WTI Oil futures hit yearly lows, bias negative [Video]

![WTI Oil futures hit yearly lows, bias negative [Video]](https://editorial.fxstreet.com/images/Markets/Commodities/Energy/Oil/oil-pumps-25838229_XtraLarge.jpg)

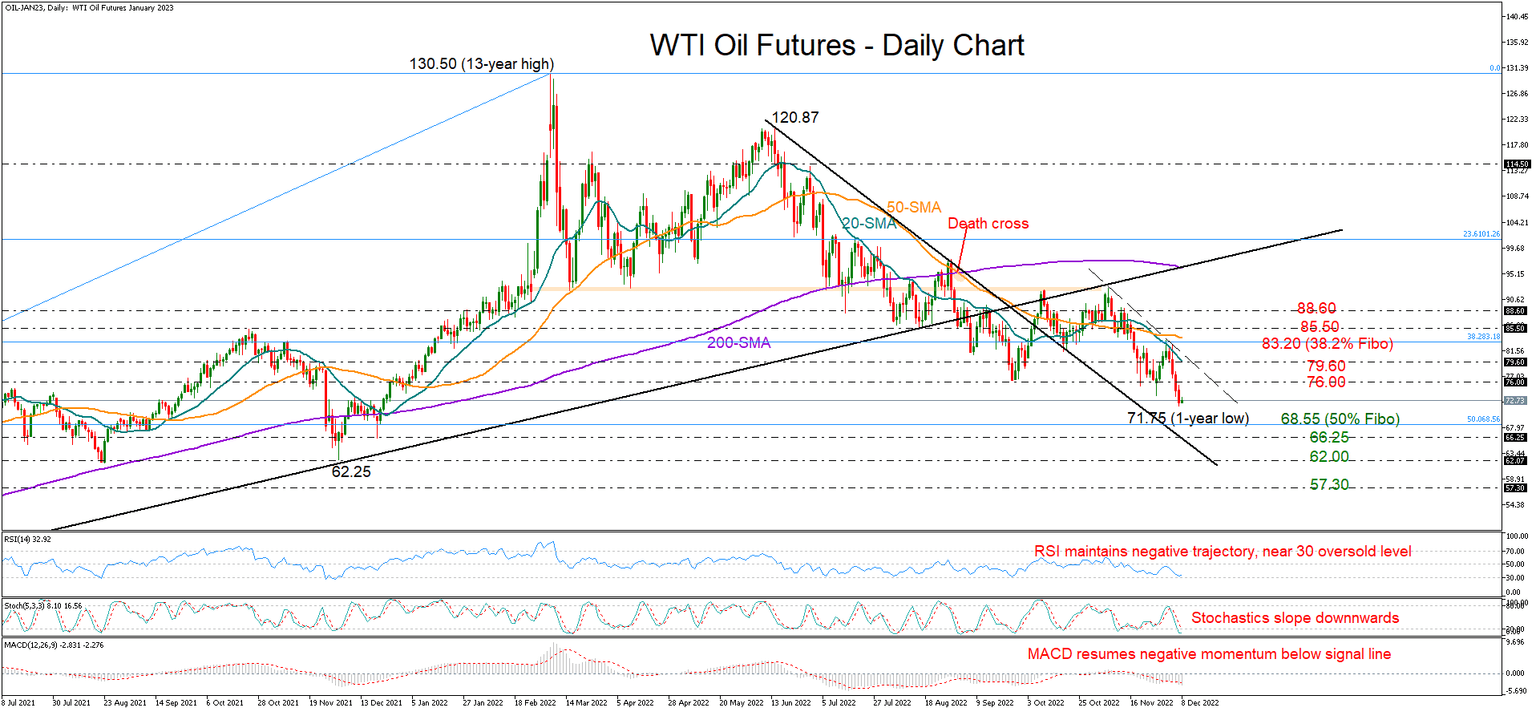

WTI oil futures entered the red zone following the rejection near the 20-day simple moving average (SMA), stretching their 2022 downtrend to a new yearly low of 71.75 on Wednesday. The 38.2% Fibonacci retracement of the 2020-2021 upleg proved to be a tough obstacle too near 83.20.

The four-day bearish streak could see a continuation, as the RSI and the stochastics have yet to confirm oversold conditions. Adding to the discouraging signals is the MACD, which has resumed its negative momentum below its red signal line.

An extension lower would bring the 50% Fibonacci of 68.55 under examination, while slightly beneath that, the 66.25 level has been frequently tested since March 2021 and might be another important area to watch. Note that the resistance-turned-support line is also positioned here. Hence, if sellers claim that barricade, the decline may get another leg to 62.00 and then to 57.30.

If the bullish scenario unfolds, the price may face initial limitations near the 76.00 level before heading for the 20-day SMA, currently around 79.60. A decisive close above the 38.2% Fibonacci of 83.20 could strengthen bullish engagement up to 88.60, unless the 85.50 barrier blocks the way higher.

In brief, the depreciation in WTI oil futures seems to have some room to go. The next pivot point could occur near 68.55.

Author

Christina joined the XM investment research department in May 2017. She holds a master degree in Economics and Business from the Erasmus University Rotterdam with a specialization in International economics.