WTI Oil points to August’s high, but will the bulls show up? [Video]

![WTI Oil points to August’s high, but will the bulls show up? [Video]](https://editorial.fxstreet.com/images/Markets/Commodities/Energy/Oil/oil-flows-out-of-barrel-20436219_XtraLarge.jpg)

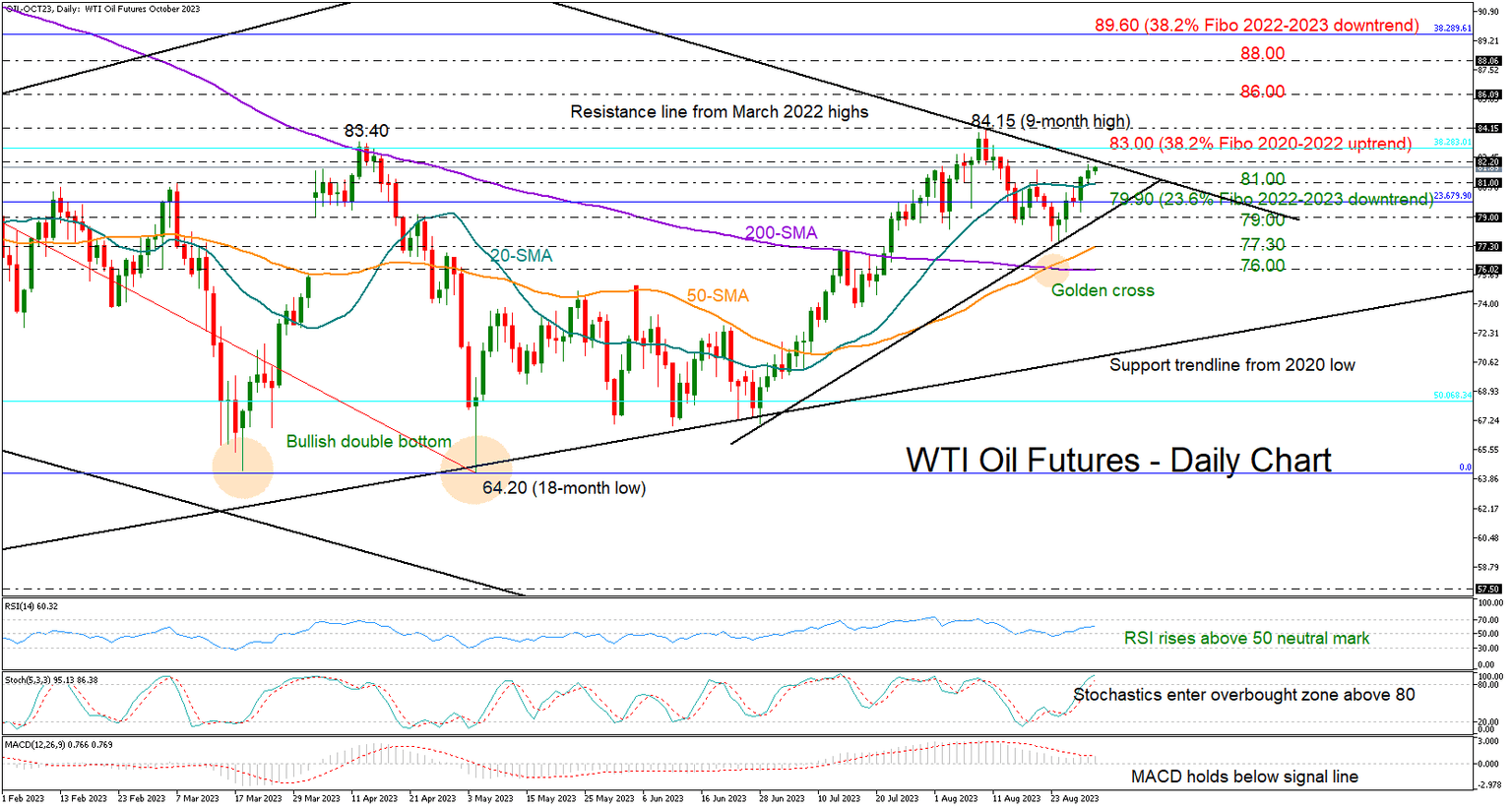

WTI oil futures (October delivery) snapped the 81.00 barricade and crawled moderately back above the 20-day simple moving average (SMA), which has been capping upside movements over the past two weeks.

While the latest bullish action has turned the attention higher to the former constraining zone of 83.00 and August’s high of 84.15, a durable increase cannot be warranted. The RSI has encouragingly distanced itself above its 50 neutral mark, but the stochastic oscillator has already crossed above its 80 overbought level, signaling some persistent fear among investors. Meanwhile, the MACD is still struggling to overcome its red signal line, feeding some caution as well.

Of note, the crucial descending trendline drawn from the March 2022 highs is within breathing distance at 82.20, threatening a downside reversal. On the other hand, the golden cross between the 50- and 200-day SMAs, which is the first in three years, suggests that any negative corrections could be part of the latest bullish phase.

If the price were to re-activate its short-term uptrend above August’s peak of 84.15, immediate resistance could emerge around 86.00. A successful penetration higher might then target the 88.00 barrier, while a more aggressive pickup could retest the 89.60 zone ahead of the key 92.50 ceiling taken from October-November 2022.

Should sellers send the price below its 20-day SMA at 81.00, the 79.90 number might come first into view given the previous limitations within the neighborhood over the past month. The tentative ascending trendline, which connects the lows from June and August, could provide protection as well near 79.00, preventing any declines towards the 50-day SMA at 77.30. A step below the 200-day SMA at 76.00 could be a bigger hassle for the market.

In brief, WTI oil futures seem to be working their way to the top of the previous uptrend, though the technical picture suggests that there might be limited bullish fuel in the tank.

Author

Christina joined the XM investment research department in May 2017. She holds a master degree in Economics and Business from the Erasmus University Rotterdam with a specialization in International economics.