WTI Crude Oil dips further from 200-day SMA [Video]

![WTI Crude Oil dips further from 200-day SMA [Video]](https://editorial.fxstreet.com/images/Markets/Commodities/Energy/Oil/oil-pump-1843603_XtraLarge.jpg)

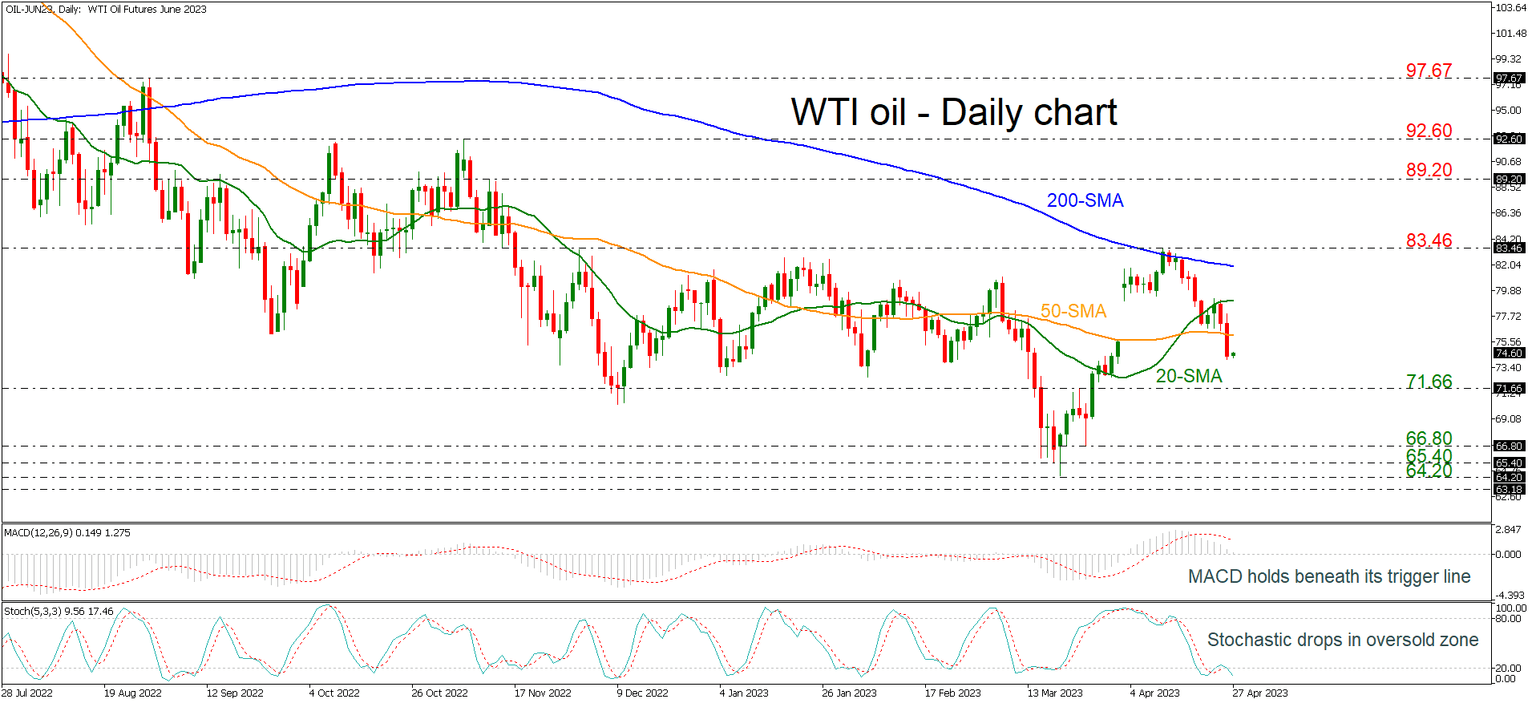

WTI crude oil futures have been underperforming over the last couple of weeks after the pullback off the 83.46 resistance and the 200-day simple moving average (SMA). The market recouped the bullish gap posted on April 3 and the selling interest continues, something confirmed by the technical oscillators. The MACD is easing beneath its trigger line, while the stochastic is diving towards the oversold territory.

Immediate support to further losses could come from the 71.66 inside swing high from March 23 ahead of the crucial lines such as 66.80, 65.40 and 64.20.

Otherwise, a successful climb above the 20- and the 50-day SMAs could drive the commodity until the 200-day SMA at 81.90 before meeting the previous peak of 83.46. Any bullish attempts higher could switch the outlook to a more positive one, hitting the 89.20 resistance level.

In brief, oil prices are looking neutral in the medium-term timeframe as they failed to exhibit any bearish or bullish tendencies. A lower low below 64.20 or a jump above 83.46 could reveal the next direction.

Author

Melina joined XM in December 2017 as an Investment Analyst in the Research department. She can clearly communicate market action, particularly technical and chart pattern setups.