Will the Fed hold steady while the BoE cuts rates?

This week, both the Federal Reserve (FOMC) and the Bank of England (MPC) will hold interest rate decision meetings.

The market expects an 85.8% chance of a 25 bps rate cut by the Fed in September, with a 13.8% chance of a 50 bps cut, due to rising unemployment and easing CPI. However, the likelihood of a rate cut this week is only 4.1%.

Former NY Fed President Dudley advised a rate cut in July. The Fed, under Chairman Powell, delayed rate hikes in 2021, calling inflation transitional, and only started raising rates in 2022 after the Russian-Ukraine conflict, leading to rapid rate hikes.

The market has priced in a September rate cut, and this FOMC meeting will likely hint at it to avoid stock market volatility.

In my previous article The unemployment triggered Sahm Rule, I discussed the slow down of the US economy.

Source: Adopted from Reuters

Historically, the US Dollar Index tends to weaken at the beginning of a rate-cutting cycle. As a result, we might see it test the support range of 99.5 to 100.7 once more.

BoE will cut rates?

The Bank of England (BoE) was the first among G7 central banks to raise interest rates at the end of 2021. Now, with the European Central Bank and the Bank of Canada having started to lower their rates and the market anticipating a similar move from the Federal Reserve, attention has turned to the BoE's next decision. It is likely that the BoE will reduce rates by 25 basis points this week.

Governor Andrew Bailey has indicated that the market's expectation of a rate cut from the Bank of England, which has been anticipated since February, is justified. This suggests that he is also considering a rate cut this year.

UK unemployment rate

UK unemployment is on the rise, activating the Sahm rule. Since Brexit, the UK has consistently experienced a shortage of workers. Annual wage growth decreased from 5.9% in the three months ending in April to 5.7% in the three months ending in May, signaling an economic slowdown.

Source: Tradingecnomics

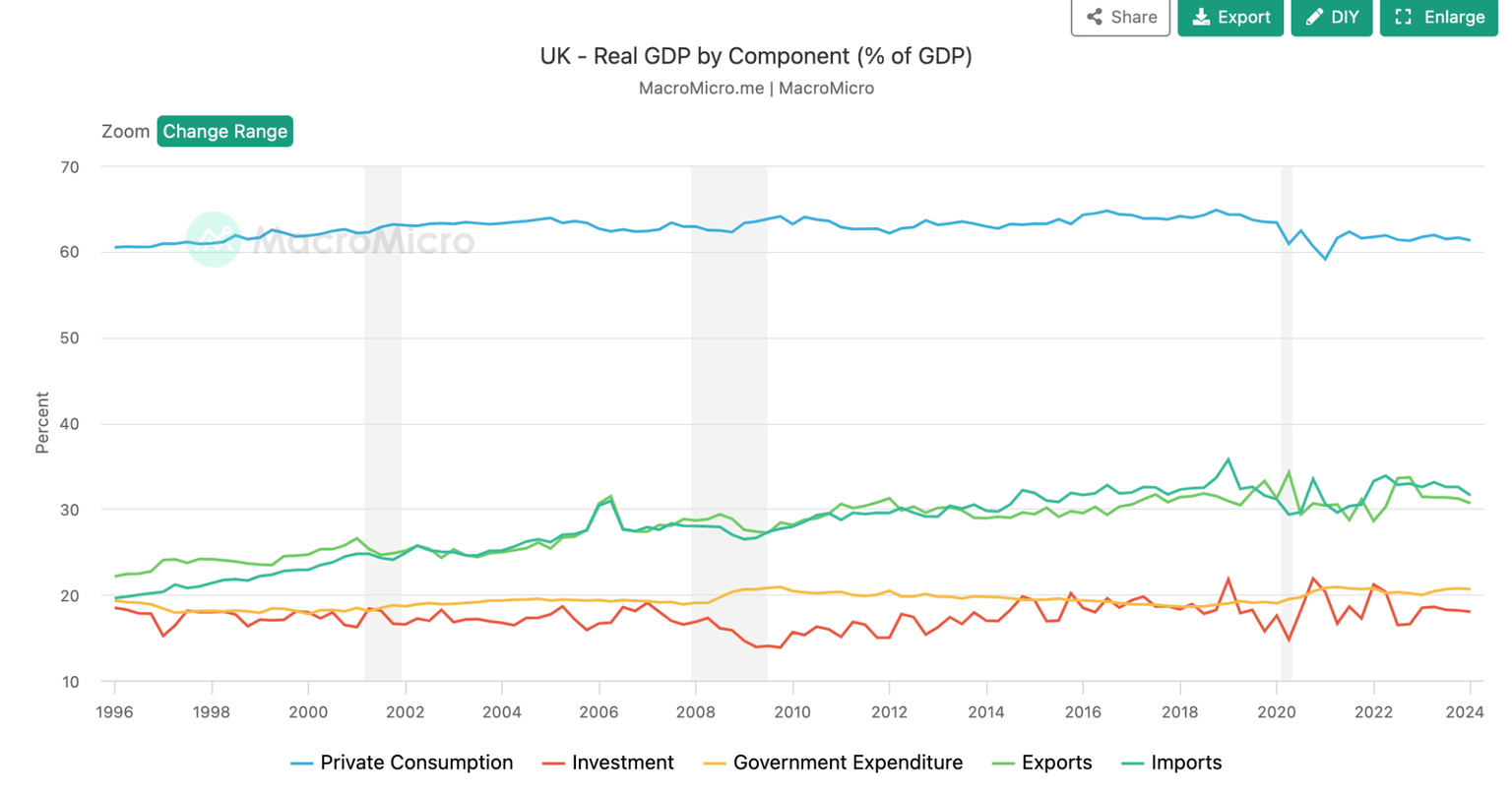

UK inflation has fallen to 2%, aligning with the central bank's target. However, with consumer confidence at -13 and retail sales declining by 1.2%, the Bank of England faces pressure to ease monetary policy to support economic growth. In the current household debt deleveraging cycle, stimulating the economy presents significant challenges. Given that private consumption accounts for 60% of the UK GDP, it is crucial for policies to focus on stabilising consumption to foster growth.

Source: UK parliament

Technical analysis

GBPUSD stochastic indicator at the time of writing is below 30, indicating oversold conditions. The price is situated between the 20-day Simple Moving Average (SMA) and the lower Bollinger Band, reflecting this bearish pressure. The pair has failed to find support at the 23.6% and 38.2% Fibonacci retracement levels, making the 50% Fibonacci level the next critical support zone to watch.

Conclusion

The Federal Reserve is anticipated to maintain current interest rates this week but is expected to signal a possible rate cut in September, aligning with market expectations. Conversely, the Bank of England is projected to reduce rates by 25 basis points this week, based on remarks from Governor Andrew Bailey. The divergent signals from the Fed and the BoE may create a balancing effect, potentially leading to a range-bound movement for GBPUSD in the near term.

Author

Prakash Bhudia

Deriv

Prakash Bhudia, HOD – Product & Growth at Deriv, provides strategic leadership across crucial trading functions, including operations, risk management, and main marketing channels.