Working out great

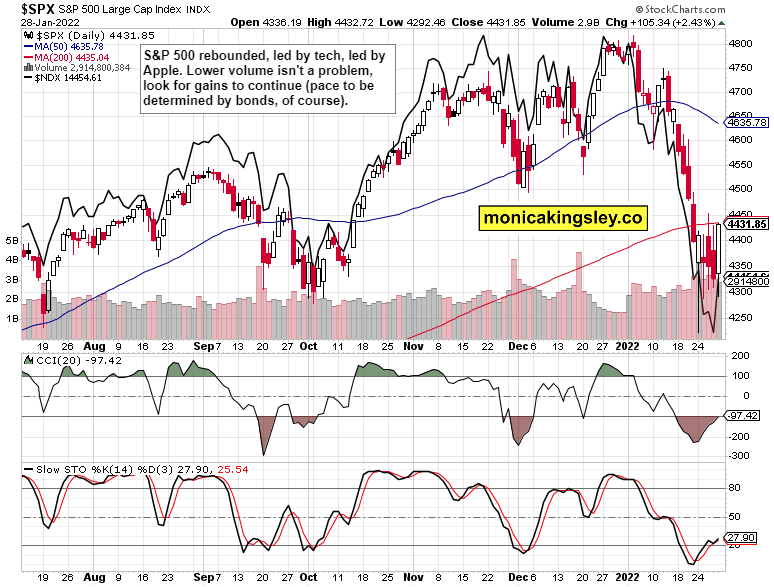

S&P 500 left the 4,270s - 4,330s range with an upside breakout – after bonds finally caught some bid. While in risk-on posture, divergencies to stocks abound – any stock market advance would leave S&P 500 in a more precarious position than when the break above 4,800 ATHs fizzled out. But a stock market advance we would have, targeting 4,500 followed by possibly 4,600. The sizable open long profits can keep growing. Only the market internals would be poor, so better don‘t look at the percentage of stocks trading above their 200-day moving averages, and similar metrics.

Enough to say that Friday‘s advance was sparked by the Apple news. When it‘s only the generals that are advancing while much of the rest remains in shambles, Houston has a problem – we aren‘t there yet.

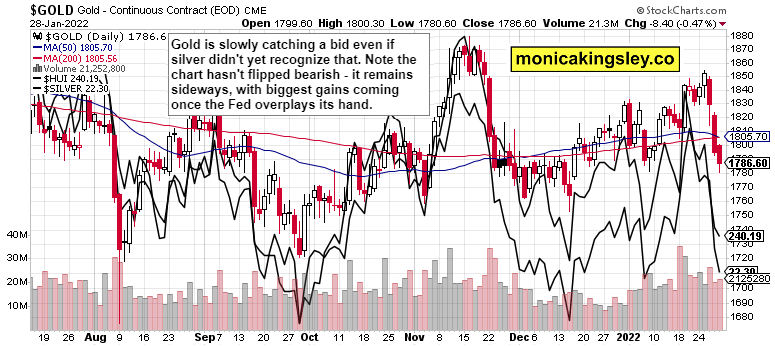

Fed‘s Kashkari also helped mightily on Friday – that implicit rates backpedalling was more than helpful. Pity that precious metals haven‘t noticed (I would say yet) – but remember the big picture and don‘t despair, we‘re just going sideways before the inevitable breakout higher. Back to rates and the Fed, there is a key difference between the tightening of 2018 and now – the economy was quite robust with blood freely flowing, crucially without raging inflation. With the Fed sorely behind the curve by at least a year, it‘ll have to move faster and have lower sensibility to market selloffs caused. Stiff headwinds ahead as liquidity gets tighter.

