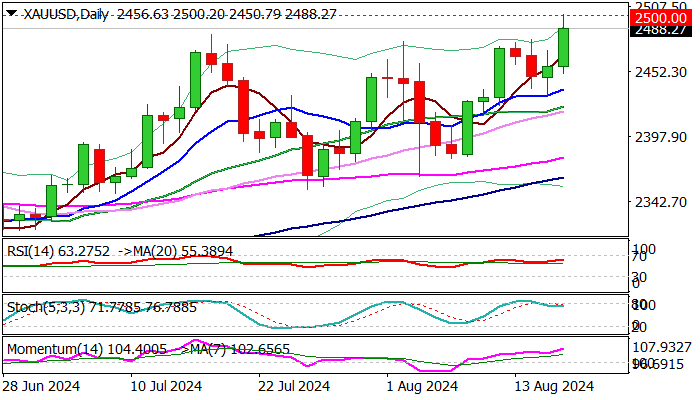

XAU/USD outlook: Gold hits new record high at $2500

Gold price surged on Friday and hit new record high at psychological $2500 level, benefiting from fresh turbulence in the markets after better than expected US data offset negative impact from much weaker than expected July NFP and brightened economic outlook.

Fading recession fears also lowered bets for Fed’s September rate cut (which jumped from 25 to 50 basis points) back to 25 basis points.

However, traders remain cautious following sharp change in signals about economic conditions and and moved to safety until getting clearer signals.

Gold is on track for strong weekly gain (around 2.2%) with weekly close above former top ($2483) to add to bullish signals, however increased headwinds at $2500 zone, due to significance of this resistance and stretched daily studies, may keep the price in consolidation.

Rising 10DMA ($2436) should ideally contain dips but break lower would sideline bulls for deeper correction towards $2422/00 (20DMA / round-figure).

Res: 2500; 2512; 2551; 2600

Sup: 2477; 2450; 2436; 2422

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.