World indices: Can history repeat itself?

The World Indices rally since the low at 10.2022. Many are already trading into new highs above the 2022 peak. The idea can be seen as bullish, and our expected wave III of (3) might have started. As it is known across the trading world, we at EWF are very bullish on the Indices. Contrary to many other traders and service, we do not see a correction in the Grand Super Cycle to happen.

We are constantly looking for an opportunity to buy the Indices. We have noticed a stock, $NVDA, which already corrects the Grand Super Cycle and trades into new highs. It is way ahead of the rest, which is a concern for us. As always, we do not recommend selling Indices. But we will explain later in the video something to keep in our mind. $NVDA is getting closer to the area between $451-$532 area. We expect buyers to take profit in the area before the acceleration into the wave (III). The idea that $NVDA can soon pullback will affect World Indices into a pullback. For those Indices which are still below the 2022 peak, they can even double off the peak.

$NVDA weekly Elliott Wave chart

The weekly chart above shows $NVDA Grand Super Cycle reaching the target area. This should produce a three waves pullback. The same scenario happened in 2008 when the $HSI HKG (Hang Seng Index) reached the extreme area within the Grand Super Cycle. Those Indices that were lagging entered into a considerable selling. The following chart shows Hang Seng Index

Monthly Hang Seng Index chart

The chart above shows the Hang Seng Index back in 2008 when it reached the extreme area and the selling that followed. As always there are Indices and Symbols which are leading and ones which are lagging. Another interesting aspect is the $USDNOK. In 2008, the pair also within the extreme area and calling for a bounce, which is in complete alignment with the Hang Seng, and a $USDX rally or bounce.

Monthly chart of USD/NOK

The chart above shows USDNOK reaches extreme area and the rally which follows from the area. The combination of the Hang Seng extreme in 2007 and the $USDNOK created a FLAT structure on the $SPX, which saw massive selling across the Market.

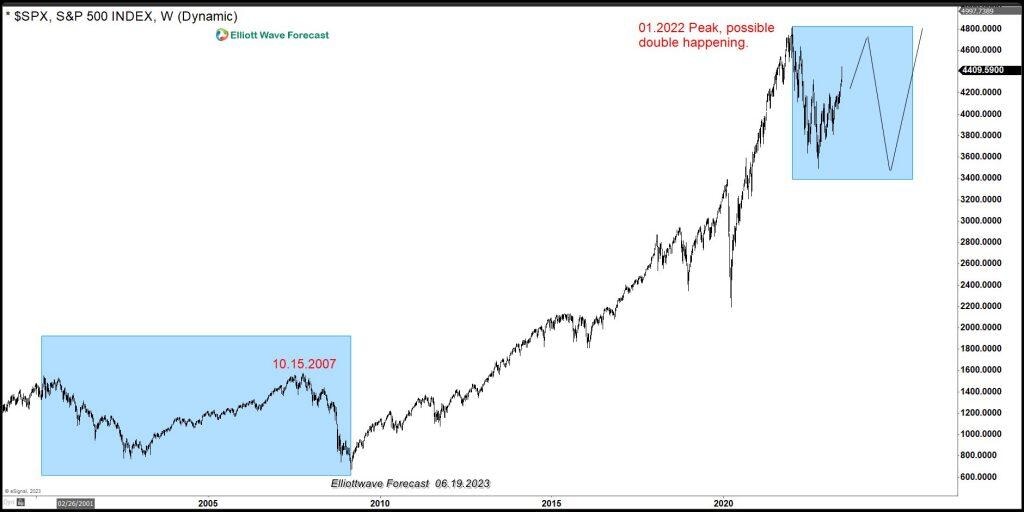

$SPX weekly Elliott Wave chart

The weekly chart of $SPX above shows the highlighted blue area when the $SPX sold hard in 2008. Please note that the Index made a marginal new high before turning lower. It happened because $SPX lagged in relationship with the Hang Seng. Now, the $USDMXN (Peso) is doing the same as the $USDNOK did in 2008. It is reaching the extreme area from the peak in 2020, which will again propose a bounce or rally to happen soon. Here is the latest Weekly chart:

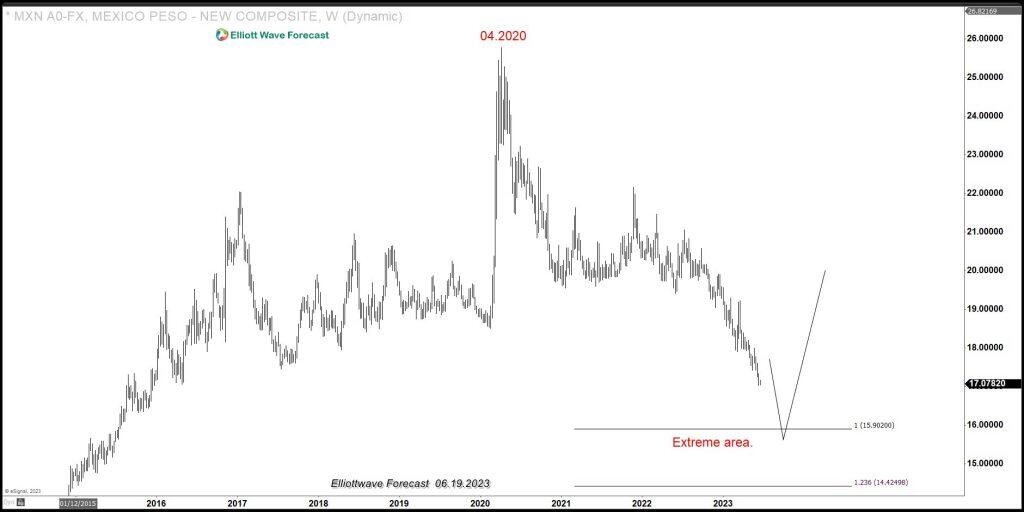

$USD/MXN Weekly Elliott Wave chart

The weekly chart above shows the area where the bounce should happen again. We believe in the idea that some Indices like $SPX lag symbol such as $NVDA. The $USDX, as represented by the $USDMXN above, soon should bounce. This in turn can create another irregular or double correction from the last significant peak across the Indices group. Can History repeat itself?

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com