WTI outlook: Oil opens with gap lower as supply fears fade after Israel's attack on Iran

Oil

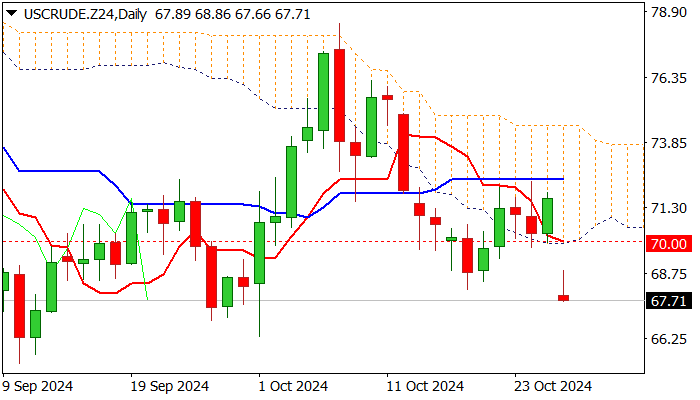

WTI oil opened with wide gap lower on Monday and fell to the lowest levels in nearly one month, registering a drop of around 5% at the start of the week.

Israel’s attack on Iran over the weekend was a main oil driver with Iran’s oil facilities remaining intact that offset fears of energy supply disruption and deflated oil prices.

Monday’s sharp fall generated strong bearish signal on dip well below psychological $70 support (also the base of thick daily Ichimoku cloud) which held the action in past three days.

Also, breach of former higher low of Oct 18 ($68.15) added to negative outlook, along with short-lived recovery attempts in early European trading.

Bears pressure lower 20-d Bollinger band ($67.23) and eye Oct 1 spike low ($66.33) which guards key support at $65.26 (2024 low posted on Sep 10).

Close below $70 is seen as minimum requirement to keep bears in play, while close below $68.15 to reinforce bearish stance, as daily studies are in full bearish setup.

Res: 69.33; 70.00; 70.30; 71.00.

Sup: 67.23; 66.94; 66.33; 65.26.

Interested in Oil technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.