XAU/USD

Gold keeps negative tone at the beginning of the week and fell to new lowest in almost seven months ($1839) in early European trading on Monday.

The metal extends steep fall into sixth straight day after registering weekly loss of 4% last week (the biggest weekly drop since mid-June 2021).

Gold was down 4.7% in September, mainly driven by stronger dollar, but recent weak US economic data signal that tight Fed monetary policy started to bite, which may result in fresh demand for safe-haven yellow metal.

Data on Friday showed that underlying US inflation eased last month (PCE index, closely watched by Fed), adding to signals that the central bank might be done with rate hikes, though percentage of expectations for another hike is still significant.

The US economic data to be released this week, are expected to provide more details, with today’s speech by Fed Chair Powell to be followed by job openings, private sector hiring and non-farm payrolls.

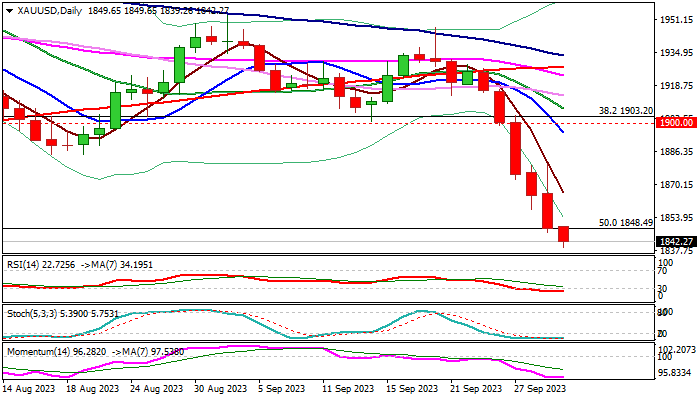

Technical picture on daily chart is bearish but deeply oversold, which suggests that bears may start to face headwinds.

Fresh weakness broke below $1848 (50% of $1616/$2080 rally) and eyeing $1823 (weekly Ichimoku cloud base) which may mark a strong obstacle and pause larger bears.

Slower pace ahead of key US labor data is likely and a partial profit taking after a steep fall could be a likely near-term scenario, with overall bearish bias to remain intact while the price stays below former low at $1885 (Aug 17).

Caution on return above $1900 zone (former strong support, now reverted to significant resistance) which would put larger bears on hold.

Res: 1848; 1866; 1885; 1895.

Sup: 1839; 1823; 1814; 1804.

Interested in XAU/USD technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD stays in positive territory above 1.0850 after US data

EUR/USD clings to modest daily gains above 1.0850 in the second half of the day on Friday. The improving risk mood makes it difficult for the US Dollar to hold its ground after PCE inflation data, helping the pair edge higher ahead of the weekend.

GBP/USD stabilizes above 1.2850 as risk mood improves

GBP/USD maintains recovery momentum and fluctuates above 1.2850 in the American session on Friday. The positive shift seen in risk mood doesn't allow the US Dollar to preserve its strength and supports the pair.

Gold rebounds above $2,380 as US yields stretch lower

Following a quiet European session, Gold gathers bullish momentum and trades decisively higher on the day above $2,380. The benchmark 10-year US Treasury bond yield loses more than 1% on the day after US PCE inflation data, fuelling XAU/USD's upside.

Avalanche price sets for a rally following retest of key support level

Avalanche (AVAX) price bounced off the $26.34 support level to trade at $27.95 as of Friday. Growing on-chain development activity indicates a potential bullish move in the coming days.

The election, Trump's Dollar policy, and the future of the Yen

After an assassination attempt on former President Donald Trump and drop out of President Biden, Kamala Harris has been endorsed as the Democratic candidate to compete against Trump in the upcoming November US presidential election.