Oil outlook: Remains under pressure as growing demand concerns offset supply fears

WTI Oil

WTI oil price came under pressure from fresh demand concerns on the latest talks that the US economy might enter recession, as disappointing US economic data point to such scenario, offsetting calming tones from US official that the economy remains resilient and so far in good condition, heading towards soft landing.

It seems that this may not be the case, as panic spilled over the markets, with stocks being hit the most and rumors that the Fed may hold an emergency meeting the soonest possible, to cut interest rates and try to at least partially reduce the damage, caused by some wrong decisions taken in past couple of years by the central bank.

Growing demand fears continue to push the price down, though this could be partially offset by increased supply concerns if geopolitical situation in the Middle East deteriorates (many signals currently point to scenario that larger conflict is inevitable).

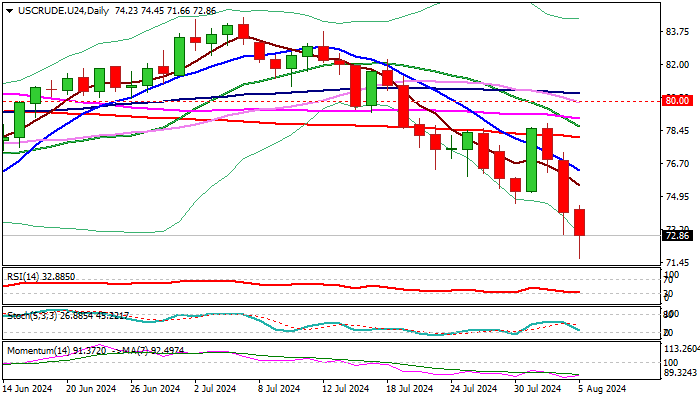

Bears eye psychological $70 support and next key levels at $68.50 (monthly cloud base) and $67.70 (December 2023 low).

Former low of July 30 ($74.60) offers immediate resistance, followed by falling daily Tenkan-sen ($75.26) and broken Fibo 61.8% ($77.06).

Res: 74.60; 75.26; 76.34; 77.06.

Sup: 72.46; 71.66; 70.00; 68.50.

Interested in Oil technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.