XAG/USD outlook: Silver rises to 12-year high

Silver price hit new highest since November 2012 on Monday, in extension of last Friday’s record daily rally of 6.4%, with psychological $34.00 barrier being cracked.

Increased safe haven demand dragged silver price, as geopolitical situation is overheated and markets pricing around 90% chance of Fed rate cut in November FOMC policy meeting.

Strong bullish signal has been generated on monthly chart after bulls eventually broke above key barriers at $30.00/50 (psychological / 50% retracement of $49.78/$11.23, 2011/2020 downtrend) which where the price was stuck for four months.

Firmly bullish daily studies continue to contribute to positive structure, underpinned by favorable fundamentals.

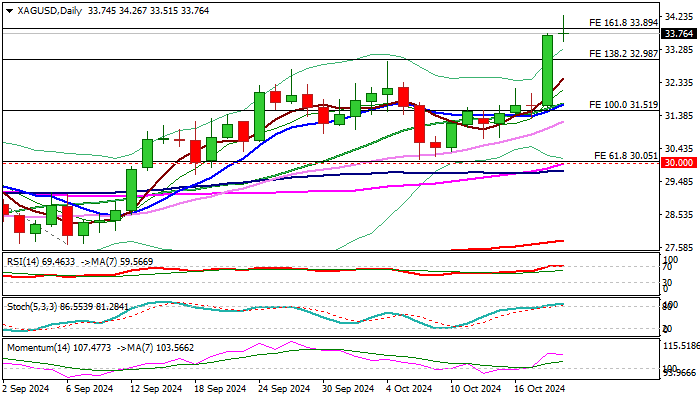

The price is currently riding on extended fifth wave of five wave sequence from $26.39 (Aug 8 low) with FE 161.8% (33.89) being cracked.

Close above this level to verify fresh signal and open way for attack at next targets at $35.00/05 (psychological / Fibo 61.8% of $49.78/$11.23) and $35.369 (FE 200%).

Meanwhile, bulls may take a breather under these barriers as daily studies are overbought, with limited dips to be ideally contained above $32.20 zone and to offer better buying opportunities.

Res: 33.89; 34.26; 35.00; 35.36

Sup: 33.51; 32.95; 32.23; 32.00

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.