-

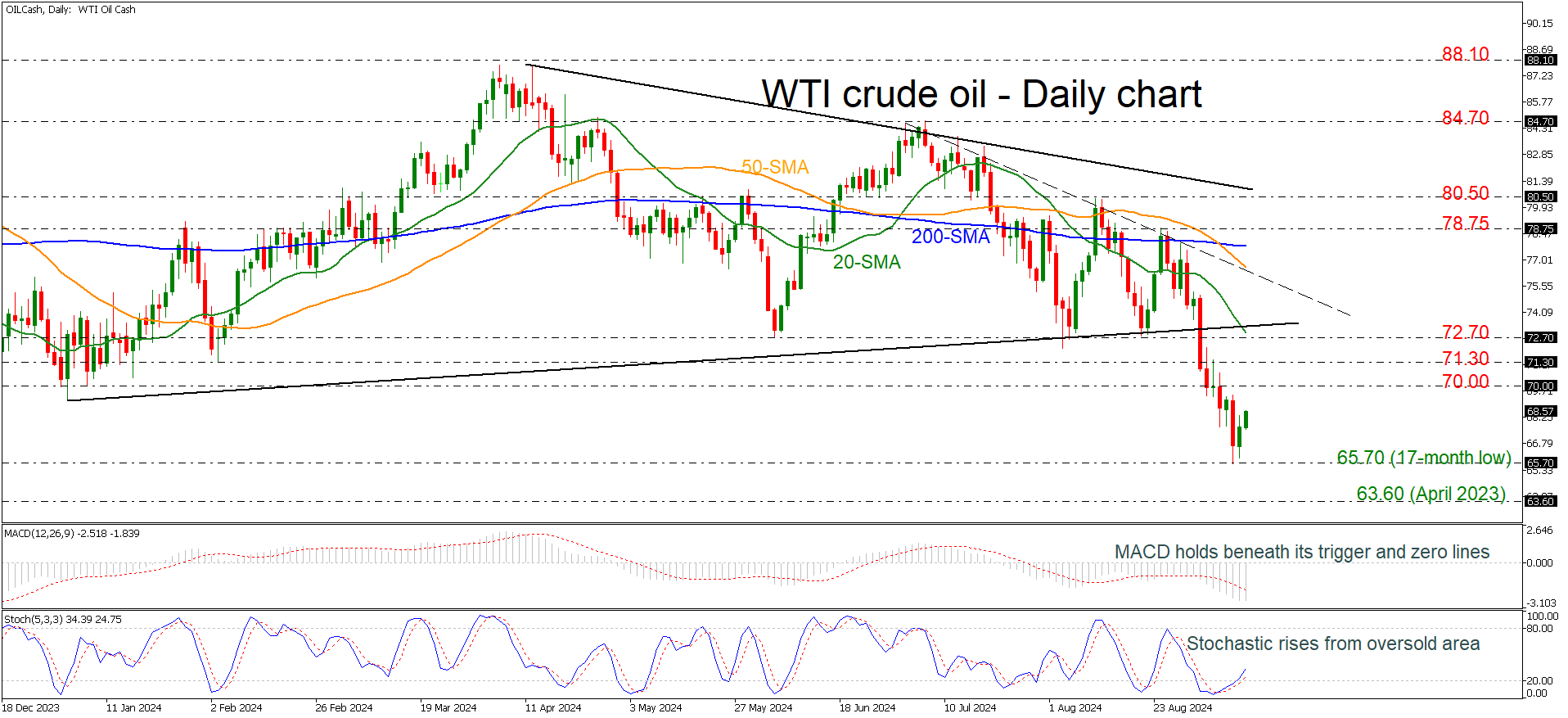

WTI crude Oil rises from 17-month low.

-

Momentum oscillators gain some ground.

WTI crude oil has finally climbed higher from the 17-month low of 65.70 after the aggressive selling interest from the 78.75 resistance. Over the last three weeks, the commodity has lost more than 16%, switching the outlook to strongly bearish.

According to technical oscillators, the MACD is losing its negative momentum and is ticking slightly up, while the stochastic oscillator is heading north after the bullish crossover within its %K and %D lines in the oversold area. Both are indicating that the sharp selling interest may come to an end.

If the market continues the upside rally, then the price may find resistance at the 70.00 psychological level ahead of the 71.30 and 72.70 levels. A jump above the uptrend line and the 20-day simple moving average (SMA) could find immediate obstacle at the short-term descending trend line at 76.60, which overlaps with the 50-day SMA.

In the negative scenario, a downturn beneath the multi-month low could boost the sell-off until the next support which is taken from the bottom in April 2023 at 63.60.

In brief, oil prices have been in a significant downward move since July 3 and only a jump above the 84.70 resistance level may switch the outlook to bullish.

Forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.

Recommended Content

Editors’ Picks

EUR/USD treads water just above 1.0400 post-US data

Another sign of the good health of the US economy came in response to firm flash US Manufacturing and Services PMIs, which in turn reinforced further the already strong performance of the US Dollar, relegating EUR/USD to the 1.0400 neighbourhood on Friday.

GBP/USD remains depressed near 1.2520 on stronger Dollar

Poor results from the UK docket kept the British pound on the back foot on Thursday, hovering around the low-1.2500s in a context of generalized weakness in the risk-linked galaxy vs. another outstanding day in the Greenback.

Gold keeps the bid bias unchanged near $2,700

Persistent safe haven demand continues to prop up the march north in Gold prices so far on Friday, hitting new two-week tops past the key $2,700 mark per troy ounce despite extra strength in the Greenback and mixed US yields.

Geopolitics back on the radar

Rising tensions between Russia and Ukraine caused renewed unease in the markets this week. Putin signed an amendment to Russian nuclear doctrine, which allows Russia to use nuclear weapons for retaliating against strikes carried out with conventional weapons.

Eurozone PMI sounds the alarm about growth once more

The composite PMI dropped from 50 to 48.1, once more stressing growth concerns for the eurozone. Hard data has actually come in better than expected recently – so ahead of the December meeting, the ECB has to figure out whether this is the PMI crying wolf or whether it should take this signal seriously. We think it’s the latter.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.