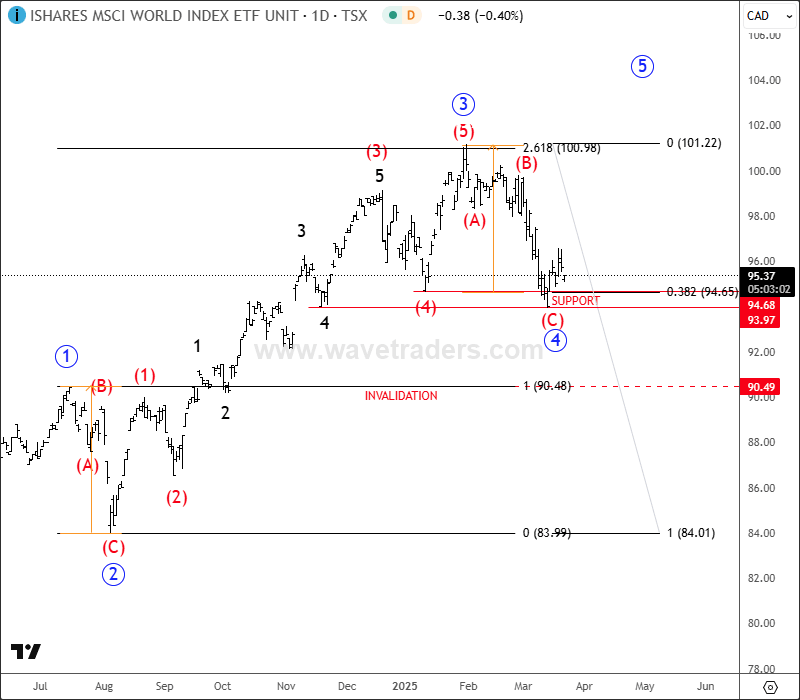

World Index shows fifth wave is still missing

World Index ETF with ticker $XWD has extended its rally for 261,8% Fibonacci retracement, which is ideal zone for wave 3, so current slow down can be just a higher degree ABC correction in wave 4. It’s now testing interesting and important textbook support at the former wave 4 swing low, 38,2% Fibonacci support area with equal wave length of waves 2=4. So, if we will get a sharp or impulsive rebound, then we may easly see a bullish resumption for wave 5 this year. Invalidation level is at 90.

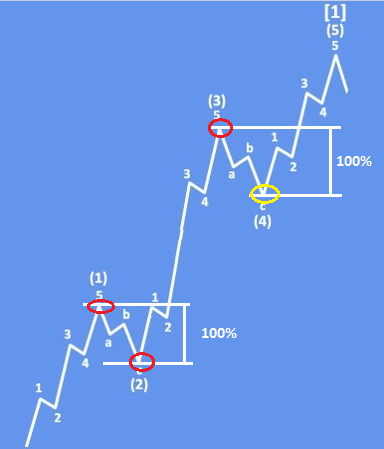

Basic impulsive Elliott wave pattern shows that World Index is finishing wave 4 correction that can extend the rally for wave 5.

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Author

Gregor Horvat

Wavetraders

Experience Grega is based in Slovenia and has been in the Forex market since 2003.