WTI Oil

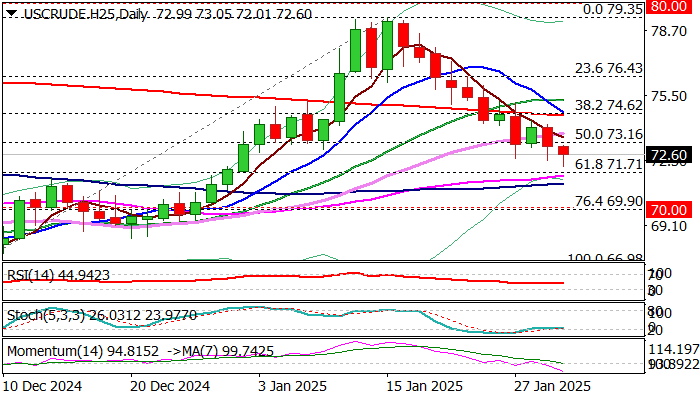

WTI oil price fell to the lowest level in nearly one month after unexpected rise in US crude stocks further weakened the sentiment.

Although fresh dip is facing headwinds, it may signal a continuation of a downtrend from $79.35 (Jan 15 peak) as technical studies show strengthening negative momentum, converging 10/200DMA’s are about to for a death cross and next week’s daily cloud twist could also attract bears.

Broken 50% retracement level at $73.16 reverted to solid resistance which should ideally cap and keep bears in play for attack at $71.71 (Fibo 61.8% of $66.98/$79.35 rally) and $71.54/18 (parallel-moving55/100DMA’s).

Broken 200DMA ($74.52) marks an upper trigger, violation of which to likely sideline bears.

Near-term action may hold in a slower mode these days as markets await decision of Trump’s administration regarding tariffs on imports from Canada and Mexico, two biggest US oil suppliers.

Res: 73.16; 73.63; 74.29; 74.52.

Sup: 72.01; 71.71; 71.18; 70.00.

Interested in WTI technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

AUD/USD recovers to 0.6300 amid strong Aussie jobs data, Trump's trade talks

AUD/USD has found fresh buyers and reverts to near 0.6350 in Thursday's Asian trading. The pair stays supported by strong Australian jobs data and fresh comments from US President Trump on a likely trade deal with China. However, deteriorating risk sentiment could limit its upside.

USD/JPY hangs near fresh YTD low amid rising BoJ rate hike bets

USD/JPY holds near fresh YTD lows of 150.46 early Thursday. BoJ's rate hike plan continues to push JGB yields higher, further underpinning the Japanese Yen. Markets weigh renewed US tariff talks, keeping the downside intact in the pair. US jobs data and Fedspeak are next in focus.

Gold price eyes fresh record highs and counting

Gold price enters a bullish consolidation phase as Trump’s tariffs affect risk sentiment. US Dollar struggles to hold ground despite hawkish Fed Minutes as US Treasury yields decline weighs. Now gold price awaits acceptance above $2,950 as the daily technical setup favors buyers.

Crypto Today: Litecoin, Binance, and Solana dominate headlines as BTC reclaims $97K

The global cryptocurrency market halted a rut of 3 consecutive losing days, gaining 1.6% to hit $3.13 trillion on Wednesday, Bitcoin price promptly reclaimed the $97,000 territory, rebounding 4% from the 15-day low of $93,388 recorded on Tuesday.

Money market outlook 2025: Trends and dynamics in the Eurozone, US, and UK

We delve into the world of money market funds. Distinct dynamics are at play in the US, eurozone, and UK. In the US, repo rates are more attractive, and bills are expected to appreciate. It's also worth noting that the Fed might cut rates more than anticipated, similar to the UK. In the eurozone, unsecured rates remain elevated.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.