-

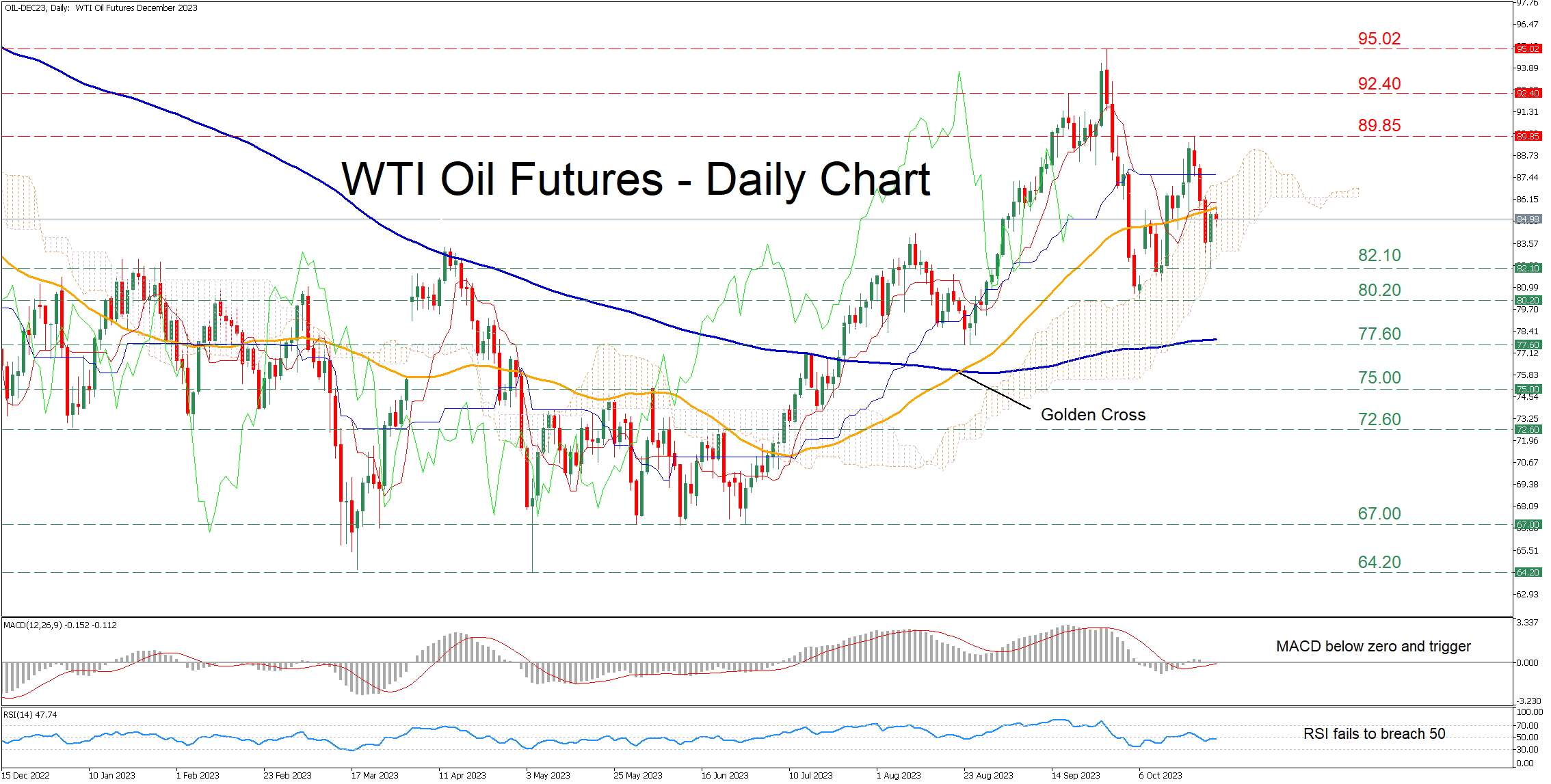

WTI futures bounce off the lower end of the Ichimoku cloud.

-

But their rebound is being held down by the 50-day SMA.

-

Momentum indicators got rejected before entering bullish territories.

WTI oil futures (December delivery) had been in a steady advance since their October bottom of 80.20 before experiencing a pullback. Although the commodity managed to halt its latest retreat and recoup some losses, the 50-day simple moving average (SMA) has been acting as a strong ceiling.

Should the price conquer the 50-day SMA, there is no prominent resistance zone before the October high of 89.85. Piercing through that wall, the price could test the September resistance of 92.40. A violation of that territory could open the door for the 2023 high of 95.02, which is also a 13-month peak.

Alternatively, if the price reverses lower, the recent support of 82.10, which overlaps with the lower boundary of the Ichimoku cloud, could act as the first line of defense. Sliding beneath that floor, WTI futures could challenge the October bottom of 80.20 ahead of the August low of 77.60. Even lower, the June resistance of 75.00 may provide downside protection.

In brief, WTI oil futures managed to pause the latest retreat, but their recovery seems to be faltering near the 50-day SMA. However, the neutral technical picture remains intact for the commodity as long as the price keeps hovering within the Ichimoku cloud.

Forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.

Recommended Content

Editors’ Picks

EUR/USD clings to recovery gains near 1.0850 ahead of Fedspeak

EUR/USD trades in positive territory near 1.0850 on Friday following a four-day slide. China's stimulus optimism and a broad US Dollar correction help the pair retrace the dovish ECB decision-induced decline. All eyes remain on the Fedspeak.

GBP/USD pares UK data-led gains below 1.3050

GBP/USD is trading below 1.3050 in European trading on Friday, reversing upbeat UK Retail Sales data-led gains. The UK data failed to alter dovish BoE expectations. The downside, however, appears limited by the US Dollar pullback. Fedspeak awaited.

Gold plants flag above fresh all-time high at $2,700 on increased prospects of global easing

Gold (XAU/USD) establishes a foothold above the $2,700 psychological level on Friday after piercing through above this level on the previous day, setting yet another fresh all-time high.

Crypto ETF adoption should pick up pace despite slow start, analysts say

Big institutional investors are still wary of allocating funds in Bitcoin spot ETFs, delaying adoption by traditional investors. Demand is expected to increase in the mid-term once institutions open the gates to the crypto asset class.

Canada debates whether to supersize rate cuts

A fourth consecutive Bank of Canada rate cut is expected, but the market senses it will accelerate the move towards neutral policy rates with a 50bp step change. Inflation is finally below target and unemployment is trending higher, but the economy is still growing.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.