XAU/USD Elliott Wave technical analysis [Video]

![XAU/USD Elliott Wave technical analysis [Video]](https://editorial.fxstreet.com/images/Markets/Commodities/Metals/Gold/Gold_Bar_XAU_Precious_Metal_XtraLarge.jpg)

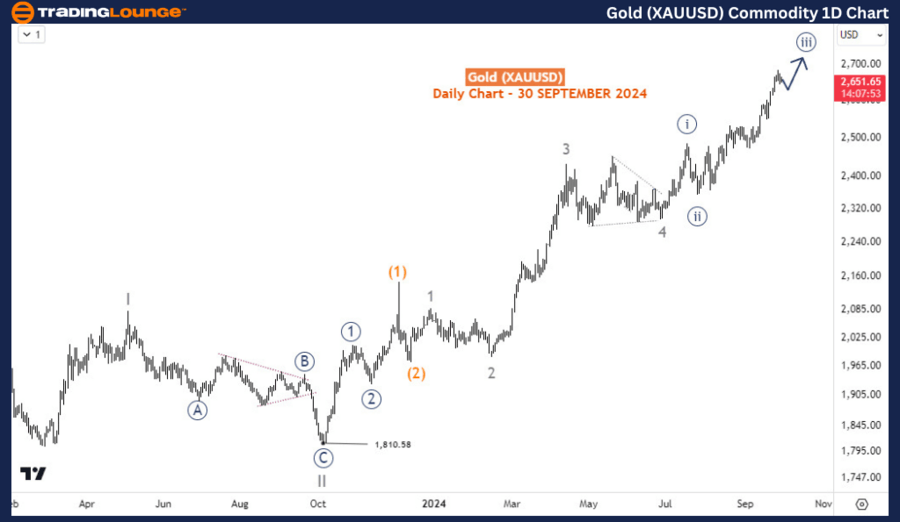

Gold Elliott Wave analysis

Gold has been retreating in the final days of September after hitting yet another fresh all-time high. The current impulse wave cycle, which began in October 2022, appears to be ongoing, suggesting that after this pullback finds support, further rallies could follow.

Daily chart analysis

From an Elliott wave perspective, the daily chart shows that Gold initiated a cycle degree impulse wave sequence in October 2022. Waves I and II of this sequence concluded in May 2023 and October 2023, respectively. Currently, the metal is in the third wave, and within it, wave III appears incomplete. Specifically, Gold is in wave 5 of (3) of 3 (circled) of III, indicating that there is significant upside potential remaining. This suggests that Gold's bullish trend is far from over, and traders should be vigilant for potential pullbacks, which could offer attractive buying opportunities as the upward trend resumes.

Four-hour chart analysis

On the H4 chart, Gold is experiencing a pullback, likely forming sub-minuette degree wave iv of minuette degree wave (iii) of minute degree wave iii (circled). Once wave iv finds support, it is expected that the bullish momentum will resume, leading to a continuation of the rally. Buyers may look for entry points near the dip as the upward trend is anticipated to continue once wave iv completes.

In summary, Gold remains in a long-term bullish trend, with further rallies expected after the current pullback concludes. The Elliott wave analysis suggests that wave III is still unfolding, providing substantial room for upside potential. Traders should keep an eye on key support levels, as these dips could present buying opportunities before Gold resumes its upward trajectory.

XAU/USD Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.