Will the Fed signal a higher-for-longer message and sink Gold?

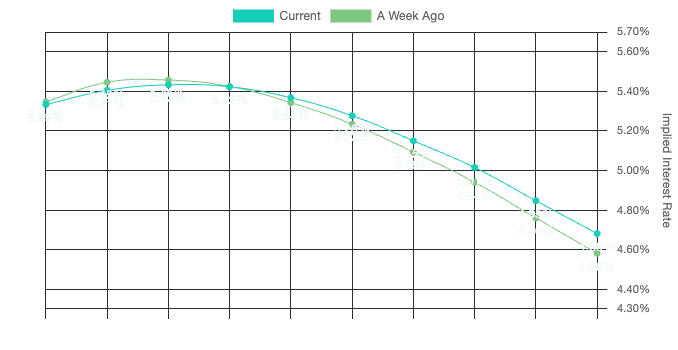

Heading into Wednesday’s Federal Reserve meeting, short-term interest rate markets expect no change from the current level of 5.375%.

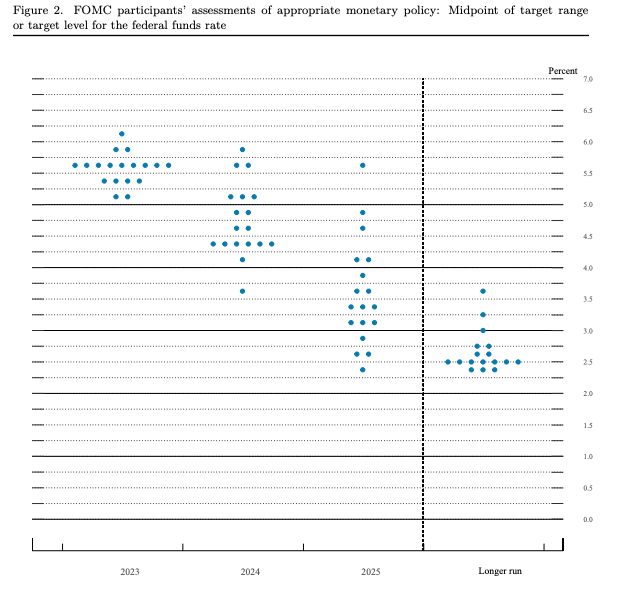

So, the question is going to be if the Fed changes its forward rate guidance. Remember, we will get dot plot projections in this meeting and the last set of projections was expecting an interest rate hike this year. You can read the last Fed statement here too.

This means the first area markets will be looking at is going to be whether or not the Federal Reserve still sees another interest rate hike this year?

The data has certainly been strong enough over the last few weeks to justify it. Although US data has been mixed, there have been some stand-out economic data points. The labour market has remained strong and ISM services have also been high with the August print beating market expectations at 54.5. However, Wall Street journalist Timiraos did indicate on September 10 that perhaps the Federal Reserve can signal a more dovish rate path ahead. So, the focus is going to come down to the Fed’s forward guidance.

A few central banks are beginning to hint at the end of their rate hiking cycle. The Reserve Bank of New Zealand has explicitly stated that it does not anticipate hiking rates any further. The European Central Bank intimated last week that it may have reached the end of its rate hikes and the Reserve Bank of Australia kept interest rates unchanged at its last meeting. Will the Federal Reserve signal the end of its rate hiking cycle on Wednesday at 7pm UK time? Remember to keep a careful eye on the press conference at 7:30. It is most likely here where the key signaling will occur. The best tradable opportunity would come from a surprise dovish shift where the Fed considers it can end the process of tightening monetary policy. In this instance, you would expect a strong gold upside.

Key risks to be aware of

However, there is also a risk that the Federal Reserve indicates there is still more work to be done on rates, and the US’s economic strength would certainly allow more interest rate hikes. So, this central bank meeting is most likely to come down to the forward guidance given by Jerome Powell. A higher-rates-for-longer message can also not be discounted and, should that happen, you would anticipate that weighing on global stocks and gold prices in the near term.

Author

Giles Coghlan LLB, Lth, MA

Financial Source

Giles is the chief market analyst for Financial Source. His goal is to help you find simple, high-conviction fundamental trade opportunities. He has regular media presentations being featured in National and International Press.