WTI oil price rose over 1% on Monday after better than expected China’s manufacturing data boosted positive sentiment, while fresh concerns about the Middle East ceasefire collapse, add support.

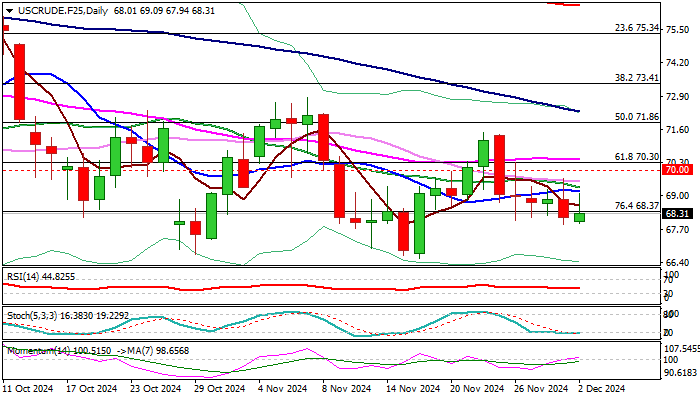

Fresh gains peaked above $69.00 mark but were so far unable to hold gains, as Friday’s bearish candle with long upper shadow, points to solid offers.

Oil price remains below psychological $70 level for the sixth consecutive day and also hold below converged daily Tenkan/Kijun-sen ($69.69), with near-term action being also weighed by last Monday’s large bearish candle (oil price was down 3.25% in the biggest daily fall since Oct 14).

On the other hand, bears have so far found a temporary footstep at $68.00 zone that keeps near-term action within a range.

Technical studies are mixed on daily chart as 14-momentum is neutral, MA’s in bearish configuration and stochastic is oversold.

Look for direction signals on break of either $68.00 or $70 triggers.

Res: 69.33; 70.00; 70.30; 71.00

Sup: 68.00; 66.93; 66.33; 65.26

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

AUD/USD: Further losses appear on the cards

AUD/USD experienced a sharp sell-off, breaking below the 0.6500 support level to hit multi-day lows and approach the November bottom near the 0.6430 zone, driven by renewed strength in the Greenback.

EUR/USD: Gains remain capped by 1.0600

The renewed strong demand for the US Dollar, combined with political concerns in France, weighed on the European currency, pushing EUR/USD below the 1.0500 support level once again on Monday.

Gold hovers around $2,640 without directional strength

Gold starts the new week on the back foot and trades below $2,650. The renewed US Dollar strength and the recovery seen in the US Treasury bond yields don't allow the pair to stage a rebound despite the risk-averse market atmosphere.

MicroStrategy, MARA add to their holdings amid Bitcoin's quest for new all-time high

MicroStrategy continued its aggressive Bitcoin purchase on Monday after it announced the acquisition of 15,400 BTC at an average purchasing price of $95,976 per token.

Trump warns BRICS over Dollar rival plans

Donald Trump, the incoming U.S. President, has issued a strong warning to BRICS nations over their plans to challenge the dominance of the U.S. dollar in global trade.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.