-

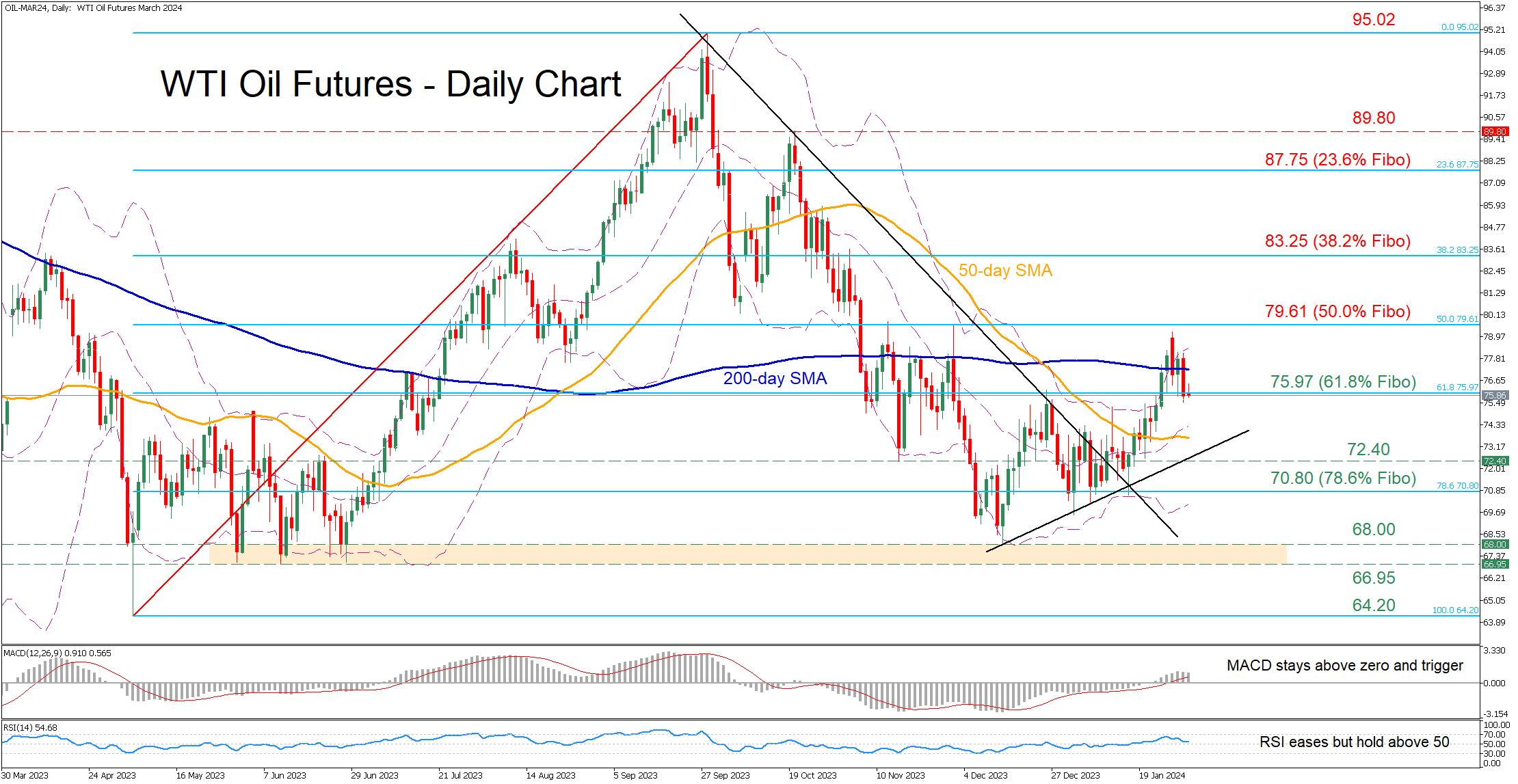

WTI futures retreat after hitting 2-month high.

-

Violate 200-day SMA but 61.8% Fibo pauses decline.

-

Momentum indicators weaken but remain positive.

WTI oil futures (March delivery) had been staging a comeback from the December bottom of 68.00, jumping above both the 50- and 200-day simple moving averages (SMAs). However, the advance got rejected a tad below the 50.0% Fibonacci retracement of the $64.20-$95.02 upleg, albeit the 61.8% Fibo prevented further retreats.

Should bearish pressures persist and the price dive below the 61.8% Fibo of $75.97, the November low of $72.40 could act as the first line of defence. Sliding beneath that floor, the price may descend towards the 78.6% Fibo of $70.80. A successful break below that zone could pave the way for the $66.95-$68.00 support range defined by June lows and the recent six-month bottom.

On the flipside, if buyers re-emerge and propel oil above the 200-day SMA, immediate resistance could be found at the 50.0% Fibo of 79.61. Further upside attempts could then stall around the 38.2% Fibo of 83.25. Conquering this barricade, the bulls could attack the 23.6% Fibo of 87.75.

In brief, WTI oil futures experienced a downward spike following their rejection slightly below the $80.00 psychological mark, but the 61.8% Fibo has been acting as a strong floor. Hence, a clear close beneath the latter could accelerate the recent retreat.

Forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.

Recommended Content

Editors’ Picks

EUR/USD turns lower below 1.0350 after German data

EUR/USD comes under mild selling pressure and eases below 1.0350 in the European session on Wednesday. The pair bears the brunt of an unexpected slowdown in the German manufacturing sector, as the nation's Retail Sales data fail to inspire the Euro. Focus shifts to US ADP data and Fed Minutes.

GBP/USD stays defensive below 1.2500 ahead of key US data, Fed Minutes

GBP/USD stays defensive below 1.2500 in the European trading hours on Wednesday, undermined by a risk-off market sentiment and elevated US Treasury bond yields on increased hawkish Fed bets. Traders look to US data, Fedspeak and FOMC Minutes for fresh trading impulse.

Gold price sticks to modest gains; upside seems limited ahead of FOMC Minutes

Gold price (XAU/USD) sticks to modest intraday gains through the first half of the European session on Wednesday, albeit it lacks bullish conviction and remains below the $2,665 resistance zone retested the previous day.

ADP Employment Change set to show US job growth slowing in December, Fed unlikely to alter plans

The ADP Employment Change will likely have a limited impact on financial markets. The US private sector is expected to have added 140,000 new positions in December.

Five fundamentals for the week: Nonfarm Payrolls to keep traders on edge in first full week of 2025 Premium

Did the US economy enjoy a strong finish to 2024? That is the question in the first full week of trading in 2025. The all-important NFP stand out, but a look at the Federal Reserve and the Chinese economy is also of interest.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.