Will the US Dollar realign with its strong fundamentals?

It is crystal clear that the United States has the superior economy at this stage of the cycle, especially when compared to Europe or China. And yet, this economic strength has not translated into a full-scale US dollar rally. What’s the missing ingredient for that to change?

Growth differentials

There’s been a striking divergence in the performance of major economies this year. The United States is currently the bright spot. Economic growth seems to have accelerated over the summer and is on track to hit an annualized 5.6% this quarter according to the Atlanta Fed. That’s mostly because consumers are still spending, with some help from real wage growth returning to positive territory.

Similarly, the labor market is still in good shape. Although there are some signs that jobs growth is cooling off, that’s natural as the US economy is already beyond full employment conditions. Even the housing market has staged a stunning recovery, with home prices hitting new record highs in much of the country despite sky-high borrowing costs.

In stark contrast, storm clouds are gathering over Europe and China. With global manufacturing going through a pandemic-fueled hangover, manufacturing hubs like Germany and China have been hit particularly hard, putting the brakes on economic growth.

Business surveys suggest this slowdown will persist and might even conclude with a mild recession, at least in the Eurozone. And while China might dodge a recession, it could still be stuck in a slow-growth environment for years as it deals with the painful deleveraging of its property sector that is experiencing a serious debt crisis.

China’s troubles have implications for other economies as well. Take Australia and New Zealand. These economies rely on Chinese demand to absorb their commodity exports, so if Chinese growth is almost stagnant, it can have negative spillovers on these economies and their currencies.

So why is the dollar not king?

Admittedly, the US dollar did power higher in recent weeks, but it’s almost flat for the year, so the latest gains have not been very impressive. One element behind the dollar’s inability to stage a fierce rally is how aggressively foreign central banks raised interest rates.

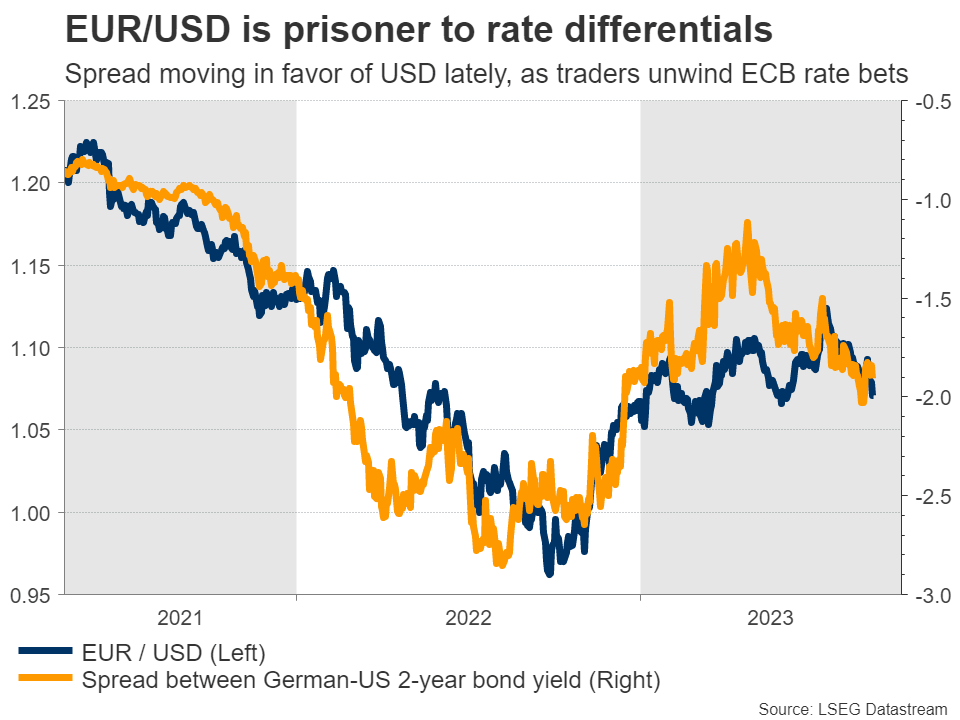

Although European yields are still below American ones, the gap has narrowed considerably, making the euro more attractive by comparison. That said, this euro-friendly yield compression has already started to unwind. The Eurozone’s economic data pulse is slowing at an alarming pace, which will inevitably affect monetary policy decisions.

In other words, European Central Bank officials cannot ignore a weaker growth profile for much longer. In fact, the central bank might pause its tightening cycle this month already, as several policymakers seem worried a recession is brewing. In this case, the euro could receive more bruises.

