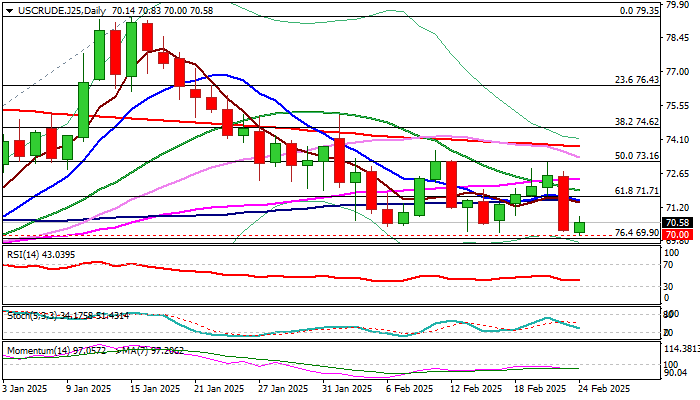

WTI oil price bounced from new two-month low ($70) on Monday, on partial profit-taking from Friday’s 3.1% drop (the biggest daily loss since Nov 25).

Fresh bears cracked psychological $70 support and probed through the floor of the recent range, signaling that larger downtrend may resume after two-week consolidation.

Fundamentals are also expected to negatively impact oil prices as resumption of oil exports from northern Iraq and growing prospects of an end of the war in Ukraine, would provide further pressure on increased supply and decrease in geopolitical risks.

Bearish daily studies support the notion as negative momentum strengthens and MA’s are in full bearish configuration and formed several bear crosses (30/200; 20/55), along with two consecutive weekly candles with long upper shadows, which signal strong offers.

Clear break of strong supports at $70 / $69.90 (psychological / Fibo 76.4% of $66.98/$79.35) is needed to confirm signal of bearish continuation and unmask targets at $68.44 (Dec 20 trough) and $66.98 (Dec 6 low).

Meanwhile, correction should mark positioning for fresh push lower, with upticks to be capped under $71.70 zone (daily Tenkan-sen / broken Fibo 61.8%) to keep larger bears intact.

Res: 70.83; 71.49; 71.83; 72.75.

Sup: 70.00; 69.41; 68.44; 67.69.

Interested in WTI technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

Gold trades near record-high, stays within a touching distance of $3,100

Gold clings to daily gains and trades near the record-high it set above $3,080 earlier in the day. Although the data from the US showed that core PCE inflation rose at a stronger pace than expected in February, it failed to boost the USD.

EUR/USD turns positive above 1.0800

The loss of momentum in the US Dollar allows some recovery in the risk-associated universe on Friday, encouraging EUR/USD to regain the 1.0800 barrier and beyond, or daily tops.

GBP/USD picks up pace and retests 1.2960

GBP/USD now capitalises on the Greenback's knee-jerk and advances to the area of daily peaks in the 1.2960-1.2970 band, helped at the same time by auspicious results from UK Retail Sales.

Donald Trump’s tariff policies set to increase market uncertainty and risk-off sentiment

US President Donald Trump’s tariff policies are expected to escalate market uncertainty and risk-off sentiment, with the Kobeissi Letter’s post on X this week cautioning that while markets may view the April 2 tariffs as the "end of uncertainty," it anticipates increased volatility.

US: Trump's 'Liberation day' – What to expect?

Trump has so far enacted tariff changes that have lifted the trade-weighted average tariff rate on all US imports by around 5.5-6.0%-points. While re-rerouting of trade will decrease the effectiveness of tariffs over time, the current level is already close to the highest since the second world war.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.