely scenario.

Markets widely expect the Fed to opt for three 0.25% rate cuts by the end of the year, though more aggressive action cannot be completely ruled out, amid recent weaker than expected US economic data which sparked fresh recession fears.

Overall, the yellow metal is expected to remain well supported by expected policy easing, as well as rising geopolitical tensions, which continue to fuel safe-haven demand.

Investors were not impressed by the US Presidential debate and prefer to stick to economic data rather than political promises.

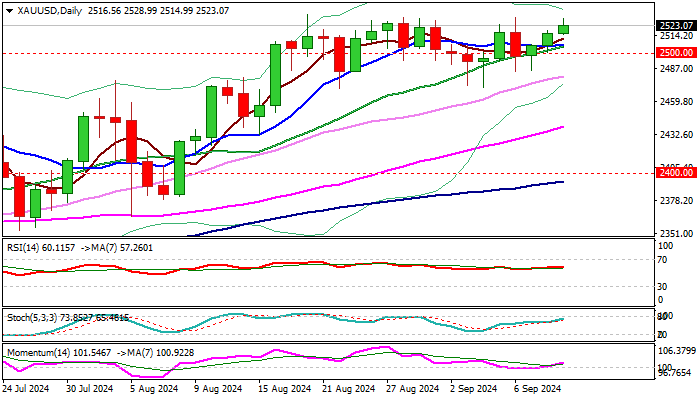

Firmly bullish technical studies on daily chart are expected to contribute to positive outlook.

Although bulls will likely face increased headwinds at record high zone, eventual break above the top of multi-week consolidation range is seen as likely scenario.

Violation of $2431 peak will expose targets at $2554 and $2568 (Fibo projections) and round-figure barrier at $2600, which many analysts see as target for this year.

Near-term action is expected to remain biased higher while the price stays above psychological $2500 support, also the mid-point of the recent $2531/$2470 range.

Res: 2531; 2554; 2568; 2600.

Sup: 2514; 2507; 2500; 2480.

Interested in XAU/USD technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD trades with moderate gains near 1.1050, US CPI awaited

EUR/USD is holding the bounce near 1.1050 in Wednesday's early European session. The pair draws support from the USD/JPY slump-driven US Dollar weakness. The further upside may be limited due to dovish ECB expectations. All eyes now turn to US CPI data.

GBP/USD reverses below 1.3100 after dismal UK data, US CPI eyed

GBP/USD is easing below 1.3100 in European trading, unable to defend gains after the dismal UK data. The UK economy stagnated in July again while Industrial Production unexpectedly declined, weighing on the Pound Sterling. US CPI report is next in focus.

Gold rallies up to all-time-highs on Fed outlook, USD weakness

Gold cycles back up towards the top of its three-week range, trading just shy of $2,530 on Wednesday. The precious metal keeps oscillating as investors debate the size of the cut the Federal Reserve (Fed) will make to interest rates at its September 17-18 meeting.

US CPI inflation could help tilt balance between 25 and 50 basis points Fed rate cut

The Bureau of Labor Statistics (BLS) will publish the highly anticipated CPI inflation data from the US for August on Wednesday at 12:30 GMT. The USD braces for intense volatility, as any surprises from the US inflation report could significantly impact the market’s pricing of the Federal Reserve (Fed) interest rate cut expectations in September.

Five Fundamentals for the week: Jittery markets fear the ECB, US inflation and more Premium

Is there still a chance? Investors hope for a 50-bps rate cut from the Fed but also fear a global recession is underway. The world's three largest economies, the US, China, and the eurozone, are set to rock global markets.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.