XAU/USD

Gold remains at the back foot and stays in red for the second day on firmer dollar and also pressured by eased US political uncertainty, which recently fueled safe haven demand, along with geopolitics and expectations for stronger Fed rate cuts.

New circumstances after Trump’s victory point to measures which will boost economic growth and subsequently fuel inflation that requires revision of Fed’s current stance on monetary policy.

The latest remarks from Fed Chair Powell suggest that the US central bank will be likely less aggressive in rate cuts and that policy easing cycle would likely end earlier than initially planned, which may further dent metal’s safe haven appeal.

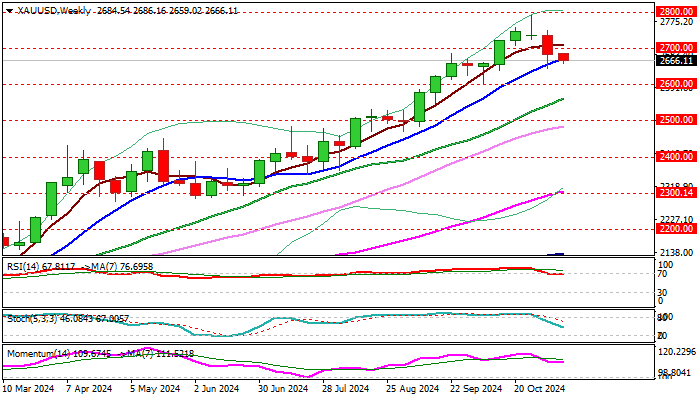

Pivotal supports at $2646/43 (Fibo 76.4% of $2602/$2790 / Nov 7 higher low) came under pressure, with break here to further weaken near-term structure and risk test of key supports at $2616/02 (top of thick rising daily Ichimoku cloud / Oct 10 trough), violation of which to generate reversal signal and open way for deeper correction.

Such scenario won’t be a surprise as gold was in steep uptrend and without significant correction for one year, however fundamentals, currently metal’s key driver, are expected to define fresh direction.

Technical studies weakened on daily chart as negative momentum continues to strengthen, MA’s (10/20/30-d) turned to bearish configuration and south-heading RSI points to more space for downside extension.

Adding to negative signals was last week’s bearish close with the biggest weekly loss since mid-May.

Markets focus on release of US October inflation data and speeches from several Fed officials (due later this week) which would provide fresh details on direction and the pace of changes in the US monetary policy in the near future.

Res: 2686; 2700; 2749; 2758.

Sup: 2643; 2600; 2560; 2471.

Interested in XAU/USD technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

AUD/USD: Next on the downside comes 0.6500

Further gains in the US Dollar kept the price action in commodities and the risk complex depressed on Tuesday, motivating AUD/USD to come close to the rea of the November low near 0.6500.

EUR/USD pierces 1.06, finds lowest bids in a year

EUR/USD trimmed further into low the side on Tuesday, shedding another third of a percent. Fiber briefly tested below 1.0600 during the day’s market session, and the pair is poised for further losses after a rapid seven-week decline from multi-month highs set just above 1.1200 in September.

Gold struggles to retain the $2,600 mark

Following the early breakdown of the key $2,600 mark, prices of Gold now manages to regain some composure and reclaim the $2,600 level and beyond amidst the persistent move higher in the US Dollar and the rebound in US yields.

Ripple could rally 50% following renewed investor interest

Ripple's XRP rallied nearly 20% on Tuesday, defying the correction seen in Bitcoin and Ethereum as investors seem to be flocking toward the remittance-based token. XRP could rally nearly 50% if it sustains a firm close above the neckline resistance of an inverted head and shoulders pattern.

Five fundamentals: Fallout from the US election, inflation, and a timely speech from Powell stand out Premium

What a week – the US election lived up to their hype, at least when it comes to market volatility. There is no time to rest, with politics, geopolitics, and economic data promising more volatility ahead.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.