WTI Oil outlook: Price rallies for the third day on favorable fundamentals

Oil

Recovery from $71.46 (Aug 21 low) extends into third straight day and accelerates on Monday on news that oil production in Libya was almost completely stopped, due to political tensions in the country.

This adds to growing fears over geopolitical tensions in the Middle East, which helped to lift the oil price in past few days.

Near-term outlook is brightening on the fundamental side, in additions to improving technical picture on daily chart.

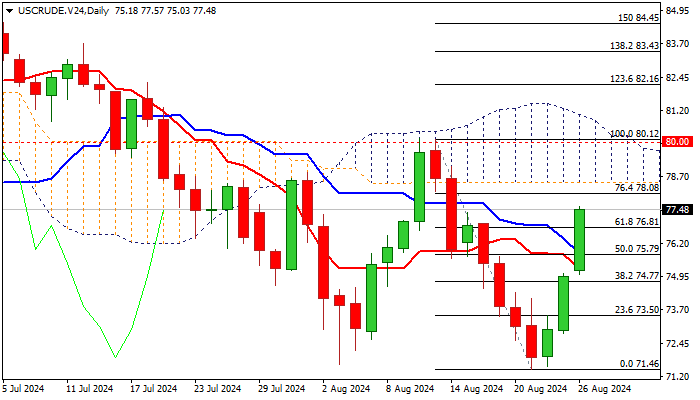

Formation of a double-bottom pattern and subsequent strong acceleration higher which broke above 10/20 DMA, 14-d momentum in steep ascend established in positive territory and rising RSI moved above neutrality territory, contribute to growing bullish signals.

Recovery has so far retraced over 61.8% of $80.14 / $71.46 downleg and pressuring initial targets at $77.79 (200DMA) and $78.09 (Fibo 76.4%) which guard another significant resistance at $78.48 (daily cloud base).

Cloud in thinning and will twist next week, therefore expected to further attract bulls, though increased headwind on approach to this barrier should be anticipated.

Oil price is likely to rise further if fundamentals remain favorable, with violation of key $80.00 resistance zone, needed to improve larger picture and open way for further upside, on completion of reversal pattern on daily chart.

Last week’s Hammer candlestick on weekly chart and 14-w momentum about to break above the centreline, add to positive signals.

Res: 77.79; 78.09; 78.48; 78.71.

Sup: 76.82; 76.52; 75.80; 75.55.

Interested in Oil technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.