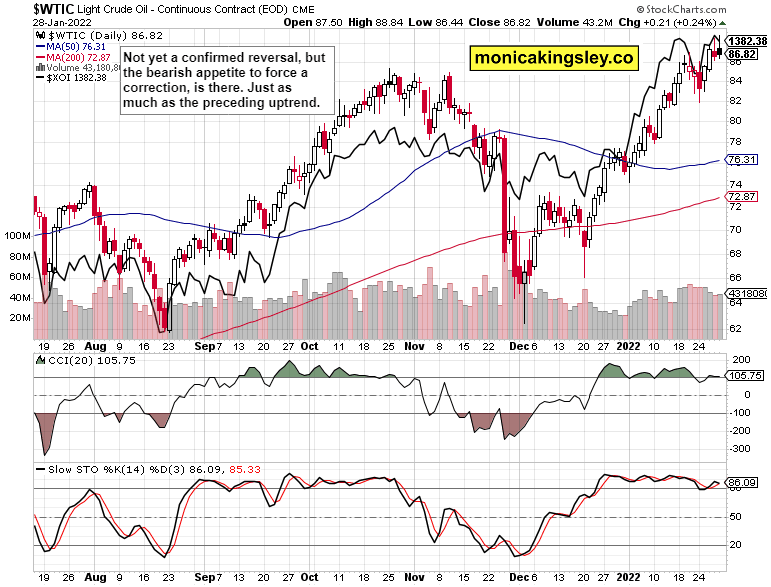

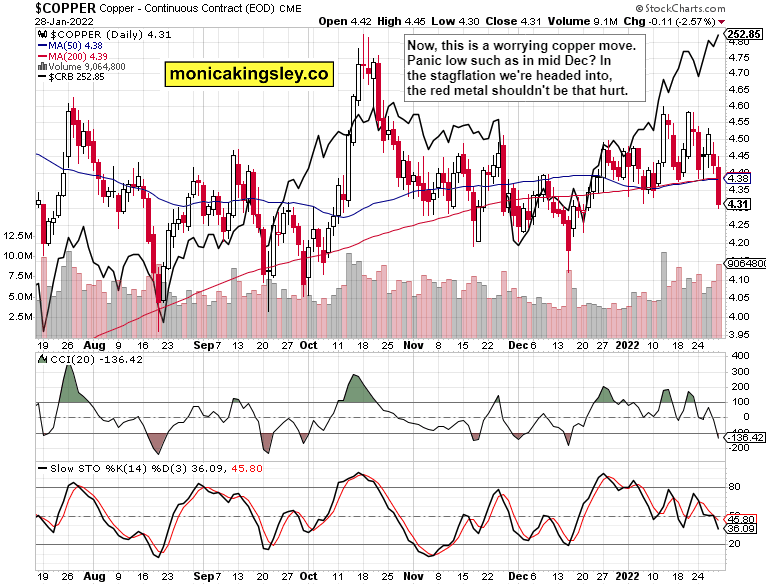

Couple that with resilient oil – more profits taken off the table Friday at $88.30 – and you‘ve got a pretty resilient inflation. Not that inflation expectations would be shaking in their boots, not that commodities would be cratering. It‘s only copper (influencing silver) that has to figure out just how overdone its Friday‘s move had been. Not that other base metals would be that pessimistic. Similarly to precious metals and the early tightening phase, commodities would be under temporary pressure as well, but outperforming as we officially enter stagflation. Not too tough to imagine given the GDP growth downgrades.

S&P 500 and Nasdaq Outlook

Great finish to the week, but S&P 500 bulls have quite a job ahead – it continues being choppy out there. I‘m still looking at bonds with tech for direction.

Credit Markets

HYG finally turned around, and Friday was a risk-on day. The question remains how far can the retracement (yes, it‘s retracement only) reach – can the pre-FOMC highs be approached? Could be, could be.

Gold, Silver and Miners

Gold and silver retreated, but no chart damage was done – things are still going sideways as the countdown is on for the Fed to either tighten too much and send markets crashing, or reverse course (again).

Crude Oil

Crude oil isn‘t broken by the Fed, and why should it be given that it can‘t be printed. Some backing and filling is ahead before the uptrend reasserts itself.

Copper

Copper is the only red flag, and seeing it rebound would call off the amber light. This is the greatest non-confirmation of the commodities direction in quite a while, and that‘s why I‘m taking it with more than a pinch of salt.

Bitcoin and Ethereum

Crypto bulls are putting up a little fight as the narrow range trading continues – I‘m not looking at the Bitcoin and Ethereum buyers to succeed convincingly.

Summary

S&P 500 bulls finally moved in an otherwise volatile and choppy week. For the days ahead, volatility is likely to calm down somewhat, but chop is likely to be with us still – only that I expect it to be of the bullish flavor. 10-year Treasury yield has calmed down, and that would be constructive for stocks – watch next for the 2-year to take notice likewise. The 2- year Treasury is quite sensitive to the anticipated Fed moves, and illustrates well the rate hike fears – coupled with the compressed 10-year to 2-year ratio, we‘re looking at rising expectation of the Fed policy mistake (in tightening too much, too fast). For now though, stocks can recover somewhat, and most of the commodities can keep on appreciating. Precious metals keep being in the waiting game, very resilient, and will turn out one of the great bullish surprises of 2022.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.