Will the US Dollar continue to rise?

Macroeconomic snapshot

Federal Reserve (FED), Federal open market committee (FOMC): The July meeting matched expectations with a 0.25% hike of the Fed Funds rate setting it at 5.25%-5.50% which is up from 5.00%-5.25% and the pause in June. The latest rate now matches the Trading Economics Q3 ‘23 forecast of 5.50% which they also identify as the peak. Over the previous three years, since the start of 2020, the interest rate has been trending up with a low of 0.25% and a high of 5.50%. Over the previous six months, the rate has climbed at a slower pace. The next meeting is due on Wednesday, September 20th.

The US interest rate is anticipated to be held at its current level for a lengthy period which is likely to lead to stabilised Treasury yields which may dissuade investors and limit upward support on the value of the dollar.

Gross Domestic Product (GDP) growth rate: Advance Q2 ‘23 estimate greatly beat expectations coming in at a 2.4% annualised expansion, up from 2.0% in Q1 ‘23. The latest report is above the FOMC 2023 change in real GDP forecast of 1.0% (revised up from 0.4%) and far above the Trading Economics Q3 ‘23 forecast of 0.6%. Over the previous three years, since the start of 2020, GDP has been trending up with a low of 3.9% and a high of 7.0%. Over the previous six months, GDP has been steadily improving. The second estimate Q2 report is due on Thursday, August 30th.

US GDP is anticipated to deteriorate this year which may decrease investor confidence in US stocks which may limit downward pressure on the value of the dollar.

Consumer price index (CPI): July ‘23 report slightly beat expectations coming in at 3.2% although is higher than the 3.0% in June ‘23. The latest report now matches the FOMC 2023 PCE forecast of 3.2% although Trading Economics are less optimistic with a Q3 ‘23 forecast of 3.5% (previously 2.5%). Over the previous three years, since the start of 2020, CPI has been trending up with a low of 0.1% and a high of 9.1%. Over the previous six months, the rate has been falling quickly. The August report is published on Wednesday, September 13th.

US CPI was expected to jump and it did so in July although a little less than expected. A fall towards the target rate of 2.5% is expected through the rest of the year. Investor confidence in EA stocks is likely to improve which may limit upward support on the value of the dollar.

Labour: July ‘23 report slightly beat expectations coming in at 3.5% which is also slightly better than the 3.6% in June ‘23. Nonfarm payrolls stayed similar at 187K from 185K although that was significantly revised down from 209K. The latest report is below the Trading Economics Q3 ‘23 forecast of 3.8%. Over the previous three years, since the start of 2020, Unemployment has been trending down with a high of 14.7% and a low of 3.4%. Over the previous six months, unemployment has been steady. The August report is due on Friday, September 1st.

US unemployment is anticipated to slightly deteriorate this year which may dissuade investor confidence in US stocks which is likely to limit downward pressure on the value of the dollar.

Monetary policy hold: As inflation in the US stabilises, the Fed now intends to hold rates steady. This makes borrowing less risky which will improve the outlook for growth, increase the appetite for stocks, and reduce the demand for the dollar as a safe haven.

This is likely to limit upward support on the value of the dollar.

Russian invasion of Ukraine: The war is having a detrimental effect on the global and US economy by causing higher energy prices, higher food prices, higher inflation and is impacting economic growth.

This is likely to limit downward pressure on the value of the dollar.

China-US trade war: The trade war is having a detrimental effect on the global and US economy by causing higher prices for consumers, increased uncertainty for businesses, disrupted supply chains, job losses and is impacting economic growth.

This is likely to limit downward pressure on the value of the dollar.

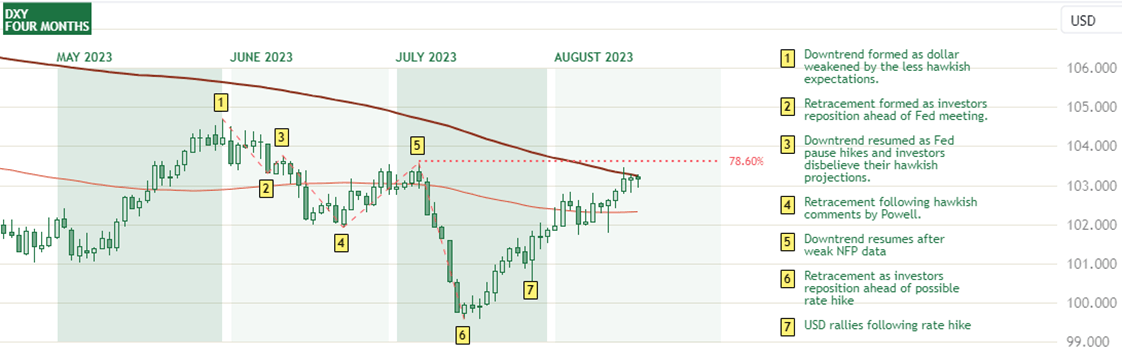

DXY longer term (Previous three months)

