-

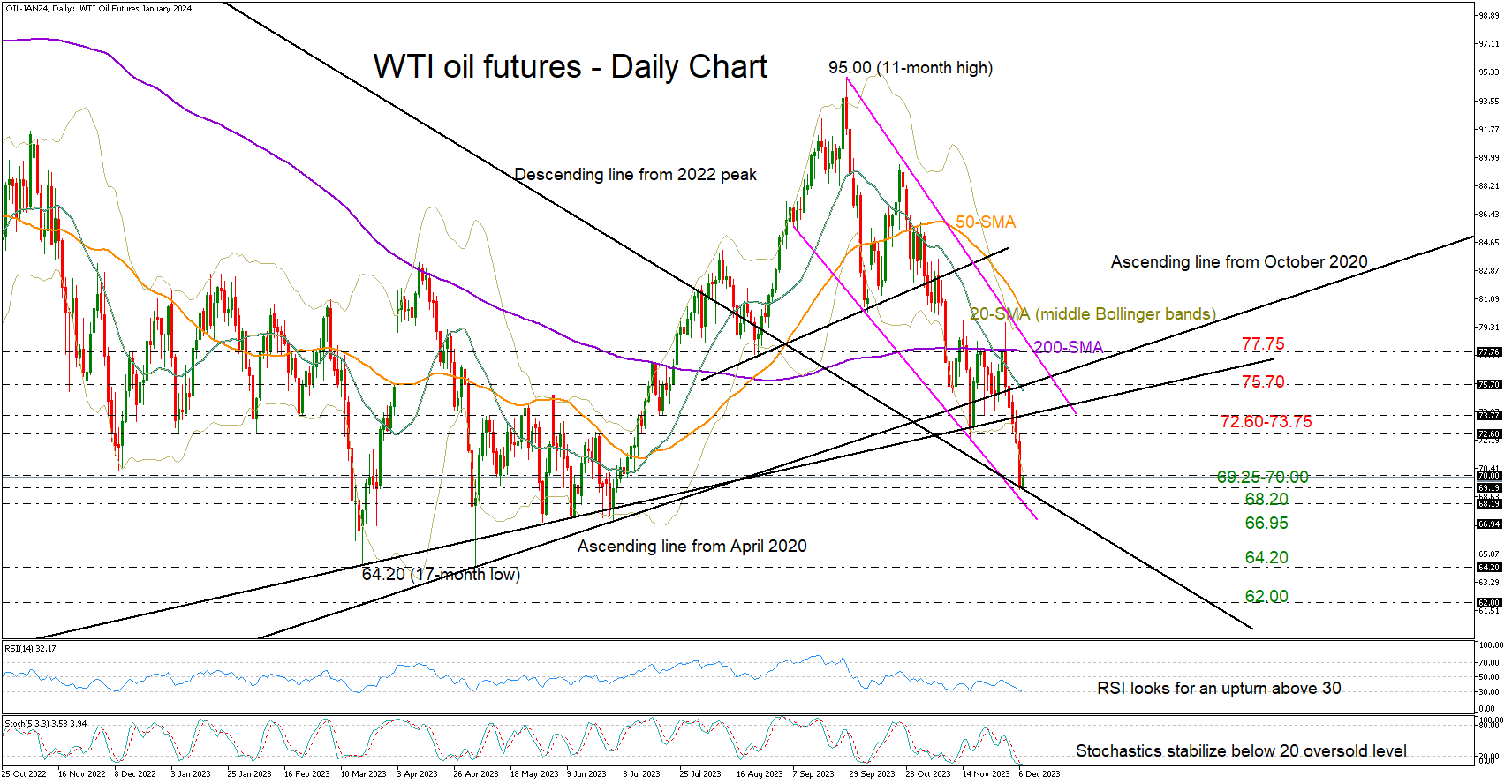

WTI oil futures test critical 2023 support zone.

-

Technical signals point to oversold levels.

-

Sellers await a weekly close below 70.

WTI oil futures were sold dramatically on Wednesday, extending their weekly losses to a more than a four-month low of 69.10.

The bears are leading for the seventh consecutive week, increasing speculation that a bullish correction could soon take place as the RSI and the stochastic oscillators are looking for an upside reversal near their oversold levels. Moreover, the market action is developing below the lower Bollinger band, suggesting that the latest downfall might be overdone.

It’s worthy to note that the market is currently testing the critical 200-period simple moving average (SMA) in the weekly chart at 70. The line paused the downtrend from 14-year highs in March and prevented a negative outlook revision in 2023. Hence, sellers might stay patient until a clear close below that threshold is achieved.

Meanwhile, in the daily timeframe, the price is struggling to crawl back above 70. If downside pressures dominate, the slide could halt immediately around the falling line from September at 68.20. The extension of the descending line drawn from the 2022 top could also block the bears around the important March-June 2023 floor of 66.95. Should the bear run continue, all the attention will turn to the 2023 base of 64.20 ahead of the 2021 floor of 62.00.

In the bullish scenario, where the recovery stretches above 70.00, buyers might drive towards the 72.60-73.75 constraining region. The ascending line from the October 2020 low is adding some credence to the area, while slightly higher, the bulls will need to climb above the 20-day SMA and the upward-sloping line from April 2020 at 75.70 to gain direct access to the 200-day SMA at 77.75.

All in all, WTI oil futures are looking oversold near a major support area after an aggressive decline. A continuation below 70 could add more fuel to the bearish wave.

Forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.

Recommended Content

Editors’ Picks

AUD/USD: Not out of the woods yet

The continuation of the selling pressure around the US Dollar lent extra wings to AUD/USD and propelled it back above the 0.6500 barrier ahead of the publication of the RBA Minutes of its November 5 event.

EUR/USD: The extension and duration of the rebound remain to be seen

EUR/USD regained further balance and trespassed the key 1.0600 hurdle to clock three-day highs following extra weakness in the Greenback and some loss of momentum around the Trump rally.

Gold gives signs of life and reclaims $2,600/oz

After suffering large losses in the previous week, Gold gathers recovery momentum and trades in positive territory above $2,600 on Monday. In the absence of high-tier data releases, escalating geopolitical tensions help XAU/USD hold its ground.

Ethereum Price Forecast: ETH risks decline to $2,258 as exchange reserves continue uptrend

Ethereum (ETH) is up 1% on Monday after ETH ETFs hit a record $515.5 million inflows last week. However, rising exchange reserves and realized losses could trigger bearish pressure for the top altcoin.

The week ahead: Powell stumps the US stock rally as Bitcoin surges, as we wait Nvidia earnings, UK CPI

The mood music is shifting for the Trump trade. Stocks fell sharply at the end of last week, led by big tech. The S&P 500 was down by more than 2% last week, its weakest performance in 2 months, while the Nasdaq was lower by 3%. The market has now given back half of the post-Trump election win gains.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.