WTI outlook: Oil price rises further on growing supply disruption concerns

WTI Oil

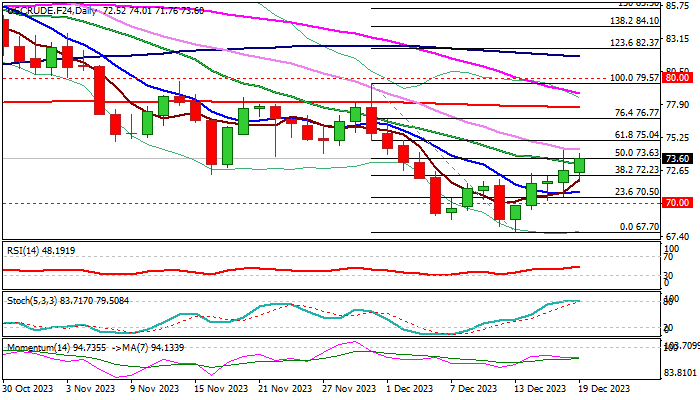

WTI oil price continues to trend higher, extending recovery from Dec 13 low ($67.70) into fifth consecutive day.

Growing tensions on several attacks on ships in the Red Sea, which prompted major shipping companies to reroute, added to fears about supply disruption amid existing conflict in Palestine and further lifted oil prices.

Recovery has so far retraced 50% of $79.57/$67.70 bear-leg, which improved the structure on daily chart, however, momentum indicator is still in the negative territory and stochastic is overbought, warning of possible recovery stall, as larger downtrend from $95.00 (2023 peak of Sep 28) remains intact.

Current corrective phase could extend further to still mark a healthy correction, as pivotal barrier at $77.69 (200DMA) is far and only sustained break here to generate stronger reversal signal and contribute to signals from bear-trap pattern on weekly chart.

Broken Fibo 38.2% level ($72.23) reverted to support which should hold dips and keep near-term bias with bulls, while dip below 10DMA ($70.96) will confirm an end of correction.

Res: 74.29; 75.04; 76.00; 76.77.

Sup: 72.23; 71.76; 70.96; 70.50.

Interested in WTI technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.