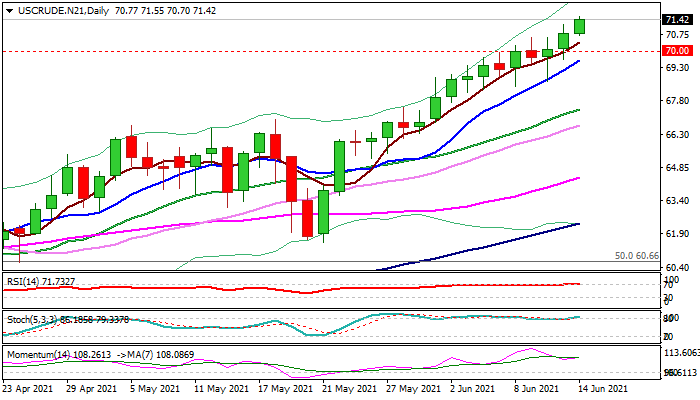

WTI oil

WTI oil price extends advance and hits the highest in nearly three years in early Monday’s trading, following bullish signal generated on last week’s close above psychological $70 barrier (the first weekly close above this level since mid-Sep 2018), with oil benchmarks extending rally into third consecutive week.

Improved outlook for fuel demand on tightness in supply and accelerating economic recovery on increased vaccination, underpin the action.

Eased lockdowns also boosted air transport while motor vehicle traffic returning to pre-pandemic levels in the US, adding to positive signals for global demand, however, fresh virus threats in Europe and India could cause headwinds to larger bulls.

Strong uptrend remains fully in play with dips to provide better buying opportunities.

Bulls eye pivotal Fibo barrier at $73.44 (61.8% of 114.80/$6.52, 2011/2020 downtrend) break of which would generate strong bullish signal and expose 2018 peak at $76.88.

Initial supports lay at 70.70/40 (session low/rising 5DMA) with dips to be ideally contained at $70.00/$69.60 (broken psychological barrier/rising 10DMA).

Res: 71.55; 72.00; 72.38; 73.44.

Sup: 70.70; 70.40; 70.00; 69.60.

Interested in Oil technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD keeps the range bound trade near 1.1350

After bottoming near the 1.1300 level, EUR/USD has regained upward momentum, pushing toward the 1.1350 zone following the US Dollar’s vacillating price action. Meanwhile, market participants remain closely tuned to developments in the US-China trade war.

GBP/USD still well bid, still focused on 1.3200

The Greenback's current flattish stance lends extra support to GBP/USD, pushing the pair back to around the 1.3200 level as it reaches multi-day highs amid improved risk sentiment on Monday.

Gold trades with marked losses near $3,200

Gold seems to have met some daily contention around the $3,200 zone on Monday, coming under renewed downside pressure after hitting record highs near $3,250 earlier in the day, always amid alleviated trade concerns. Declining US yields, in the meantime, should keep the downside contained somehow.

Six Fundamentals for the Week: Tariffs, US Retail Sales and ECB stand out Premium

"Nobody is off the hook" – these words by US President Donald Trump keep markets focused on tariff policy. However, some hard data and the European Central Bank (ECB) decision will also keep things busy ahead of Good Friday.

Is a recession looming?

Wall Street skyrockets after Trump announces tariff delay. But gains remain limited as Trade War with China continues. Recession odds have eased, but investors remain fearful. The worst may not be over, deeper market wounds still possible.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.