WTI Oil futures hope for a positive start to 2025

-

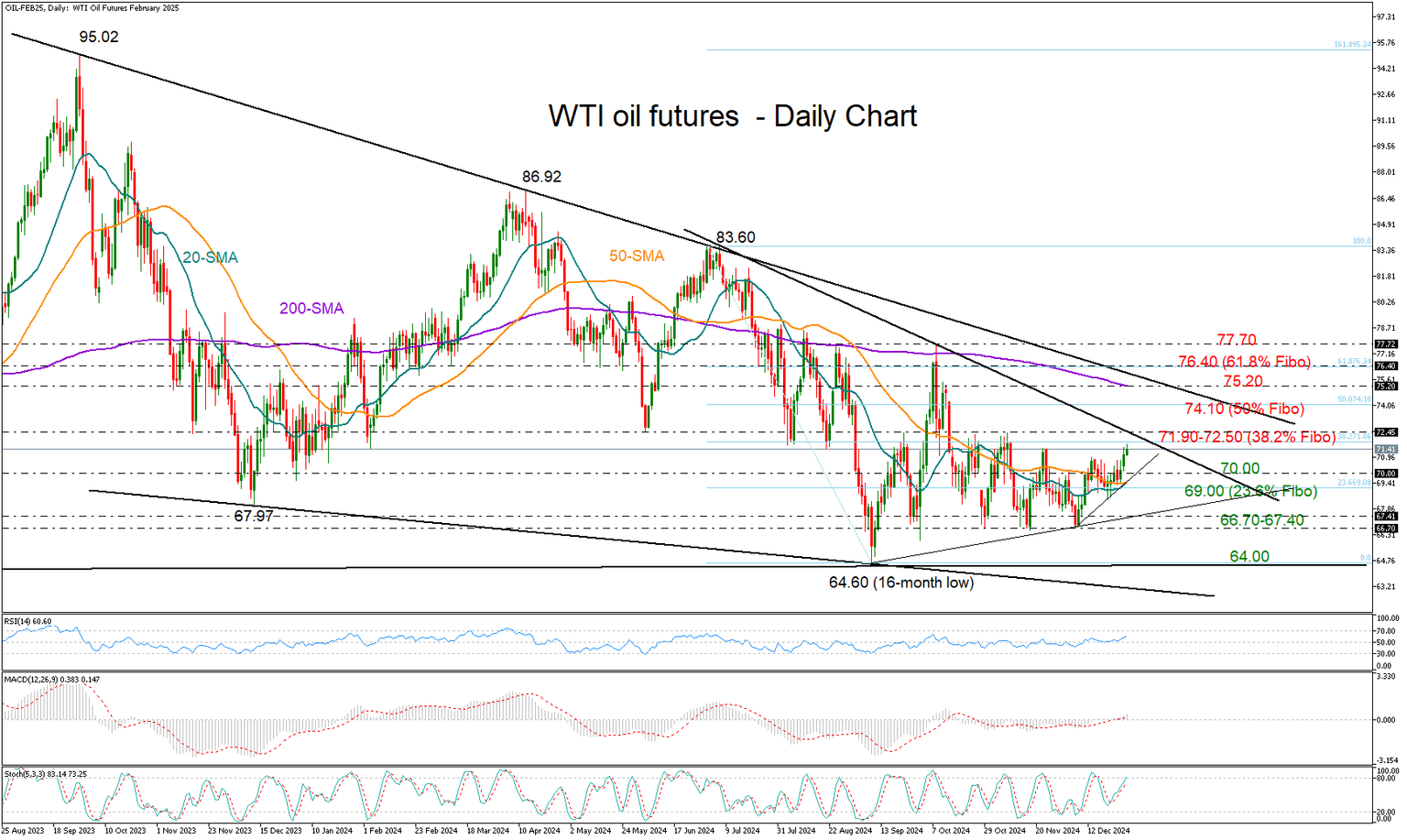

WTI oil futures gain positive momentum above short-term SMAs.

-

Next challenge could occur within the $71.90-$72.50 area.

WTI oil futures are poised for a bullish start to the new year, having cemented the base around the $66.70 level, which successfully halted selling pressure for the fourth time in December. More recently, prices have climbed above both the 20-day and 50-day simple moving averages (SMAs), reinforcing the possibility that the recent rebound could gather further momentum.

The rising RSI and MACD endorse the positive scenario, but traders are unlikely to push the price higher unless they see a solid close above the nearby resistance of $71.90-$72.50. This level coincides with the 38.2% Fibonacci retracement of the July-September decline and the descending trendline from June. A breakout higher could initially pause near the 50% Fibonacci of $74.10 and then move toward the 200-day SMA and the long-term trendline from September 2023 both seen within the $75.20-$76.40 region. Beyond that, the next key level is October’s high of $77.68.

Should the bears pop up near the $72.00 number, the price may again seek shelter within the $69.00-$70.00 area. If selling interest persists, the spotlight will turn to the critical $66.70-$67.40 region, a break of which could cause an aggressive decline toward the 2024 low of $64.60 and the $64.00 level.

Summing up, WTI oil futures are poised for a new bullish cycle, with the confirmational signal likely coming above $71.90-$72.50.

Author

Christina joined the XM investment research department in May 2017. She holds a master degree in Economics and Business from the Erasmus University Rotterdam with a specialization in International economics.