How oil prices evolve will be extremely important for FX markets too. Since the Eurozone and Japan import almost all their energy from abroad, a spike higher in oil prices tends to hurt those currencies, by impacting the terms of trade of their economies and restricting growth.

Therefore, if the recent supply-driven spike in oil prices continues, that would be detrimental for both the euro and the yen. In the yen’s case, there’s also the massive gap in interest rate differentials to consider, as the Bank of Japan refuses to abandon negative rates even in this inflationary environment.

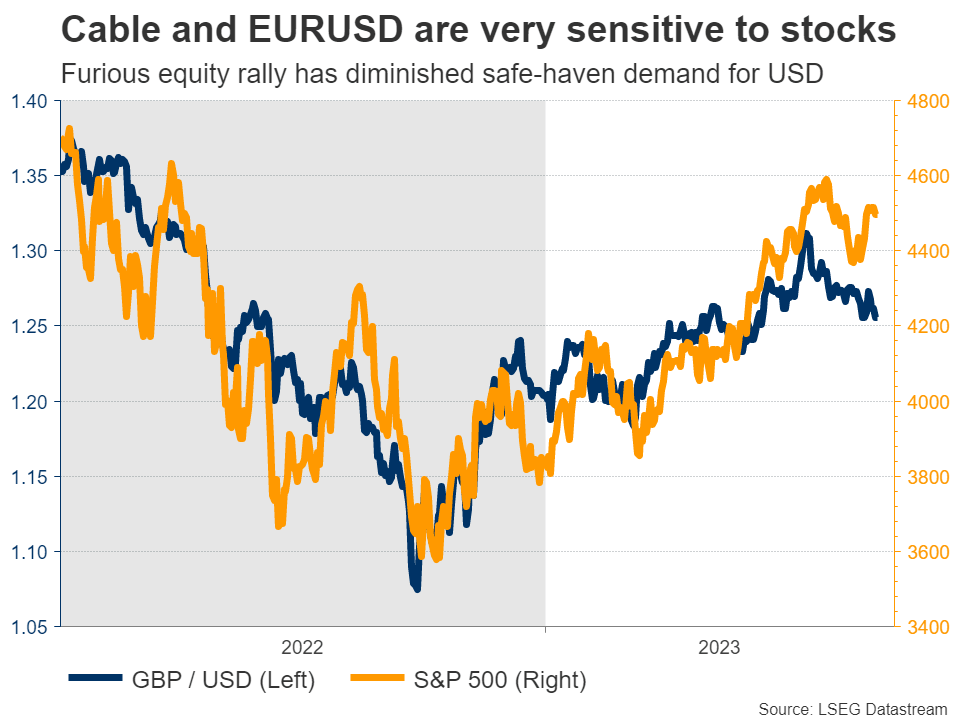

Last but not least, the cheerful tone in stock markets this year has been a crucial factor in holding back the safe-haven US dollar, while benefiting the likes of the British pound and to a lesser extent the euro. This means that any correction in high-flying stocks could also inflict collateral damage on euro/dollar and sterling/dollar.

‘All weather’ currency

All told, the US economy and by extension the dollar seem more attractive than any alternatives. This economic resilience has started to be reflected in the bond market as well, with US yields spiraling higher. Hence, the greenback has transformed into an ‘all weather’ currency again, offering a combination of high yields and safety thanks to its reserve currency status.

On the flip side, the outlook for other currencies is darker. Europe and China are plagued by slowing growth, the Japanese yen has been ravaged by rate differentials, and the British pound is trading like a proxy for equity markets, leaving it vulnerable to shifts in risk sentiment. Keep in mind that FX is a relative game, so the dollar inevitably benefits if other currencies struggle.

Over the last year, the FX market has been trading almost entirely on interest rate differentials. However, with most major central banks about to conclude their tightening cycles, the next dominant theme might be economic growth differentials, which clearly favor the United States at this stage. Ultimately, capital does not flow into distressed economies.

In this sense, the missing link for a powerful US dollar rally might be a correction lower in stock markets that fuels demand for safe haven plays. With valuations historically stretched and earnings growth stagnant in an environment where US yields are pressing higher and global growth is losing steam, that’s a real possibility.

Author

Marios graduated from the University of Reading in 2015 with a BSc in Economics and Econometrics. Prior to joining XM as an Investment Analyst in December 2017, he was providing financial analysis, reporting and consulting service