Without Chinese growth, inflation is set to fall, market implications

- Chinese stimulus pulled the world from the 2008 financial crisis.

- Beijing's reluctance to help ailing construction companies is already weighing on growth.

- President XI's new "common prosperity" drive is a sign for things to come.

- Global inflation is set to subside, and central banks should let it pass.

"We will keep economic operations within a reasonable range" – these words by Chinese Premier Li Keqiang have only been the latest conveying a message of moderation. That is a far cry from China's urge to grow as fast as possible and to leap forward. It has implications for the rest of the world.

China has been undergoing a gradual soft landing from its rapid years of growth. The stock of people moving from low-productivity farm jobs to highly productive positions in cities is dwindling. China is also suffering from low population growth more similar to the West than to emerging markets.

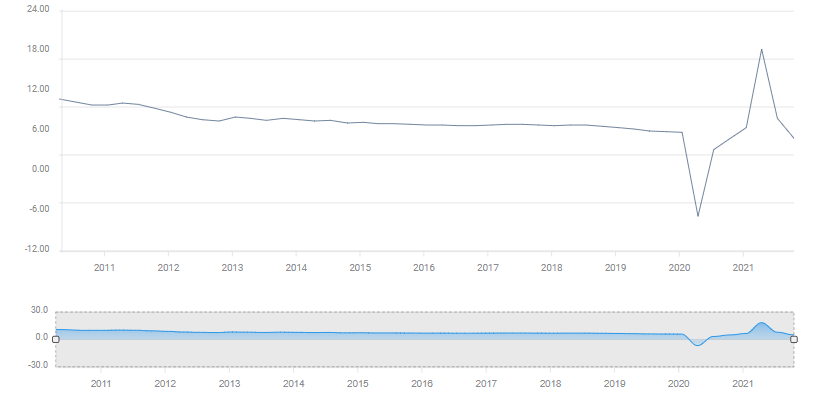

The covid crisis caused substantial jitters but has not altered this trend toward slower growth. On the contrary, third-quarter expansion slipped under 5%, a substantial climbdown from pre-pandemic levels.

Source: FXStreet

Chinese slowdown, more deliberate than accidental

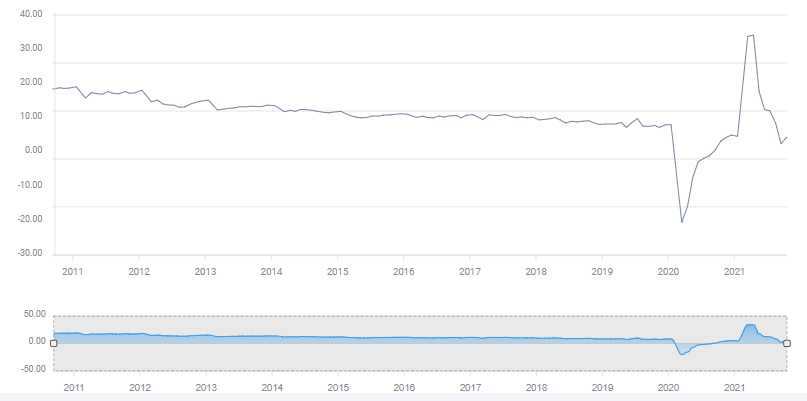

Leaving classic industry behind and moving to futuristic tech such as Artificial Intelligence is a positive development, China has yet to shift from a manufacturing-based economy to one that is based on consumption like America. Retail sales are going nowhere fast.

Chinese manufacturing is slowing without consumption picking up the slack.

Source: FXStreet

What looked like a failure to rotate the economy now seems to be a shift from the top. Chinese President Xi Jinping is seemingly rediscovering the Party's communist roots, calling to spread prosperity. Being rich is frowned upon.

After years of encouraging private enterprise and startups, he is reining in successful companies and their popular founders, such as Alibaba's Jack Ma. It goes hand in hand with Xi's growing authoritarian rule.

Another sector that has enjoyed leeway is now reaching the end of the road. Construction companies that have been building rapidly and creating bubbles are now left to suffer. That has a chilling effect the broader economy.

Authorities will not let Evergrand'e debt turn into a "Lehman moment" but the unwillingness to bail it out is a warning sign for other firms such as Sinic and Fantasia. Beijing's call to Evergrande's founder to pay the company's debt out of his private pocket is a novelty when it comes to accountability.

Impact on inflation

China matters as it is the world's second-largest economy. Moreover, its previous stimulus lifted the world out of the financial crisis back in the wake of the 2008 crisis. It is not going to play that role again.

What does it mean for the world? While supply-chain disruptions will take time to alleviate, the demand issue will likely diminish sooner rather than later. That should ease price pressures.

China's approach is deflationary and a score for Team Transitory – the group of economists seeing through current price rises and expecting them to be a one-off jump rather than the beginning of a cycle of gains.

The early 2000s commodities' supercycle was fueled by China. Without China, there is no commodities boom nor hyperinflation which Jack Dorsey suggests.

Will central banks see Beijing's behavior as a sign of falling prices? Or will they be bullied by bond markets? That question is critical, especially for the Federal Reserve, which is the most powerful of them all.

If the Fed fights back against bonds and has China in mind, it means stocks could continue their upward move, and the dollar could decline.

More: How these five currencies are positioned ahead of the Fed, ranked from strongest to weakest

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.