XAU/USD outlook: Gold hit three-month low, bears await US CPI data for fresh signal

XAU/USD

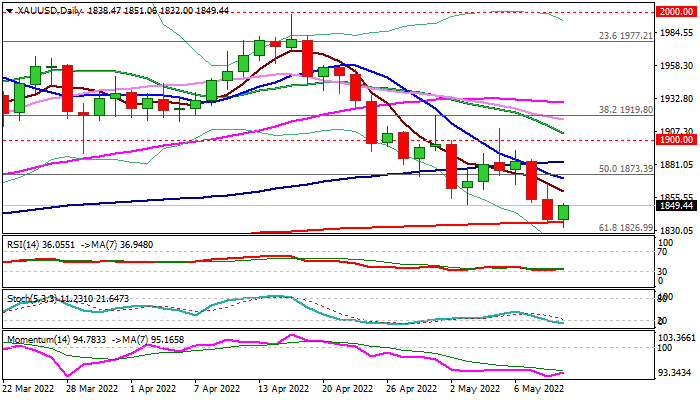

Spot gold is trading near new three-month low ($1832) posted in early Wednesday’s trading, with larger bears pausing here as traders await fresh signals from US inflation data, due later today.

The metal was under increased pressure from robust dollar which hit new 20-year high, driven by expectations of extended aggressive stance of the US central bank in attempts to cool down soaring inflation.

Analysts expect US monthly consumer prices growth to cool to 0.2% in April from 1.2% in March while annualized figure is forecasted to drop to 8.1% after hitting a 40-year peak at 8.5% previous month.

Traders focus more on the CPI’s impact on the Fed rather than gold’s role against inflation, with metal’s price likely to rise if inflation falls below expectations,

Conversely, stronger than expected figure in April would increase pressure on the yellow metal and push the price lower.

Bears cracked the upper boundary of critical support zone between $1835 and $1827, consisting of 200DMA and Fibo 61.8% of $1676/$2070, where the price action is currently facing headwinds.

Bullish scenario on rebound from here would require rise through pivotal barriers at $1895/$1900 to signal reversal and sideline bears, while break of these supports would risk fresh bearish acceleration and expose supports at $1800/$1780 (psychological / Jan 28 trough).

Res: 1860; 1870; 1895; 1900.

Sup: 1835; 1827; 1818; 1800.

Interested in XAU/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.