XAU/USD – Gold price trend this week

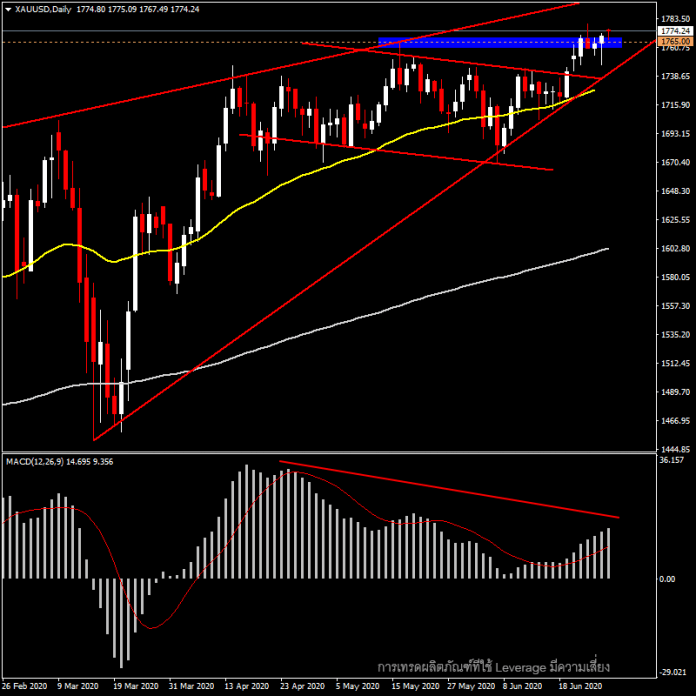

XAU/USD, Daily

On Friday, the US stock markets opened in negative territory and deteriorated into the market close at an average of more than 2.5%. This was followed by the 10-year US Treasury yields that fell below 0.65%, resulting in the gold price bouncing back up to stand above $1770. USOil closed almost $1 a barrel lower at $38.16. The number of people infected with Covid-19 around the world has reached 10 million, and the number of deaths is now at more than 500,000 , while in the United States the number of people infected reached its highest record ever last week at over 2.5 million, with deaths at 125,000.

However, in the midst of the high number of people still infected last weekend, the Chinese National Biotec Group (CNBG) announced the results of a second vaccine test for humans. This was found to be a safe and effective treatment and could help to build confidence in the market this week.

From a technical standpoint, gold is now above the previous high of May. This seems to be the “rhythm for the buyer” that may be based on purchase timing breakout which could result in the price of gold rising to the psychological level of 1800, with the high last week on an intra-day basis set at 1779. In the Daily time frame, the uptrend is narrowing and the MACD has started to move in conflict with the price since the end of May. This could be a technical signal that buyers must be careful.

However, this week, with important information like the NFP moved to Thursday because Friday marks the start of the July 4th holiday weekend in the US, and national days in Canada and Hong Kong on Wednesday, market liquidity may disappear this week.