The US Dollar Index (DXY) has formed a downtrend since the start of June when investors began to price a lower peak interest rate which weakened the dollar. This dovish sentiment has been retraced three times as the Fed consistently remained hawkish. The DXY is currently retracing from the lows below 100.00 and looking to test the 76.8% fib near 103.50. If the fib level breaks then the downtrend will be broken.

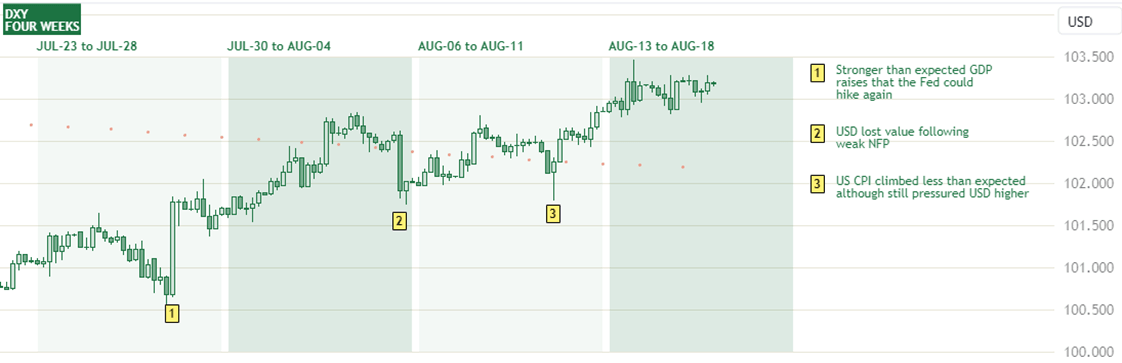

DXY (Previous three weeks)

The US Dollar Index (DXY) has gained value over the previous three weeks, supported by strong economic data although NFP stalled the climb it did resume once CPI was confirmed to have risen in July. The index is above the 50 day moving average.

US Dollar Index (DXY) outlook

Upcoming and recent events

Thursday, August 10th

- US CPI y/y climbed to 3.2% vs 3.3% exp

Wednesday, August 16th

- FOMC Meeting Minutes

Thursday, August 17th

- US Unemployment Claims fall to 240K exp. from 248K prev.

Wednesday, August 23rd

- Flash Manufacturing PMI 48.0 prev.

- Flash Services PMI 52.3 prev.

Thursday, August 24th

- Day 1 of the Jackson Hole Symposium.

- US Unemployment Claims.

Friday, August 25th

- Day 2 of the Jackson Hole Symposium.

CME Group 30-Day Fed Fund futures

- September: rising sentiment of a hold, 90% in favour (from 86%), 10% for a 0.25 hike (from 14%).

- November: falling sentiment of a hold, 61% in favour (from 70%), 35% for a 0.25 hike (from 28%).

Six Month Bond Yields

- Treasuries: holding at 5.50% from 5.50% last week.

Value of the US Dollar Index (DXY) to remain above 102.0 unless the Unemployment Claims jumps unexpectedly higher on Thursday: The previous three week moves have been trending up. Events this week are favoured towards a very slightly stronger USD over the shorter term. An unexpected increase in unemployment claims would signal that the Fed may avoid further hikes and weaken the dollar over the shorter term.

Longer Term Value of the US Dollar Index (DXY) to remain below 103.5: The previous three month moves have created a downtrend which is currently being tested. The macroeconomic situation suggests the downtrend is likely to continue over the longer term.

Author

Gavin Pearson

Independent Analyst

Gavin Pearson of Jeepson Trading is a currencies speculator from the UK focused on the G7 economies and is a recognized member of the eToro Popular Investor Program as well as being a funded prop trader with The 5%ers.