Oil outlook: WTI Oil price eases from new highs as market awaits fresh signals

WTI Oil

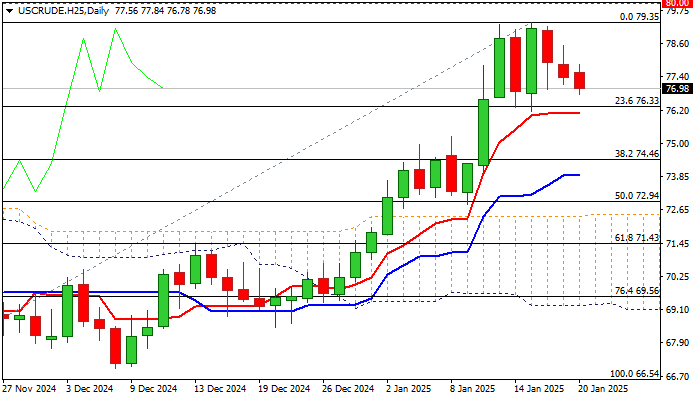

WTI oil price eased further in early Monday trading, after last week’s multiple upside rejections at the base of daily Ichimoku cloud ($79.00) left a weekly bull-trap, prompting traders for a partial profit-taking.

All eyes are on inauguration of the US President Donald Trump and a number an executive orders he promised to sign in his first 24 hours in the White House.

Markets also speculate that Trump may relax some of energy related sanctions against Russia, in attempts to start moving the war in Ukraine towards the end.

Larger bulls faced headwinds from barriers at $80 zone (50% retracement of $95.00/$65.26 / 200WMA) as well as a ceasefire Gaza, which capped the latest rally.

Overall technical picture remains bullish, and is boosted by better than expected recent economic data from China, world’s top oil importer, which brightened demand outlook in coming months.

The recent formation of 10/200DMA golden cross was supportive, however fading bullish momentum suggests that there will be more room for deeper correction before broader bulls regain traction.

Initial supports lay at $76.33/10 (Fibo 23.6% of $66.54/$79.35 / daily Tenkan-sen), followed by 200DMA ($74.90) and Fibo 38.2% ($74.46) where deeper dips should find firm ground and mark a healthy correction.

At the upside, the latest top ($79.35) and $80 zone mark pivotal barriers, violation of which to expose targets at $83.64 (Fibo 61.8% of $95.00/$65.26) and $84.50 (June 30 lower top).

Res: 78.53; 79.00; 79.35; 80.00.

Sup: 76.33; 76.10; 74.90; 74.46.

Interested in Oil technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.