XAU/USD outlook: Gold hits new record high

Gold price entered uncharted territory again on Thursday, after fresh acceleration higher (the price was up slightly above 1% in early US trading) was sparked by US economic data which added to expectations for Fed rate cut next week.

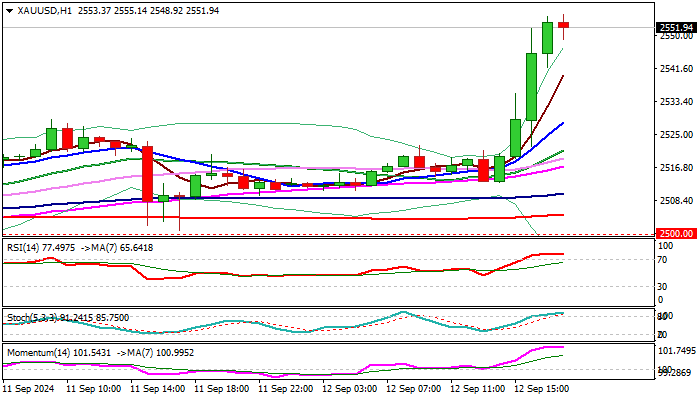

The yellow metal price hit new record highs and met the first target at $2554 (Fibo 138.2% projection of the upleg from $2471), with further advance to focus $2561 (161.8%), $2591 (200%) and 2600 (psychological and 2024 peak, according to many analysts.

I may disagree with this view, as gold completed three-week consolidation and generating signal of continuation of larger uptrend.

In addition, fundamentals remain favorable and improving, as bets for rate cuts rise and overall geopolitical situation, which strongly contributes to safe haven demand, remains overheated, suggesting that gold price may rally more.

Daily close above former range top ($2531) is required to verify bullish continuation signal and preferably to contain extended dips as strongly overbought conditions on lower timeframes suggest that bulls may take a breather.

Res: 2555; 2561; 2591; 2600.

Sup: 2547; 2541; 2531; 2528.

Interested in XAU/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.