XAU/USD

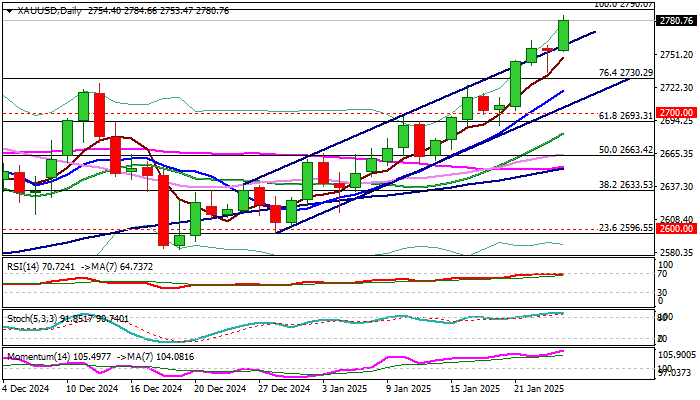

Gold price accelerated higher on Friday, offsetting initial negative signal that was developing on daily chart, from Thursday’s Hanging man candlestick.

Fresh gains (up 1% until early US session on Thursday) came ticks ahead of gold’s record high ($2790, posted on Oct 31) and signaling that bulls remain firmly in play.

The yellow metal is on track for a fourth consecutive weekly gain and about 6% advance in January, with recent rally being sparked by uncertainty surrounding President Trump’s trade policies, particularly the latest signals about softer approach to China tariffs and possible trade deal, as well as his calls to lower interest rates.

Contradicting signals in first few days of Trump’s new term in the White House weakened dollar and boosted demand for safe haven gold.

Retest of new all-time high and attack at nearby $2800 psychological barrier could be likely scenario in coming sessions, with sustained break higher to signal continuation of larger uptrend, which was on hold during past nearly three months for consolidation.

Fundamentals are likely to remain favorable as reality somewhat diverges from Trump’s post-election rhetoric, particularly in foreign policies, while technical studies remain in firm bullish configuration on daily and weekly chart and underpin the action.

Recent break above bull channel resistance trendline signaled that bulls tighten grip.

However, bulls may face increased headwinds from very significant $2790/$2800 resistance zone and enter consolidative phase before resuming higher.

Dips are likely to be shallow (if current environment remains unchanged) and offer better levels to re-enter bullish market.

Former breakpoints at $2730/21 zone now act as solid supports which should keep the downside protected.

Res: 2784; 2790; 2800; 2850.

Sup: 2761; 2748; 2730; 2721.

Interested in XAU/USD technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD bounces off lows, retests 1.1370

Following an early drop to the vicinity of 1.1310, EUR/USD now manages to regain pace and retargets the 1.1370-1.1380 band on the back of a tepid knee-jerk in the US Dollar, always amid growing optimism over a potential de-escalation in the US-China trade war.

GBP/USD trades slightly on the defensive in the low-1.3300s

GBP/USD remains under a mild selling pressure just above 1.3300 on Friday, despite firmer-than-expected UK Retail Sales. The pair is weighed down by a renewed buying interest in the Greenback, bolstered by fresh headlines suggesting a softening in the rhetoric surrounding the US-China trade conflict.

Gold remains offered below $3,300

Gold reversed Thursday’s rebound and slipped toward the $3,260 area per troy ounce at the end of the week in response to further improvement in the market sentiment, which was in turn underpinned by hopes of positive developments around the US-China trade crisis.

Ethereum: Accumulation addresses grab 1.11 million ETH as bullish momentum rises

Ethereum saw a 1% decline on Friday as sellers dominated exchange activity in the past 24 hours. Despite the recent selling, increased inflows into accumulation addresses and declining net taker volume show a gradual return of bullish momentum.

Week ahead: US GDP, inflation and jobs in focus amid tariff mess – BoJ meets

Barrage of US data to shed light on US economy as tariff war heats up. GDP, PCE inflation and nonfarm payrolls reports to headline the week. Bank of Japan to hold rates but may downgrade growth outlook. Eurozone and Australian CPI also on the agenda, Canadians go to the polls.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.